As a Ryman Healthcare shareholder, you may have been pleased to see the company recently report an underlying profit of $255 million to 31 March 2022, up 13.6% on last year; a record Australian profit; and the delivery of 711 new units and beds (292 in the first half; 419 in the second half).

What you may not have been aware of, although it has been fully disclosed for a number of years, is that Ryman includes in its ‘new’ development figures, units and beds that are both actually complete and available for occupation and settlement by an incoming resident; and units and beds that while not complete at balance date, are deemed by the directors and auditors as ‘nearing completion’.

If a unit is deemed to be ‘nearing completion’, the company accounts for it as being complete at balance date. Where it has pre-sold that unit off the plan, and there is a contract in place with a future resident, the company accrues the estimated cost to complete that unit, the future debtor and the profit on the sale of that unit.

Units deemed ‘nearing completion’ are treated for accounting and profit reporting purposes to be actually complete on balance date and included in that year’s reported profit.

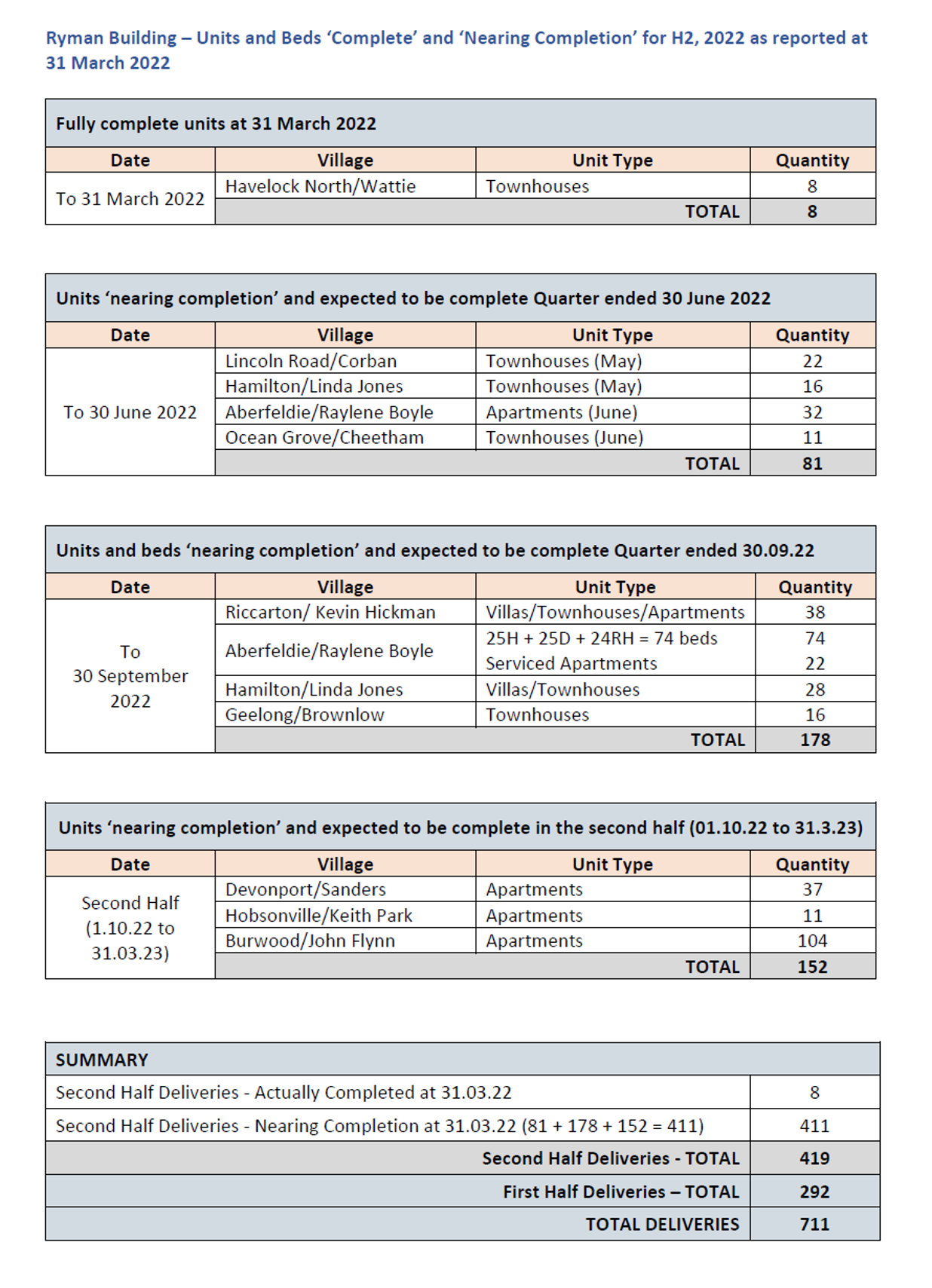

However, what you may not have been aware of, is that of the 419 units reported as being delivered in the second half, I calculate that only 8 of those units were actually completed and ready for occupation on 31 March 2022.

The remaining 411 units and beds, or 98%, were actually not completed but were deemed by the company to be ‘nearing completion’ on 31 March 2022.

Breaking down the numbers

How do I know this? I have been visiting Ryman construction sites for a number of years around balance date and I did so again this year – the New Zealand sites around 31 March, and the Australian sites a month later on 29-30 April. Over the years, I have learned a lot from simply walking around the exterior of a construction site and looking over the fence. I have set out my observations in the table below.

Of the 411 units and beds deemed by Ryman to be ‘nearing completion’ at balance date, I anticipate that only 81 of the 411 will be completed and available for occupation and settlement by 30 June 2022. In fact, some will already have been completed as I write this today.

I expect another 178 units and beds to be completed by 30 September 2022.

However, what I am particularly concerned about is the 152 units that will not be complete until after 1 October 2022, comprising:

- 11 units in the Keith Park village in Hobsonville

- the final 37 apartments at the William Sanders village in Devonport

- the final 104 independent apartments at the John Flynn village in Burwood East, Melbourne.

Construction Progress

Shown below are photographs I took at the John Flynn village on 29 April 2022. There would have been even less progress a month earlier on the 31 March balance date.

Photographs taken at Devonport (William Sanders Retirement Village) and Hobsonville Point (Keith Park Village) show varying stage of progress towards completion.

The photographs clearly show a structure still being built, no roof, and little in the way of exterior cladding. And certainly little sign of interior fittings like kitchens and bathrooms being installed.

Ask yourself – does this look like a building ‘nearing completion’ or a building still under construction?

In late February 2022, I joined a John Flynn Zoom sales presentation open to the public and learned that the building was due to be completed in November 2022. Having visited the site, I would question the viability of this delivery date, with delivery more likely in early 2023.

Impact on Results

At the 20 May 2022 presentation, the company disclosed that 95% of the 104 apartments had been pre-sold; around 98 of the 104 apartments.

Assuming average margins, this suggests the profit on those 98 John Flynn apartments in this one development alone would be approximately $20m – $20m which would have been included in the $255 million profit to 31 March 2022 – notwithstanding that the apartments are unlikely to be completed and settled before November 2022.

While it may be appropriate for Ryman to count units as ‘nearing completion’ which are due to be complete soon after balance date, the longer into the future that Ryman brings forward the recognition of future profits, the greater the risk of construction delays, winter weather, increased costs and the potential for sales to fall through in a softening residential market – and thereby impact FY2023 financial outcomes.

Transparency and Disclosure

The fact that 411 of the reported 419 units and beds were not actually complete at 31 March 2022, is a material issue; I feel that there should be more transparent disclosure to shareholders.

This information is certainly not confidential – as long as someone is prepared to go to the trouble and expense of visiting these Ryman construction sites, as I have done, it is easily obtained.

Following my visit to Australia, and prior to the release of the profit statements, I wrote to the Chair and CEO of Ryman asking that the company either report only actual built and complete units; or if they chose to continue with the current policy of including units ‘nearing completion’, they interpret ‘nearing completion’ in a more conservative way.

However, regardless of how Ryman chose to implement the policy, I asked that they disclose to shareholders actual details of the incomplete units that they have chosen to recognise as being ‘nearing completion’ (by village) and the financial impact of doing so.

In my correspondence with the company since they have released their FY2022 results, I have repeated my requests for that disclosure to be made to all shareholders. To date, they have not done this. The purpose of writing this article is to bring this information to the attention of you, Ryman shareholders and members of the New Zealand Shareholders Association in general. I am grateful to the NZSA for the opportunity to do so.

The company did however email me to advise the following:

- “We are accounting for our profits in line with accounting standards. The treatment of our investment property is a key audit matter, and an important consideration by both the board and management.”

- ”Our investment property was considered in detail by both our audit and financial risk committee and the board, alongside the auditors’ consideration of this matter.”

- ”On our investment property:

- Our investment property is measured at fair value. The rebuttable presumption under NZ IAS 40 is that investment property can be measured at fair value.

- We measure our investment property at fair value with the exception of land, work in progress and units not sold.

- When a unit is nearing completion we use fair value. We do this on a stage or site basis.

- Build numbers and underlying profit are non-GAAP measures, which are additional disclosures made by Ryman to its shareholders.”

- Our investment property is measured at fair value. The rebuttable presumption under NZ IAS 40 is that investment property can be measured at fair value.

At the Results Presentation on 20 May 2022, the Chair and CEO were at pains to remind me the accounts were approved by both the auditors and directors and the assessment of whether a unit was considered ‘nearing completion’ had been decided in a totally consistent manner with previous years.

If that is the case, I have to accept those comments at face value and I cannot see any reason why the Directors would not want you to know the information I have disclosed to you today. It is certainly a question I intend to ask them at the Ryman AGM which is usually held in late July, and I would encourage you to attend as well.

I also intend to ask each Director standing for re-election why they think the final John Flynn building shown in the attached photographs is ‘nearing completion’ at 31 March 2022.

John Boscawen

5 Responses

Thank you for your work, John.

May I ask what you think of the capital structure? There has been talk of a capital raise / rights issue due to the relatively high gearing of Ryman. Can you comment on this, please?

Also, how does the debt maturity structure look like?

Cheers,

Rainer

Ryman advised you:

“We measure our investment property at fair value with the exception of land, work in progress and units not sold.”

The John Flynn village certainly looks like WIP.

If they took up some profit on the %age of completion basis, then maybe OK, but to take it all up is counting the chickens before they hatch.

I note that Note 4 Income Tax, in the Annual Report, shows a substantial deduction from Profit before Income Tax Expense of Non-Taxable Income. This deduction is described as principally from the fair value movement of investment property. I am thinking that a lot of that could well be unearned profit.

So they are straight up and down with the tax man, but are pulling the wool over the shareholders eyes!

I also note, from Note 19. Key Management Compensation, that management get short and medium term incentives. I wonder how the unearned profit influences those incentives.

The job is done when it is completed!

Sock it to them John – good work.

Congratulations John on an excellent piece of research.

While I have no doubt that Ryman and it’s auditors are complying with whatever accounting conventions apply in such circumstances, to me as a layman, the longbow is being drawn here, particularly in current volatile market conditions, and Ryman should voluntarily disclose in a note to the accounts each year, the sort of information you have had to discover the hard way, with comparative figures also shown for the previous year.

Why not put that to both the company and to it’s auditors, and if Ryman remains unwilling to disclose such material information to its shareholders, perhaps the directors could explain what their objection is.

Yes I agree we need the exact details of the results not something that can be eschewed to obtain a different outcome to suit a number of purposes

Really appreciate this info, compliments to John for doing the research.