NZSA Disclaimer

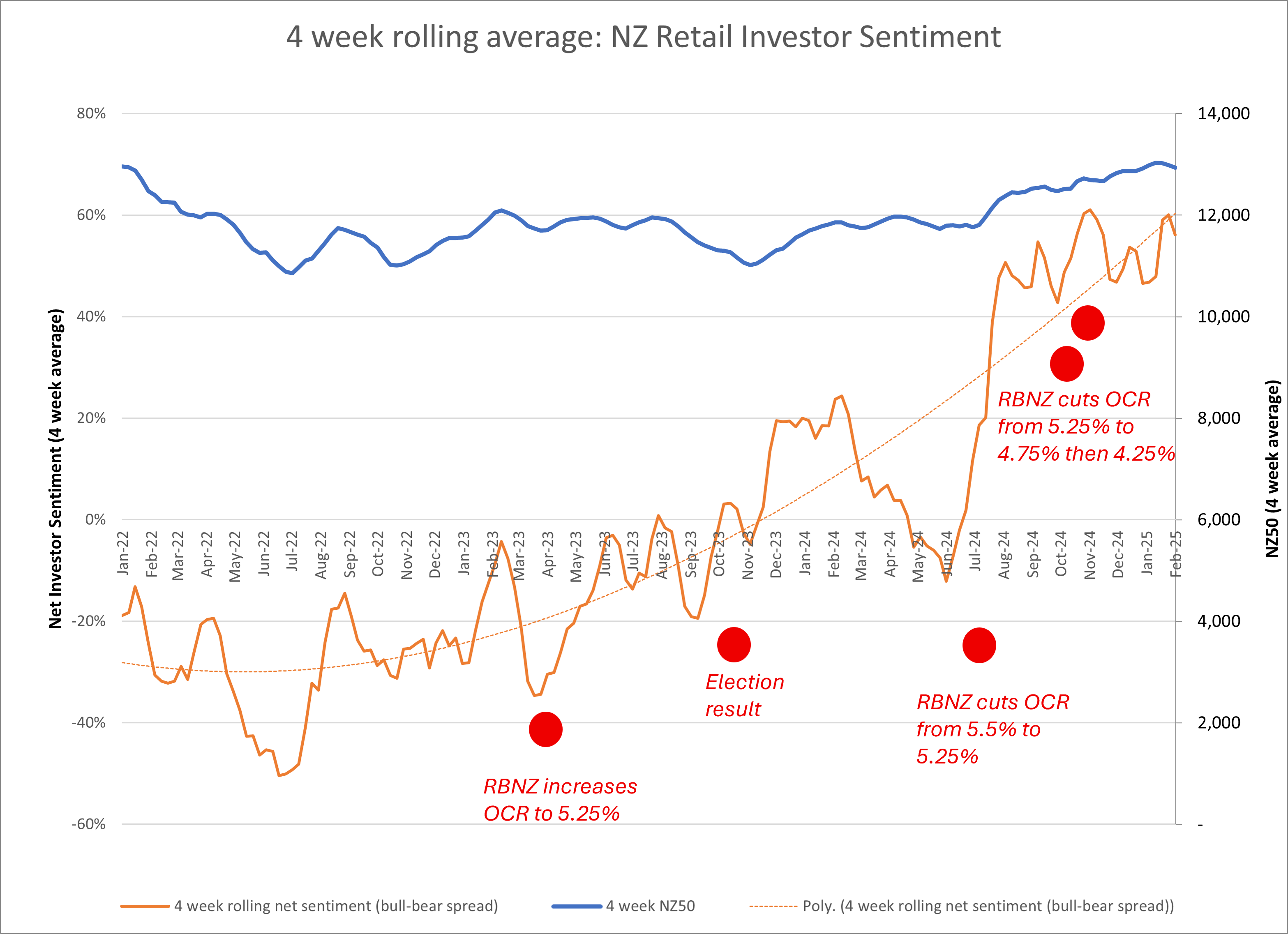

There’s been an interesting development in the NZSA / UC Investor Sentiment Index since the middle of 2024, with (net) investor sentiment taking a significant leap during June. Six months later, heading into 2025, those levels have been maintained.

Each week, NZSA, in conjunction with the University of Canterbury, surveys a random sample of its members with a view to determining how investors feel about the future of the NZ50, the ASX200 and the S&P500 (the latest survey results are available at this link). ‘Net’ sentiment is calculated by subtracting the ‘bears’ (those who think the market will perform poorly in the next six months) from the ‘bulls’ – those who believe the market will increase.

This is very much part of a longer-term study into investor behaviour and the impact on markets. NZSA began the survey series in early 2020. You’re likely to see more of this as we discuss quarterly survey outcomes during 2025 – we think your responses offer a valuable insight into market dynamics.

When it comes to the NZ50, net sentiment began to increase from early 2023, but really gained legs as positivity surrounding the first set of interest rate cuts took hold.

There’s a few things we can learn from this chart.

Firstly, investors will respond immediately to perceived changes in investing or economic conditions, whether they be positive or negative. Short-term sentiment surrounding a change in the OCR (official cash rate) matters to investors, even if they operate with a long-term outlook.

Second, despite the massive change in net sentiment by retail investors, reflecting a positive view of NZX conditions in six months, the index has changed by 0% since January 2022. So perhaps it isn’t the time to bet the proverbial farm on a recovery in our local market just yet (at least, not solely on the basis of investor sentiment).

Those two takeaways show that past or current events are no guarantee of a future outcome. Rationally, most investors know this – but whether conscious or unconscious, this is still a warning to be wary of FOMO (fear of missing out).

While there might not be much of a correlation over the longer term, there are some definite shorter-term trends. So despite a 0% NZ50 return over the three-year period of the graph above, there is a 25% positive correlation between the actual net sentiment for each week and the change in NZ50 index over the next six months. Essentially, the more positive investors feel, the more likely they may be to create their own reality.

Overseas markets

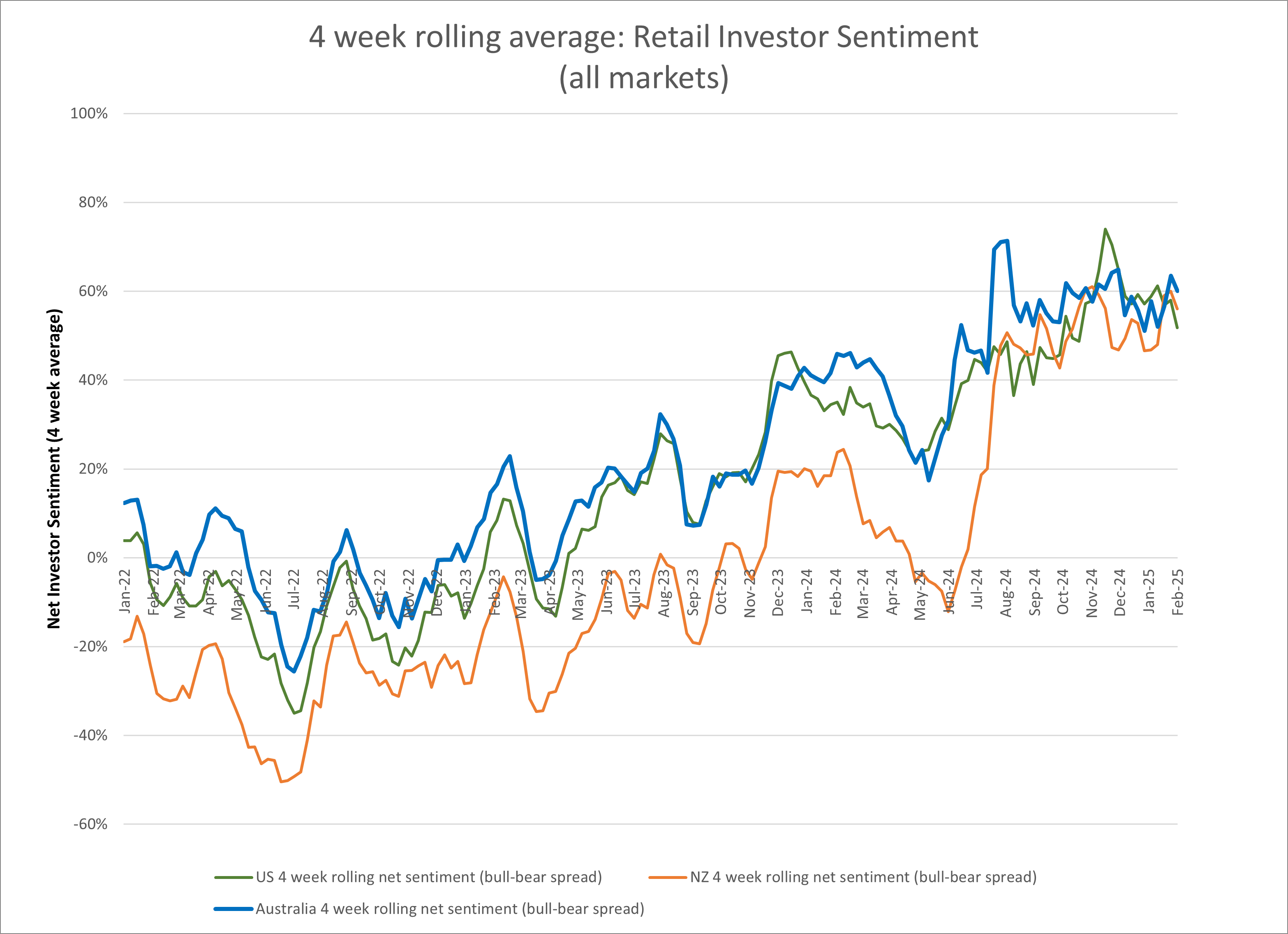

Before I pull out the data, my own ‘unconscious bias’ is that most Kiwis think the grass is always greener somewhere else, regardless of whether that is true or not.

So what have investors thought when it comes to the Australian ASX200 and the US S&P500?

Okay, I take it back. Investor rationality clearly overcomes long-held cultural norms, even in New Zealand!

While both Australian and US expectations have outpaced NZ for much of this three year period, there is arguably a clear economic rationale to support that. More recently, President Trump’s election seemed to spur investors in November 2024, with net sentiment spiking at close to 80% – however, the most recent survey results have seen increasing nervousness; in fact, the 24% believing that the US market will decrease in the next six months is the most since October 2023.

But let’s be clear – there is a striking convergence between all three of these markets when it comes to investor sentiment, with the NZ50 trading off the ‘lowest base’ when it comes to recent returns. Also, behind the ‘net’ number, more investors appear to be getting off the fence, with “neutral” responses undergoing a sharp decline over the last quarter across all markets.

From a behavioural perspective, the NZSA / UC Investor Sentiment Survey seems to be hinting that maybe, just maybe, 2025 will be the NZX’s year.

Oliver Mander

Let’s see what an actual proper economist has to say! Shamubeel Eaqub starts his national tour in Hamilton tomorrow (February 11th) and Auckland (February 12th), with other events at NZSA branches all over New Zealand later in the month.