Date Released: May 25th 2023

Tap/Click here to download pdf version

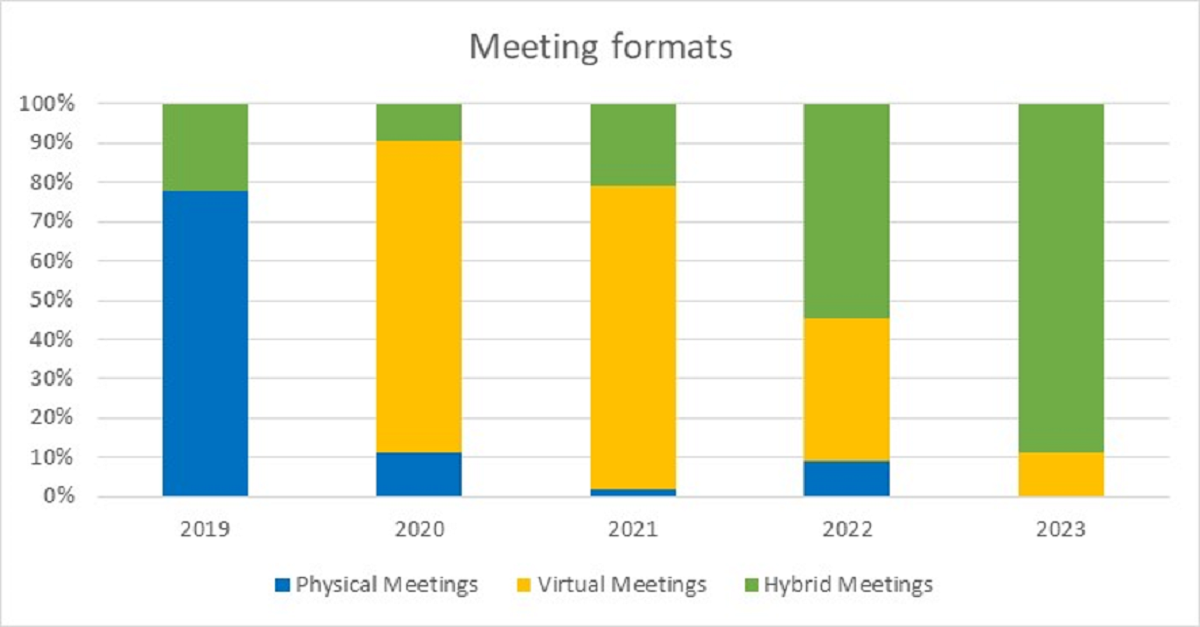

Recent research undertaken by The New Zealand Shareholders’ Association (NZSA) has highlighted the value placed on ‘hybrid’ meeting formats by investors – but also shows a declining overall level of attendance at Shareholder Meetings of NZX-listed companies since 2019, across all meeting formats.

The ‘hybrid’ meeting format comprises both a ‘physical’ and ‘virtual’ component to cater for the disparate needs of its shareholders.

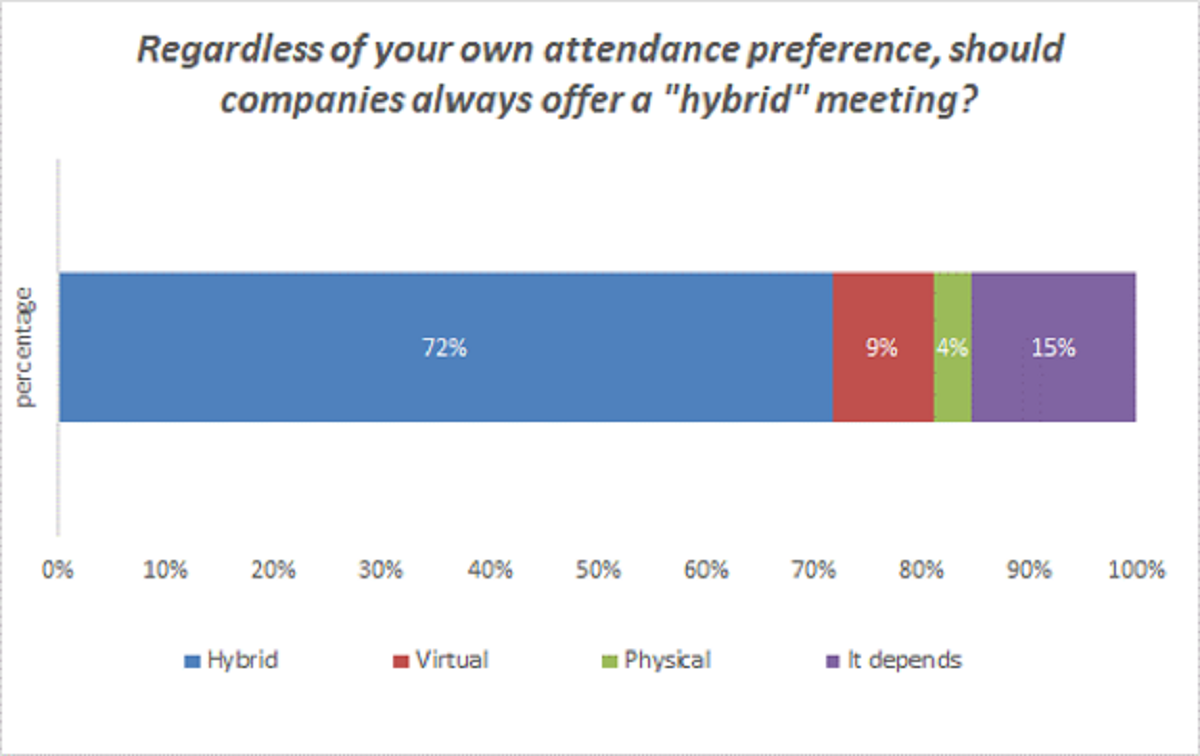

A recent survey undertaken by NZSA amongst investors showed that 72% of respondents favoured hybrid meetings. “Investors believe that this combines the best features of each format – the virtual component allows all shareholders to participate, regardless of their location, while the physical component allows effective face-to-face shareholder engagement with their directors” says NZSA CEO, Oliver Mander.

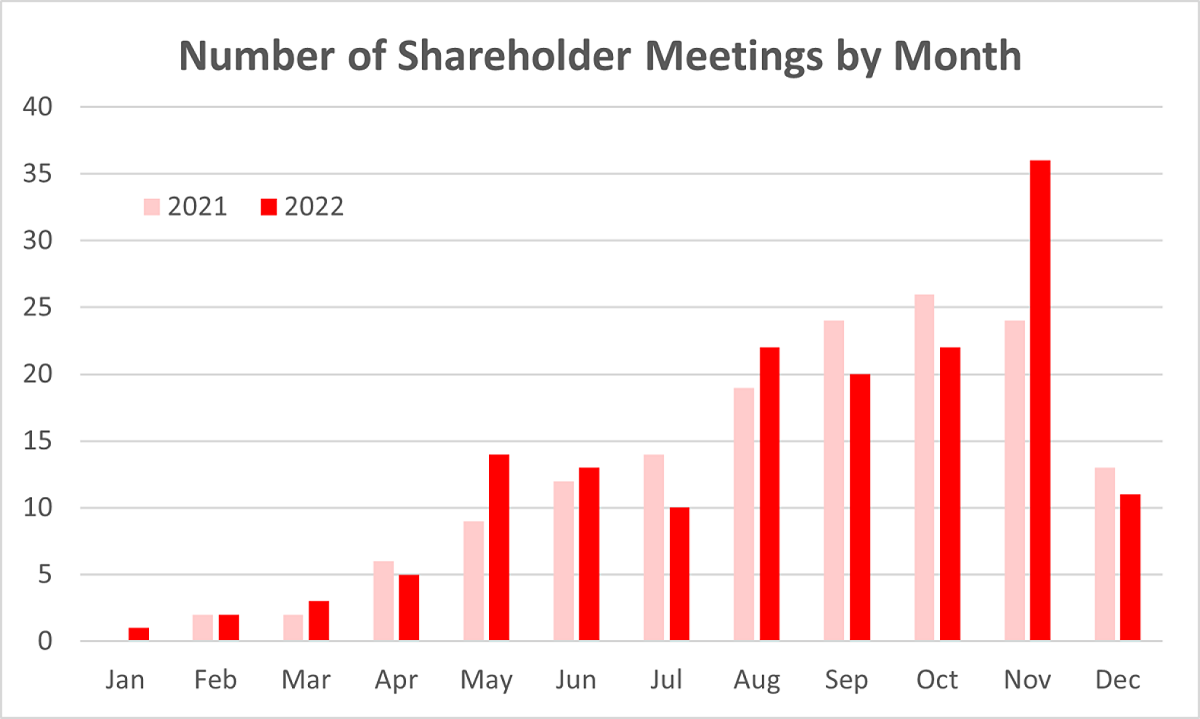

Despite that, the same research also showed a declining level of shareholder meeting attendance by shareholders. Regardless of meeting format, overall average attendance for all meeting formats – physical, virtual, hybrid – has declined by approximately 24% since 2019. This decline is more marked for hybrid meeting formats, with a reduction on a like-for-like basis (2019 v 2022) averaging 30%.

While NZSA had observed declining physical attendances at many hybrid Shareholder Meetings, attendance data shows that this has not been offset by an increase in virtual attendance – indicating an overall decline in investor attendance.

“A Shareholder Meeting continues to be a key interaction between a company and its shareholders, with shareholder agency a key underpinning factor in the development of companies throughout history” says NZSA CEO, Oliver Mander.

“For investors, it’s always important to be represented – even if you’ve outsourced your investment decision-making to a DIMS provider, it’s important to be an informed customer. For issuers, we think it’s important that the Shareholder Meeting is regarded as a ‘good cost’ – a cost that shareholders are willing to bear to provide assurance and representation.”

NZSA maintains a best-practice policy encouraging the provision of virtual and physical attendance options for shareholders, ‘right-sizing’ the physical component of their Shareholder Meetings to suit their shareholder base and physical attendance levels, and providing insight that adds value to shareholders.

Additional Information

NZSA Shareholder Meeting Policy

NZSA Scrip Magazine Commentary, May 12th 2023

NZSA coverage of shareholder meetings (this includes Special Meetings and Annual Meetings for NZX and some USX issuers)