Director independence always has the potential to be a fraught topic of conversation, especially when it comes to the Board Members of our listed issuers. NZSA expects a majority of independent directors on a company’s Board, regardless of ownership structure, to ensure effective representation for shareholder interests. After all, an independent director is bound to act in the best interests of the company – which should ultimately benefit a major shareholder.

Shareholder Patronage

What is clear, however, is that where an issuer has a majority (or major) shareholder, the concept of director independence is at the patronage of said majority shareholder. If an independent director is not supported by a majority shareholder, there is always the ability for a major shareholder to use their vote at the company’s shareholder voting to vote against an independent director. This played out last year at NZ Automotive (NZX: NZA), although in the event the company retained a majority of (strongly) independent directors after a significant board re-shuffle.

There are few options open to Board members either; where an independent director holds concerns about the interests of a major shareholder, a carefully-worded resignation is one of the few options available. Unfortunately, however, this ‘tars the brush’ for other similarly-structured issuers, whose independent directors might be resigning for genuine personal reasons.

It was interesting for NZSA to observe the additional resolutions brought by a shareholder at the NZ Oil and Gas (NZX: NZO) shareholder meeting last year, essentially proposing a form of “controlling shareholder” management where a majority of minority shareholders would be required to approve the appointment of a lead independent director. NZ does not have a regulatory regime governing this situation, despite many of our listed companies featuring a share register dominated by an individual or small group of shareholders.

From a retail shareholder perspective, it is “representation” that is the core benefit of director independence, regardless of any correlation with company performance. We’re not saying performance doesn’t matter – unsurprisingly, that’s important for any investor – but we do want that performance to be sustainable, with the parameters for what constitutes good performance defined by ALL shareholders, not the interests of a select (and majority) few.

Perceptions

What is curious from NZSA’s perspective is the seemingly negative perception that Board members have around being labelled “non-independent”. A lack of independence doesn’t make someone a bad director – and the very factor that may make them non-independent (such as a significant shareholding or tenure) may also add a unique perspective to Board decision-making.

Tenure

Of course, that word ‘tenure’ has a powerful ability to generate further pursed lips and furrowed brows amongst the director community. In recent years, NZSA has been explicit in considering effective succession management as an outcome of a Director’s tenure – and the alternative risk for investors if this is not managed well. We think that’s a much more ‘nuanced’ approach than applying a straight “bright-line” test linked to the length of tenure of individual directors. It also allows clear scope for the (often unique) role that a founder can play on a Board.

Nonetheless, tenure remains an important, objective data component in assessing the succession risk for an issuer; the impacts of poor succession planning are ultimately likely to sheet home to shareholders.

There is an implicit trade-off associated with director tenure and succession management; the short-term gains and benefits associated with a long-serving, institutionalised Board, as compared with the ‘learning curve’ and new thinking associated with a Board comprised of new directors. As with most things, it’s likely that the truth (whatever that means) lies somewhere in the middle of those two extremes.

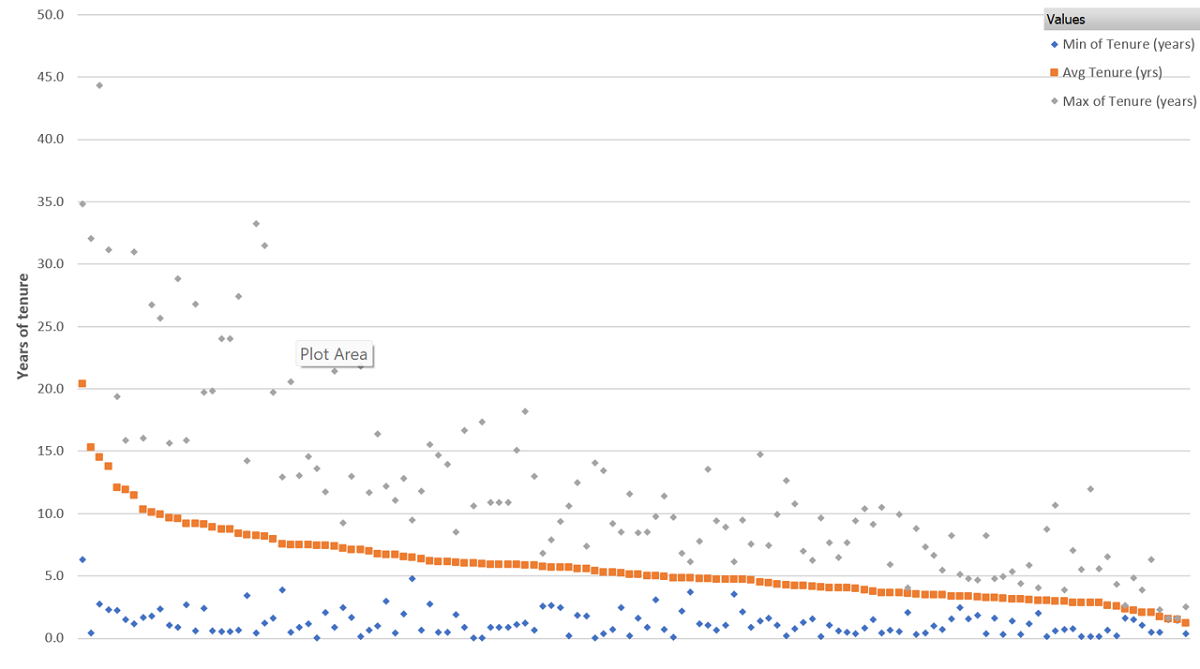

Long-term directors can be associated with great performance over long-term timeframes. There are many examples, some highlighted in the image below. The issue for long-term investors is not about performance right now or in the past; it’s about gaining assurance that the evolution of a Board can sustain that great performance into the future.

NZSA has started to maintain a database that allows us to ‘profile’ directors. When it comes to tenure, there’s already some interesting observations from the data we have collected.

- The longest serving director of an NZX issuer? We think Michael Hill (of Michael Hill International NZX: MHI) might just take the award, at 44.5 years.

- The highest average tenure? No surprises here…Mainfreight (NZX: MFT) at an average tenure of over 20 years.

- The least average tenure? Newly-listed WasteCo group, with an average tenure of 1.2 years

- Of 757 Directors of NZX companies, 545 are described as independent, with an average tenure of 5.1 years. For all directors, the average is 5.8 years.

One of the key questions where we are looking to undertake further research is whether there is any change in corporate performance caused by sudden retirements of long-tenure directors .

Culture

Ultimately, much of this discussion comes down to culture – a powerful driver of Board decision-making (and independence), but one that is usually nebulous or even invisible to an external observer. While there are tools that exist to “measure” the effectiveness of board culture, most of those tools require the input of those on the Board. That’s a fantastic process for a Board to create its own self-improvement plan, but isn’t really any help to mere shareholders who can only make their assessments based on the information in front of them.

Regardless of patronage or tenure or even functional expertise, NZSA would expect that every Board member can challenge their Board to adapt and change, to maintain their company’s strategy and performance at the forefront of their sector. We live in a fast-paced world, fuelled by ever-increasing technology impacts, environmental change, disruptive competitors and customer expectations. The requirement for the directors that govern your investments to keep an open mind and be awake to new ideas is more important than ever.

In this context, it stands to reason that the best NZSA can do is to highlight key data elements that can help shareholders or potential investors understand each individual company. We’re also participating actively within the NZX’s Corporate Governance Institute. And naturally, we’re inherently curious about research that can add greater insight into the topic.

Oliver Mander

One Response

The board diversity is equally important and needs also to be researched to gather evidence so this issue can also be dealt with at Board of Directors elections