NZSA Disclaimer

There are many ways to express this sentiment. In cricket, the saying goes that “form is temporary, but class is permanent“. In investment markets, the saying goes that “a rising tide floats all boats” – tellingly expressed in the affirmative when all too often it’s a case of watching out for the opposite.

In this context, it’s appropriate that we’re talking about boats. Yesterday, I spent the day in Invercargill and Bluff; from a pragmatic perspective, this let me exercise NZSA’s proxy on behalf of shareholders at South Port’s annual shareholder meeting. But in reality, it was simply important for me to get face-to-face with the Board and management of Southland’s only listed company, in the same way that NZSA does for every other company on the exchange. South Port’s relative remoteness to Queen St, Lambton Quay or Cathedral Square should be no barrier for investors. Unfortunately, New Zealand’s geography renders such a noble principle moot for much of the investing population.

So, why not share my experiences and impressions with the wider NZSA membership? This article acts as both the ‘meeting report’ compiled by any NZSA volunteer and additionally as a slightly deeper dive into an investment that is just that bit harder to visualise for most. View this note as a ‘site visit’ through the eyes of your visiting proxyholder – certainly, when it comes to a port operation, there is nothing quite like being there.

South Port themselves certainly seemed happy to see me. It certainly stood out that the entire Board and much of the management team were physically present at the meeting and were very happy to chat with me and other shareholders afterwards. I received a tour of the Port facilities by Commercial Manager, Jamie May, who answered my many questions about the port operations and its role in the Southland community.

It is worth noting at this point that this opportunity is available to other investors, by way of the ‘Port Community Open Days’ that South Port operate each year. Rest assured that the Port was not favouring one investor group over another.

Regional Context

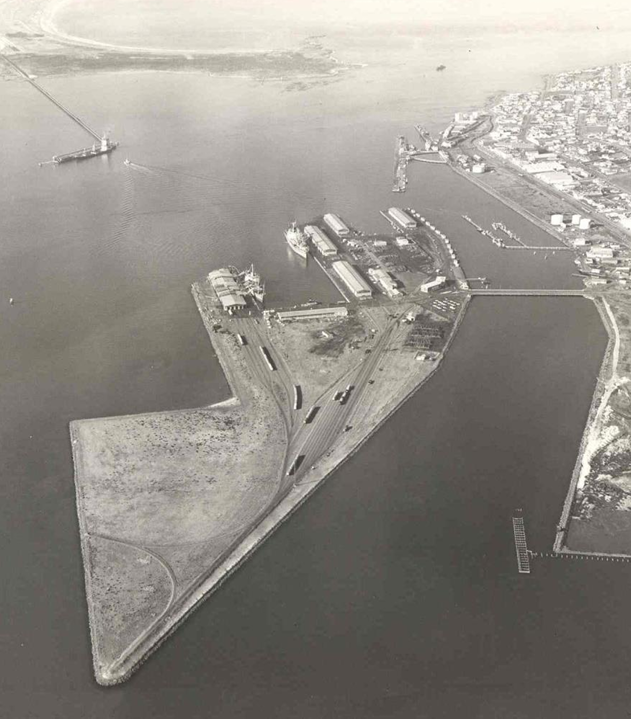

South Port listed in July 1994, following the dissolution of the former Southland Harbour Board in 1988. There is still a close link between the Southland region and its port – Environment Southland (the brand for Southland Regional Council) continues to hold a 66.48% shareholding and South Port itself promotes its key purpose as facilitating the best logistics solutions for the region. Most of the port is situated on a man-made 40 hectare island, Island Harbour created during the 1950’s. The company also operates a wharf (‘Town Wharf’) on the western landside coast and owns the Tiwai wharf servicing the Aluminium Smelter on the eastern coast of the harbour. Access to Island Harbour is via a single bridge for both road and rail, a unique potential point of failure that has seen the Port invest plenty in its strengthening to ensure future resilience.

This 1970’s image shows the partially-utilised Island Harbour (opened December 1960) together with the Tiwai wharf on the left and the ‘Town Wharf’ in the mid-distance on the right.

South Port has just completed an upgrade of the Town Wharf to sustain existing fuel tanker operations and support future cruise ship growth.

Island Harbour is now fully utilised, with the last remaining vacant space recently used as a staging area for nearby windfarm projects.

South Port derives no ‘wharfage’ revenue from the Tiwai wharf, with the smelter paying a license fee for the use of the wharf structure.

Most of South Port’s cargo is ‘bulk’ or ‘break-bulk’, accounting for 87% of cargo tonnage in FY23 creating a very different driver of value compared to other listed ports. Container traffic is serviced by a weekly MSC line service, supported by two mobile container cranes to improve operational flexibility on site.

Given the limited land available on Island Harbour, land use and revenue optimisation from available land is a key driver for the port’s efficiency and profitability. Like other ports, South Port has purchased some surrounding land near its operations, with a view to adding value longer-term. The driver for South Port is a little different, certainly given the relatively low value of land in Bluff compared with, say, Wellington. Land near the port creates flexibility for future warehousing or less site-critical activity, allowing the port to make the most of its limited land on Island Harbour for bulk and container operations. The port also has an eye on future cruise ship trade – while only a minor player, with 12 cruise ship calls last year, there are already 18 cruise ships booked in for the coming season. Nearby land may play a role in developing specialist facilities if required.

Operationally, land on Island Harbour is used either to support bulk storage operations for ship loading or leased to key customers for customer-owned storage. South Port also offers its own warehousing operation on-site for key customers, adding further value, and also uses land for its container loading and storage operations. South Port also offer a ‘syncrolift’ facility – the only such facility south of Lyttelton – and associated boat workshops (operated by third parties). Ultimately, the port is keen to ensure that its land use drives the highest risk-balanced delivery of returns for shareholders.

Returns and operations

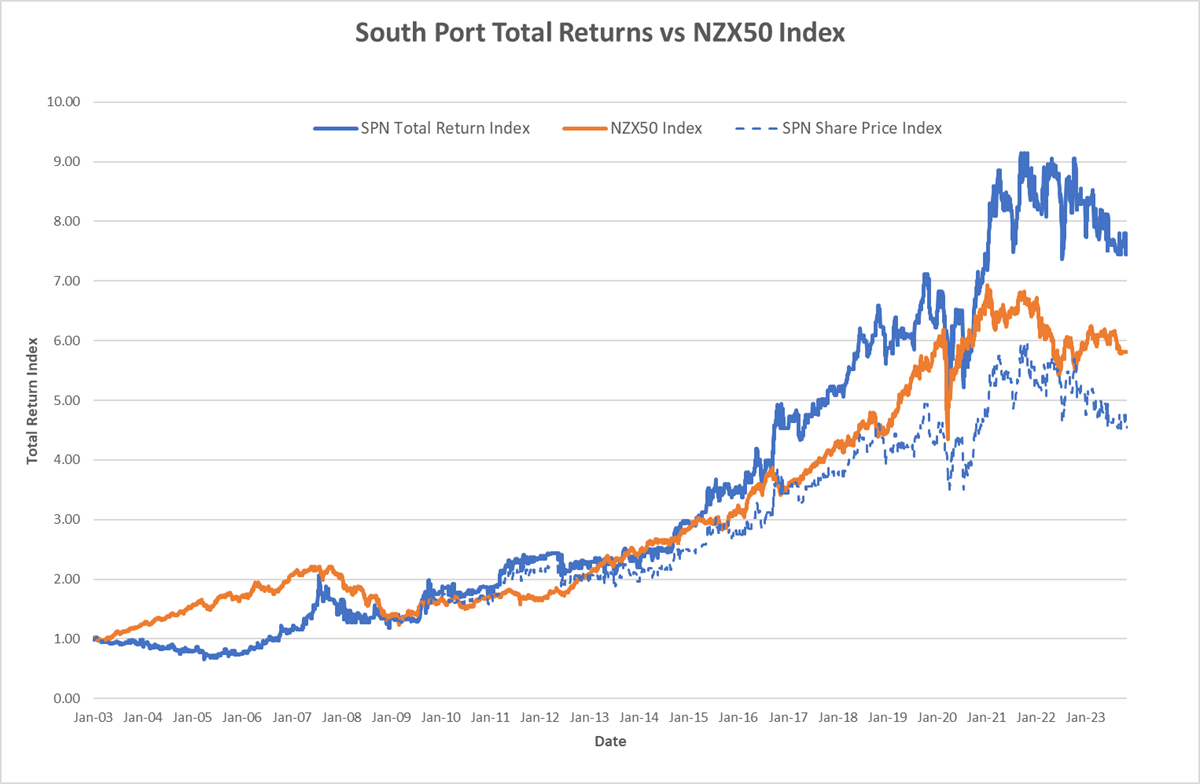

Shareholders have done well since listing – albeit, after a slow start. It took four years for SPN to catch up with the index, but since then, shareholders would be well pleased with the stable and consistently improving returns the company has delivered. The chart below shows the ‘total return’ (compared to the NZ50) since the inception of the NZX Gross Index in January 2003:

That’s equivalent to a 10.3% return each and every year since January 2003 (assuming re-invested dividends). There’s two key messages to that investment outcome: firstly, time in the market matters and secondly, the power of ‘compounding’ returns truly is the eighth wonder of the world.

It makes no difference whether you’re sitting in the PwC tower in Commercial Bay or at the much more down-to-earth Island Harbour headquarters of South Port in Bluff.

Most of South Port’s export volume is derived from a relatively small catchment area surrounding the port. Open Country Dairy and Ballance (fertiliser) are a short drive up State Highway 1, with the log and woodchip trade coming from slightly further afield. Other exports from the port include Aluminium (with ingots managed via the ports operations on Island Harbour) and fish meal.

The port also services the local oyster trade, whose products are much beloved of many New Zealanders in a city far further north. The image below shows the specialised (small) buildings used to support the season.

More recently, the port has been used as a staging area for new windfarm developments around Southland. There’s little doubt that the region will play a unique role in the ongoing decarbonisation effort for New Zealand’s energy supply. Currently, Mercury, Contact and Manawa all have windfarm developments at varying degrees of progress in the region. For the first time in decades, there is the potential for competition within Southland for new electricity supply – whether supplying new data centres targeting the Eastern seaboard of Australia, new ‘green hydrogen’ projects or even (!) an aluminium smelter that might just decide there is an economic case to maintain its operations. Recent Transpower investment to upgrade the key transmission lines to Canterbury will also support energy development, regardless of Southland region energy outcomes.

As an aside, investors would be forgiven for applying some interpretation to the subliminal messaging in the composition of South Port’s Board. New Chair Philip Cory-Wright is also on the Board of NZ Windfarms, while Michelle Henderson is on the Board of Meridian Energy.

Regardless, the port clearly expects some benefit from its proximity to planned or in-flight energy development projects.

An investment in South Port is a proxy for an investment in Southland. Current developments within the region and the lack of institutional investor interest may be of interest for many retail investors. While a majority shareholding by Environment Southland may be a concern, the company has demonstrated that it operates at arms length from its major shareholder. As always though, investors should ensure that their interests are aligned with the interests of South Port’s major shareholder.

The Meeting

Some context.

NZSA has been heartened over recent years by the clear improvement in South Port’s disclosures and its efforts to strengthen its Board and governance practices. The much-vexed question of director tenure is fast disappearing into the distance with a concerted effort made by the Board to seek out and appoint its ‘new generation’ of directors. It’s also likely that the Board will have a better eye on succession management in future, to avoid the risk of a loss of knowledge associated with sudden transitions.

While the shareholder meeting still requires a physical presence to vote, at least it is now live-streamed – an improvement on prior practice. South Port notes its strong connection to its local community and majority shareholding by Environment Southland as key to holding its shareholder meeting on site. Certainly, the view from the window of an operating container terminal offered an additional perspective on the presentations made by outgoing Chair, Rex Chapman, and CEO, Nigel Gear.

The company was keen to trumpet its credentials as a ‘dividend-yield’ share, underpinned by steady underlying performance. In response to a shareholder question related to Director Fees, outgoing Chair Rex Chapman noted that share price declines in recent years had little to do with company performance and everything to do with the significant increase in external interest rates reducing the value of the relative yield for investors.

If the power of compounding returns is the eighth wonder of the world, interest rates are the devil incarnate – as those of us with longer memories know only too well.

South Port has incurred significant capex and opex costs in recent years, all aimed at improving resilience and sustaining or improving its current operations. Highlights include the deepening of two key channels serving both the Tiwai Wharf and Island Harbour to support vessel draft of 10.7m, the refurbishment of the southern portion of the Town Wharf, the purchase of a new (third) tug – the first new tug purchase in the port’s history – and strengthening the access roadway to Island Harbour.

Chapman signalled that future project spend was likely to return to more ‘business-as-usual’ levels.

He also highlighted his disappointment that Ngāi Tahu were declined consent for a new offshore marine salmon farming operation and noted that South Port would introduce a long-term incentive scheme for its staff over the coming year.

The presentation by CEO Nigel Gear focused heavily on South Port’s people, values and community.

At one point, the meeting descended into a bit of a ‘love-in’ for the outgoing Chair as a mark of respect for his long service – a point also noted by a clearly embarrassed Rex Chapman. He noted that the Port had focused heavily on becoming an ’employer of choice’ within the region with a recent focus on improving gender balance at all levels (including the Board). South Port recently instigated a director development programme, in conjunction with the Southland Chamber of Commerce.

We should be taking a lead as Southland’s only listed company

Rex Chapman, outgoing Chair, South Port Limited

We agree, Rex.

The immediate outlook for the company is less favourable, driven by the macro-economic factors affecting the wider New Zealand economy. The impact of China’s faltering growth are being felt as far away as Southland. Guidance of $11.7m – $12.3m NPAT issued prior to the start of the financial year has now been revised to $9.0m, although the company is looking to maintain its dividend.

Questions and Resolutions

Given the large shareholding of Environment Southland, a favourable vote was never in dispute. NZSA also voted its proxies in favour, despite some pointed questions that acted as encouragement for maintaining recent successful board member renewal.

A number of questions were received, including from NZSA. We were assured that succession planning for the Board remained at the forefront of their minds and that directors certainly did not view their roles as a “job for life”. There was a concern expressed by a shareholder over director workload, with the response that “this has never been an issue“. The company will continue to diversify its cargo base and manage costs to maintain resilience through all economic cycles.

An unusual question was received related to whether the company held any investments in gold to buffer against business volatility. In a deft verbal switcheroo worthy of any seasoned politician, Rex Chapman assured the questioner that the business held appropriate currency hedges to manage foreign-exchange volatility.

There was some grumbling from shareholders about the recent increases in director fees (“we need to be at the market median“) and (from NZSA) whether the company would publish a skills matrix. The Board had apparently considered this request from NZSA’s feedback last year and had decided against this. Philip Cory Wright later noted that it was “hard to express skills in a public way“, although we helpfully pointed out that it didn’t seem to be a problem for most other public companies. In a later discussion with Philip, he clarified that he meant that he did not want an skills disclosure to be merely a ‘box-ticking’ exercise – indeed a worthy sentiment.

The company’s community link was fully on display when asked whether the Board would continue to commit to maintaining the wharf at Halfmoon Bay (Stewart Island). Chapman noted that if South Port didn’t do it, they will continue to make sure it happens.

The meeting closed with a short address from an upbeat incoming Chair Philip Cory-Wright, who offered his own view on board tenure and the value offered to South Port by the relationships around the Board table.

Oliver Mander

Oliver attended the South Port Annual Meeting as part of NZSA’s coverage of listed companies. His visit was solely funded by NZSA.

One Response

Thank you for a varied and interesting report Olliver. I’m very pleased you were able to visit the ASM and that NZSA has been able to affect some enlightenment with the Board. I like that positive changes are happening and will very pleased when the company offers hybrid meetings.