If you’re not yet a member, join now for access to a whole lot more!

2 October 2025

Genesis Energy Limited (GNE)

The company will hold its Annual Shareholders Meeting at 2.00pm Thursday 16 October 2025.

The location is Novotel Christchurch Airport, 30 Durey Road, Christchurch.

You can also join the meeting online at this link.

Company Overview

The company sells electricity, reticulated natural gas and LPG. It is New Zealand’s largest energy retailer with over 520,000 customers. It generates electricity from a diverse portfolio of thermal and renewable generation assets located across the country. The company also has a 46% interest in the Kupe Joint Venture, which owns the Kupe Oil and Gas Field offshore of Taranaki.

In October 2024, the company acquired the majority shareholding in ChargeNet the country’s largest EV public charging network.

Paul Zealand who had served on the Board since 2016 retired in May 2025.

Current Strategy

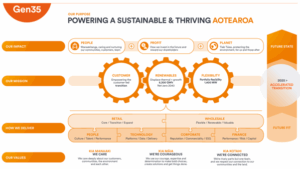

In November 2023, the company announced its new Gen35 strategy with the aim of transitioning its generation fleet to 95 per cent renewable by FY35, increasing generation capacity and empowering a customer-led transition. The strategy is now in “Horizon 2” deliverables, with initial deliverables completed during FY24.

This has included monetising the “firming” generation flexibility provided by Huntly by reaching agreements with Mercury, Meridian and Contact. This agreement is subject to Commerce Commission authorisation. The draft determination released by the Commission on September 30th has indicated that the public benefits likely outweigh detriments, so they are inclined to grant authorisation.

Previous Year Shareholder Meeting

NZSA recorded the following key items at last year’s annual shareholder meeting:

- Genesis’s generation costs rose by $100m in the last year.

- Questions from shareholders were numerous, reflecting strong interest in the company’s ongoing transformation.

- The 2024 financial year was not an easy one for Genesis Energy, as evidenced by the 22% decline in EBITDAF and a reduction in the annual dividend from 17.6c to 14c net.

The meeting report is available at this link.

Disclaimer

To the maximum extent permitted by law, New Zealand Shareholders Association Inc. (NZSA) will not be liable, whether in tort (including negligence) or otherwise, to you or any other person in relation to this document, including any error in it.

Forward looking statements are inherently fallible.

Information on www.nzshareholders.co.nz and in this document may contain forward-looking statements and projections. For any number of reasons, the future could be different – potentially materially different. For example, assumptions may be wrong, risks may crystallise, unexpected things may happen. We give no warranty or representation as to any future financial performance or any other future matter. We may not update our website and related materials for changes.

There is no offer or financial advice in our documents/website.

Information included on www.nzshareholders.co.nz and in this document is for information purposes only. It is not an offer of financial products, or a proposal or invitation to make any such offer. It is not financial advice and does not take into account any person’s individual circumstances or objectives. Prior to making any investment decision, NZSA recommends that you seek professional advice from a licensed financial advice provider.

There are no representations as to accuracy or completeness.

The information, calculations and any opinions on www.nzshareholders.co.nz and in this document are based upon sources believed reliable. The NZSA, its officers and directors make no representations as to their accuracy or completeness. All opinions reflect our judgement on the date of communication and are subject to change without notice.

Please observe any applicable legal restrictions on distribution

Distribution of our documents and materials on www.nzshareholders.co.nz (including electronically) may be restricted by law. You should observe all such restrictions which may apply in your jurisdiction.

Key

The following sections calculate an objective rating against criteria contained within NZSA policies.

|

Colour |

Meaning |

|

G |

Strong adherence to NZSA policies |

|

A |

Part adherence or a lack of disclosure as to adherence with NZSA policies |

|

R |

A clear gap in expectations compared with NZSA policies |

|

n/a |

Not applicable for the company |

Governance

NZSA assessment against its key policy criteria are summarised below.

|

G |

Directors Fees: Director’s fees and the fee pool are clearly disclosed in the Annual Report. We note that Directors are entitled to be compensated for additional work, however there were no payments made to Directors under this provision in FY25.

|

G |

Director Share Ownership: Directors are not required to own shares.

|

G |

CEO Remuneration: The company discloses its remuneration policy on its website, which includes an overview of the remuneration philosophy applicable to the company. The Human Resources and Remuneration Committee are responsible for implementing the policy.

Incentives: The CEO is paid a short-term incentive (STI) in cash and a long-term incentive (LTI) by way of Performance Share Rights.

NZSA encourages fulsome disclosure in relation to any incentive payments made to the CEO, including disclosure of measures (or measure ‘groups’), weightings, targets, and the level of achievement versus target for each component associated with any awards. This methodology is supported by the new NZX Remuneration Reporting Template.

The STI is awarded at a target of 50% of base salary. The measures, weightings, and level of achievement against each component are well-disclosed, with the overall STI award being made at 78% of target.

Performance rights are awarded under the LTI at 50% of base salary. Vesting then occurs after a three-year performance assessment period. Measures include total shareholder returns (TSR) which is favoured by NZSA. No award was made in FY25.

NZSA prefers a weighting towards the LTI to align with long-term shareholders’ interests.

The company discloses the gender pay gap but not the CEO/employee remuneration ratio.

Golden Parachutes: In the interests of transparency, NZSA believes there should be explicit disclosure around the severance terms (including notice periods) associated with the CEO, including whether specific termination payments are offered. We also encourage disclosure as to whether any sign-on, retention, loss of benefits from a previous employer payments or takeover bonus are offered.

|

G |

Director Independence: All Directors are independent.

|

A |

Board Composition: The company does not participate in the IoD’s Future Director programme designed to develop and mentor the next generation of Directors. NZSA expect NZX50 companies to participate as part of a responsibility to develop and mentor the next generation of Directors.

Whilst the Annual Report includes a skills matrix, it does not attribute skill sets to individual Directors to demonstrate how they contribute to the governance of the company and add value.

The nature of the company’s board indicates a commitment to thought, experiential and social diversity, with relevant experience for Genesis.

|

G |

Director Tenure: NZSA looks for evidence of ongoing succession or ‘staggered’ appointment dates that reduce the risks associated with effective knowledge transfer in the event of succession. We also prefer a term maximum of 9-12 years, unless there are exceptional circumstances that may apply.

Genesis Directors have been appointed between 2016-22, indicating a thorough commitment to Director renewal balanced with institutional knowledge.

|

G |

ASM Format: Genesis Energy Limited is holding a ‘hybrid’ meeting, (i.e., physical, and virtual), a format preferred by NZSA as a way of promoting shareholder engagement while maximising participation.

|

G |

Independent Advice for the Board & Risk Management: NZSA looks for evidence, through disclosures, that a Board has access to appropriate internal and external expertise to support board assurance activities. We also look for evidence that Boards are across their risk management responsibilities.

The Board Charter notes that “individual Directors may (with the prior approval of the Chairman) engage and consult with professional advisors from time to time, with any costs being met by the Company.” The Company Secretary is also accountable to the Chair on governance matters, although it is less clear as to the extent to which other internal assurance staff have unfettered access to the Board.

Genesis offers clear disclosure of strategic, business, and financial risks, as well as the processes that support risk management (further disclosed in the Corporate Governance Statement). The company also publishes a separate Climate Statement.

Audit

NZSA assessment against its key policy criteria are summarised below.

|

G |

Audit Independence: Good disclosure.

|

A |

Audit Rotation: We note that under the Public Audit Act 2001, the Auditor-General appoints the Auditor and ensures the Lead Audit Partner is rotated at 5 years. There is no disclosure of the date the Lead Audit Partner and Audit firm was appointed nor the policy on Audit firm rotation.

In light of events overseas and (recently) within New Zealand, NZSA believes it is important that companies have a clear Audit firm rotation policy and a process to regularly test the market as regards audit fees.

Environmental Sustainability

|

G |

Overall approach: Genesis has elected to use adoption provision 2 (anticipated financial impacts) under NZ Climate Standard 2. Their broader reporting continues to embed environmental sustainability into strategy. Genesis also manages freshwater impacts through hydro re-consenting and flow requirements, invests in native planting and wetland restoration, and tracks construction waste diversion. While voluntary, these initiatives show commitment to environmental sustainability beyond climate obligations.

|

G |

Sustainability Governance: Genesis discloses a Board Skills Matrix that includes sustainability expertise. The Board is supported by sub-committees, with climate matters overseen through the Audit and Risk Committee. Management accountability is allocated through the Climate Working Group and senior sustainability roles.

|

G |

Strategy and Impact: Genesis reports progress on its Gen35 strategy, with FY25 marking the launch of Horizon 2 (to FY28). Key initiatives include commissioning the Lauriston solar farm, beginning grid-scale battery construction at Huntly, and progressing biomass trials to displace coal. Genesis links these actions to its long-term science-based net-zero 2040 target. The reporting also recognises the challenges of FY25 (dry periods, gas constraints) and their impact on emissions performance, while still embedding climate issues directly into corporate strategy.

|

G |

Risk and Opportunity: Genesis continues to provide detailed disclosure of both physical and transition risks, using scenario analysis and materiality assessments. It sets out how climate risks are identified, prioritised, and managed, while also highlighting opportunities such as customer electrification, EV charging through ChargeNet, and new renewable projects.

|

G |

Metrics and Targets: Genesis discloses Scope 1, 2, and relevant Scope 3 greenhouse gas emissions, with comparative data from prior years. For FY25, the Scope 3 target was achieved, while the Scope 1 and 2 generation target was missed due to higher coal use, though emissions remained below the FY20 baseline. The company’s science-based targets (validated by SBTi) and net zero 2040 goal remain central to reporting. Climate-related metrics are also integrated into executive incentives, with a portion of variable pay linked to emissions outcomes.

|

G |

Assurance: Genesis’s FY25 GHG disclosures were assured by Deloitte. The assurance standard was ‘reasonable’ for Scope 1 & 2 and ‘limited’ for Scope 3, a level in excess of the requirement. NZSA continues to encourage the extension of assurance beyond GHG inventories to cover the broader environmental and climate disclosures.

Ethical and Social

NZSA assessment against its key policy criteria are summarised below.

|

G |

Whistleblowing: Good disclosure.

|

G |

Political Donations: Clear disclosure that the policy is not to make political donations.

Financial & Performance

|

Policy Theme |

Assessment |

|

Capital Management |

G |

|

Takeover or Scheme |

n/a |

Genesis Energy’s share price rose from $2.11 to $2.37 (as of 30th September 2025) over the last 12 months – a 12% increase. This compares favourably with the NZX 50 which rose 6% in the same period. The capitalisation of GNE is $2.6b placing it 21st out of 115 companies on the NZX by size and makes it a large company.

|

Metric |

2021 |

2022 |

2023 |

2024 |

2025 |

Change |

|

Revenue |

$3,221m |

$2,834m |

$2,374m |

$3,048m |

$3,642m |

20% |

|

Operating Expenses |

$2,863m |

$2,394m |

$1,860m |

$2,653m |

$3,265m |

22% |

|

EBITDA |

$358m |

$440m |

$514m |

$394.5m |

$397.1m |

1% |

|

NPAT |

$34m |

$222m |

$196m |

$131.1m |

$169.1m |

29% |

|

EPS1 |

$0.032 |

$0.211 |

$0.184 |

$0.121 |

$0.154 |

27% |

|

PE Ratio |

101 |

14 |

13 |

19 |

15 |

|

|

Capitalisation |

$3.5b |

$3.1b |

$2.6b |

$2.4b |

$2.6b |

9% |

|

Current Ratio |

0.78 |

1.05 |

0.75 |

1.18 |

1.13 |

-5% |

|

Debt Equity |

1.56 |

1.22 |

1.12 |

1.11 |

1.05 |

-5% |

|

Operating CF |

$324m |

$262m |

$423m |

$439.8m |

$311.7m |

-29% |

|

Operating CF (cps) |

$0.31 |

$0.25 |

$0.40 |

$0.41 |

$0.28 |

-30% |

|

NTA Per Share1 |

$1.58 |

$1.91 |

$1.91 |

$2.14 |

$2.38 |

11% |

|

Dividend1 |

$0.174 |

$0.176 |

$0.176 |

$0.14 |

$0.143 |

2% |

1 per share figures based off actual shares at balance date (not weighted average)

A better year for Genesis reflected in a rising share price. As was the case in 2025, revenues were up solidly by 20% to $3,642m but a corresponding 22% increase in operating expenses of $3,265m meant a steady EBITDA of $397.1m was achieved. After a revaluation in change in fair value of financial instruments, depreciation, and other items, GNE delivered a NPAT of $169.1m, a 27% increase. This provided shareholders with EPS of $0.154 and places GNE on a PE of 15.

The Gentailers, rightly or wrongly, are not priced on their earnings but rather their operating cashflows and the ability to deliver dividend streams. GNE’s operating cashflow were down 30% to $311.7m, equating to $0.28 cents per share. Operating cashflows were affected by a large rise in the level of inventories. The changes in quantum of this item will affect the annual changes in operating cashflows.

Genesis’ dividend rose 2% to $0.143 per share. Both the interim and final dividend are fully imputed.

Depreciation is a large component of Genesis’s expenses, being $239.1m. This somewhat explains the large divergence between operating cashflows and NPAT.

The company is in a sound financial position with the current ratio at 1.13 and the debt equity ratio continuing to improve slightly to 1.15. GNE has $268.3m of short-term debt and $1,182.4m of non-current debt for total interest-bearing debt of $1,450.7m. This is well within normal metric ranges, and gives GNE a good mix of debt and equity for funding.

NTA rose substantially to $2.38, with the shares trading at a similar level.

On page 25 of an investor presentation, GNE provide some forward looking guidance where they expect FY26 EBITDAF to be between $430m and $460 million and capital expenditure to be around between $55m and $65m, with an additional growth CAPEX of about $300m.

The Crown is the largest shareholder with a 51.23% controlling stake. Outside of this holding, shares are widely held with a large and diverse range of investors.

Resolutions

1. To re-elect Catherine Drayton as an Independent Director.

Catherine was appointed to the Board in March 2019. She is currently the Chair of both Connexa Limited and Mint Innovation Limited, as well as being a director of IAG New Zealand and Warren and Mahoney Limited. Her former governance roles include Chair of Guardians of New Zealand Superannuation, Chair of Christchurch International Airport Limited, Director of Meridian Energy Limited, Director of Beca Limited, Director of Ngai Tahu Holdings, and Director of Powerbyproxi Limited. Catherine’s executive career as a senior partner in PricewaterhouseCoopers, specialising in mergers and acquisitions, culminated in leading that company’s Assurance and Advisory practices for Central and Eastern Europe (excluding Russia).

We will vote undirected proxies IN FAVOUR of this resolution.

2. To re-elect Warwick Hunt as an Independent Director.

Warwick Hunt was appointed to the Board in 2022. He has worked in senior professional service and advisory roles in Australia, Asia, the Middle East, Africa, the UK, and Europe in addition to New Zealand over the last 30 years. He has worked across a range of sectors, including energy, professional services, financial services, agribusiness, and aviation. He is Chair of the Bank of New Zealand, a non-executive Director of National Australia Bank (NAB) and an Executive Fellow of Kings College London Business School. Warwick has served as Territory Senior Partner of PricewaterhouseCoopers (PwC) New Zealand and Middle East Region and Managing Partner of PwC United Kingdom and Europe Middle East Africa. He is a Fellow Chartered Accountant (Australia and New Zealand) and an Honorary Fellow of Kings College London.

We will vote undirected proxies IN FAVOUR of this resolution.

3. To re-elect Hinerangi Raumati-Tu’ua as an Independent Director.

Hinerangi Raumati-Tu’ua was appointed to the Board in March 2022. She is the Chair of Tainui Group Holdings Limited, Te Pou Herenga Pakihi Limited, and Turangawaewae Trust Board. She also serves on the Boards of a number of entities, including Taranaki Iwi Holdings Limited, Guardians of New Zealand Superannuation and is an executive committee member of Waikato-Tainui. She has previously held governance roles in a range of entities, including the Reserve Bank of New Zealand, Watercare, Aotearoa Fisheries Limited (Moana NZ) (as Chair), Sealord Group Limited, Parininihi Ki Waitotara Incorporation (as Chair), Port Nicholson Fisheries Limited, Te Ohu Kai Moana Trustee Limited, Auckland Council Investments Limited, Public Trust, and Waikato Community Trust.

In addition to her strong commercial, investment and corporate governance background, Hinerangi has focused on the development of post settlement commercial entities and commercial frameworks with a Te Ao Maori view. Hinerangi has served as CFO of Tainui Group Holdings and Executive Director Operations at Te Wananga o Aotearoa. Hinerangi was named Māori Businesswoman Leader of the Year in 2016 in the University of Auckland Aotearoa Māori Business Leaders Awards and received the Maori Leadership in Finance award in 2024. She served on the Cullen Tax Working Group in 2019.

We will vote undirected proxies IN FAVOUR of this resolution.

4. To re-elect Tim Miles as an Independent Director.

Tim Miles was appointed to the Board in November 2016. He began his career with IBM and later joined Data General Corporation, rising to Director of Marketing – Asia Pacific. He then joined Unisys Corporation in various senior executive roles before taking up roles as the Chief Executive Officer of Vodafone New Zealand, the Chief Executive Officer of Vodafone UK and the Vodafone Group Chief Technology Officer. Upon returning to New Zealand, Tim was Managing Director of listed agricultural group PGG Wrightson before taking up a role as Chief Executive Officer of Spark Digital, playing a key role in the transition of Spark to become New Zealand’s leading digital services provider. Tim is Chair of Forty South Limited and a Director of ASX listed company oOh! Media Limited. Tim previously served as a Director of UDC Finance, Goodman Property and Chair on the Advisory Boards of Revera Limited and the CCL Group.

If he is re-elected, he will have served almost 12 years at the end of that time. Following our comments above as regards Board tenure we would expect this to be his last term.

We will vote undirected proxies IN FAVOUR of this resolution.

5. To elect David Baldwin as an Independent Director.

David Baldwin was appointed to the Board in October 2025 and is therefore required to offer himself for election. He brings more than 35 years of international leadership and governance experience across Asia-Pacific, Europe, and North America. He has held senior executive and Director roles spanning renewables, gas and LNG, utilities, chemicals, and infrastructure asset management. His career includes leadership positions with Contact Energy, Origin Energy, Shell, and Berkshire Hathaway Energy. Most recently, David was a Senior Managing Director with Macquarie Asset Management, where he advised and served on the boards of energy, infrastructure, and private equity portfolio companies. David is currently a non-executive director of Energy Development Corporation in the Philippines and Cyrq Energy in the United States, both Macquarie Asset Management portfolio companies.

We will vote undirected proxies IN FAVOUR of this resolution.

Proxies

You can vote online or appoint a proxy at https://www.investorvote.com.au/

Instructions are on the Proxy/voting paper sent to you.

Voting and proxy appointments close 2.00pm Tuesday 14 October 2025.

Please note you can appoint the Association as your proxy. We will have a representative attending the meeting.

The Team at NZSA