NZSA Disclaimer

At a Special Meeting held on December 14th, shareholders of Burger Fuel approved a special resolution for the return of capital to shareholders. Or did they…?

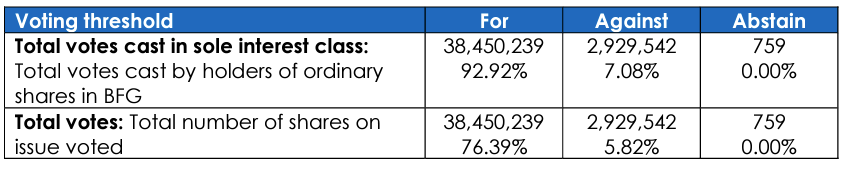

A deeper analysis of the shareholder voting results gives a slightly different picture as to the outcome. The ‘raw’ vote by shareholders is shown in the image below:

When taking into account the majority shareholding held by associated persons of CEO Josef Roberts (71.42%), however, it becomes clear not only that very few minority shareholders voted (only 10.79%), but that 53.9% of these minority investors voted against the proposal (5.82% / 10.79% = 53.9%).

NZSA has long-held concerns about Burger Fuel’s governance quality and strategy. They are also infamous as the only NZX-listed company that refuses to engage with NZSA. As to our concerns, it’s a long list…including director independence, CEO remuneration, the lack of underlying accountability of the independent directors to minority shareholders, related-party transactions, CEO performance, lack of strategy and so on.

In fact, we’re prepared to speculate that were the NZSA proposals for a minority interests regime be applied to Burger Fuel, it would be unlikely that the independent directors would survive a vote.

Much sheets home to the lack of transparency and information disclosure offered by the company in its disclosures and reporting.

In this context, we couldn’t help but notice that a ‘notice of opposition’ has been filed with the Court, opposing the capital return (this was also disclosed by the company on the NZX last week). A capital return might seem attractive in the context of a poorly-performing investment with little hope of a future positive outcome for shareholders. But as there was no alternative information or ‘counter-narrative’ provided by BFG, does this represent a glimmer of an alternative plan for long-suffering shareholders?

Does someone out there have the passion and some better ideas for re-invigorating Burger Fuel? If that is indeed the case, would it not be better to call for the replacement of the strategy-less Board with Board members who might have better ideas about generating longer-term returns for shareholders?

How interesting. Rest assured we’ll be keeping an eye on this over the coming days and weeks. In the meantime, for those with a subscription to NBR, this article (Kate McVicar) is worth a read.

Oliver Mander

Note: On 28 January 2024 this note was updated to clarify the 71% held by Roberts interests is held by “associated persons”, rather than just “related parties”.