NZSA Disclaimer

There’s been plenty of media and shareholder comment around the non-binding indicative offer received by Rakon Limited. A non-binding indicative offer (NBIO) was announced by Rakon to the market way back on December 11th 2023 – the announcement detailed the price ($1.70), that the bidder was ‘credible’ and disclosed that the NBIO had been received by the Board on December 7th.

Tellingly, though, there were two further key phrases added to the announcement.

The Proposal is incomplete and highly conditional and, as a result, there can be no certainty that any transaction will eventuate.

The Proposal was confidential when received and ordinarily the receipt of a proposal at such an early stage would not require disclosure. However, Rakon has become aware that the existence of the Proposal may be known by some shareholders, so is releasing the details to ensure that all shareholders are aware of them.

Rakon market announcement, December 11th 2023

Both statements highlight some key issues for Boards facing takeover proposals.

The timeline – and the impact of leaks

It’s now a touch over five months later.

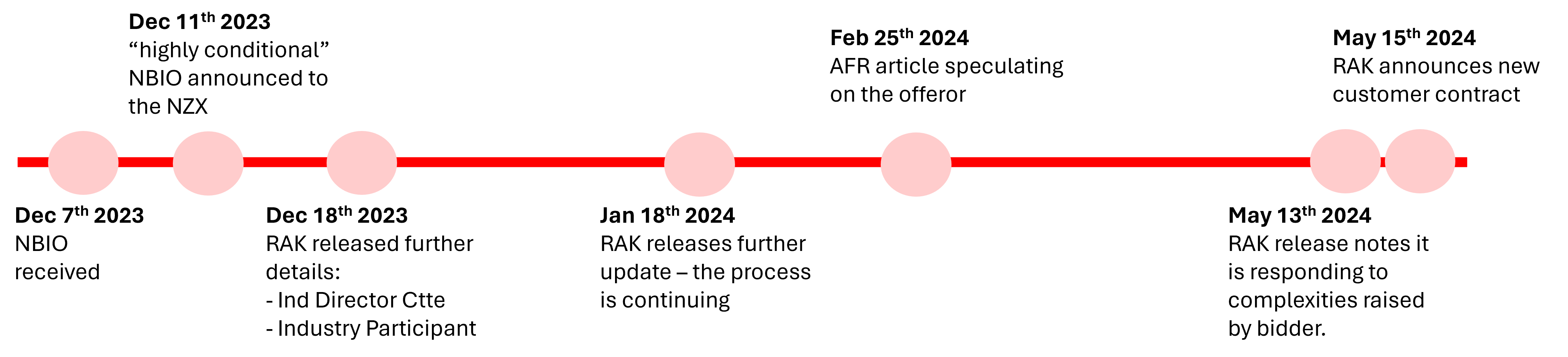

There have been a total of four announcements to the NZX by the company relating to the proposal, including the initial announcement on December 11th 2023. In late February, the Australian Financial Review (AFR) published leaked details of the NBIO, including that a likely bidder was NASDAQ-listed Skyworks.

There have also been a variety of media articles, prompted by concerns from significant shareholder Mike Daniel, that the Board should be progressing the offer quickly. The concern raised by Daniel is fair. A $1.70 NBIO at a time when the share price was originally trading at $0.60 would seem to be a no-brainer – and any shareholder will want to make sure that the Board is acting in the best interests of the company and representing shareholder interests effectively.

That is not just about progressing a deal at pace, of course – its also about ensuring that shareholders receive fair value for their shares.

From a process perspective, the saga has also highlighted the differences in motivations of different shareholders, bidders and other ‘insiders’, and the methods used to exert pressure on decision-makers to create an outcome that favours individual interests.

This is not a negative comment on independent activism or balanced media commentary.

It does reflect some cynicism at the motivations of those who choose to leak confidential details to the press to advance their own interests. Unfortunately for the integrity of New Zealand’s capital markets, most leaks turn up on the other side of the Tasman, as seemed to occur in this case with the disclosure of the potential bidder by the AFR in February this year. Who leaked? Perhaps an investment banker hungry for a deal? We’ll never know. As a generic statement, the uncontained spread of confidential information will often impact a target company’s Board by preferring speed over value – usually to the detriment of the target company’s shareholders.

In this case, it may also impact the bidder’s appetite for a deal – it is clear from Rakon’s announcements that the bidder wished to remain anonymous, and is a likely condition made by the bidder in progressing negotiations beyond the initial NBIO.

Let’s go back to that December 11th announcement, and the statement that Rakon was announcing it had received an NBIO because some shareholders had become aware of the proposal and it wanted to make sure that all shareholders were aware.

Under NZX ‘continuous disclosure’ rules, Rakon had no choice but to announce the offer at that stage, based on the possibility of a leak. The aim of continuous disclosure is to ensure there is no information asymetry in the market – and that all buyers and sellers of shares are operating with the same information. Clearly, if one shareholder is aware of an NBIO, and others are not, they would be able to trade for their own advantage as an insider in the market.

NZSA has no wish to go back to the prehistoric age of the 1980’s and 1990’s when insider knowledge appeared to be the norm in share trading.

Like all things, however, continuous disclosure’s greatest strength is its greatest weakness. A declaration to market only four days after a complex, conditional, non-binding offer has been received should indicate to shareholders that things are not at an advanced stage.

Compare this with the Scheme of Arrangement that saw MHM Automation de-list earlier this year; like Rakon, this was notified to NZX in November 2023, with the Scheme vote occurring in February 2024. Unlike Rakon, however, the Scheme was only notified to shareholders once negotiations had been completed – around 60 days after receipt of the initial NBIO. Furthermore, the initial NBIO had not been disclosed to the NZX at the time.

I don’t see a lot of shareholder discontent around the process, timelines or the outcomes surrounding that much less complex transaction.

There is other precedent also. The process resulting in the takeover (via a Scheme of Arrangement) of Pushpay Holdings took over a year to work through. And Rakon shareholders should take some comfort from knowing that the Chair of the Independent Directors Committee evaluating the various proposals for Pushpay was none other than current Rakon Chair Lorraine Witten.

Media

Let’s go back in time slightly. There was plenty in the flurry of media surrounding Rakon’s first two market announcements that framed the issue for shareholders – and set the platform for the issues facing the Rakon Independent Directors Committee that was established to take the proposal further.

Rakon’s announcement on December 18th 2023 stated that the Board has “received communications from significant shareholders indicating their support for the board to progress the Proposal.”

On December 19th, a NZ Herald article noted an e-mail from Daniel to Rakon Board Chair Lorraine Witten stating he and associated parties controlling 11.3% or Rakon shares would support any takeover proposal at this level; it’s unclear whether the reference in the company’s December 18th announcement to significant shareholders reflects this email or extends to other shareholders, including the founding Robinson family who control approximately 30% of the company’s shares and are also represented on the Rakon Board.

The Herald reported that Daniel was urging the Board to “get a wriggle on and consider the $1.70 per share takeover offer – saying he has seen other sale opportunities blown because of director dilly-dallying.“

This was a change from earlier December 13th commentary from Daniel to the NZ Herald; this article noted that “$1.70 sounded like “a pretty good offer” but that he would need to know the identity of the buyer, and the conditions, before making a decision.” That same article quoted both myself and Forsyth-Barr analyst James Lindsay:

The timing of the bid appears opportunistic, with Rakon amid a cyclical industry downturn that has weighed heavily on its share price.

Forsyth Barr analyst James Lindsay, NZ Herald December 13th 2023

I wouldn’t use the word ‘opportunistic’, but it’s clear that global markets, including New Zealand, are at the bottom of a valuation cycle, and that makes the offer look quite strong in terms of the raw share price.

NZSA CEO Oliver Mander, NZ Herald December 13th 2023

I, on behalf of NZSA, also expressed some concern that the Board (and the company) may find itself backed into a corner: “NZSA was wary that the unsolicited offer had been described as “highly conditional” – and would be particularly concerned if any of the conditions involved trading restrictions on Rakon during the scheme negotiating period.“

Lessons from the commentary

It is not in shareholders’ interests to allow a Board to be ‘pressured’ into a deal. In a trade-off between speed and fair value, NZSA would hope that fair value wins every time. And yet, the risk of pressure on Boards and their directors when negotiating a Scheme of Arrangement is high – after all, any deal needs the support of the target company’s Board to take the Scheme to shareholders.

So what are concerns that any Board negotiating a Scheme might want to concern themselves with?

Fair value: Boards are obligated to have a clear understanding of the fair value of the company. This isn’t necessarily related to share price – arguably, the recent performance of the NZX market as compared with global benchmarks is a causative factor in the number of NBIO’s that have been received over the last 9 months (lest we forget: Arvida, Sky TV, MHM, Rakon, Comvita). Where there is some uncertainty, the Board may seek a ‘fresh view’ from an external analyst or valuer. The more complex the company, the more time that can take.

Complexity: As a follow on from the above, the inherent complexity of Rakon’s business does not help. Any tech company is ‘IP rich’; add to that the nature of Rakon’s business (including Defence) and the geo-political complexity associated with the markets it operates in. That complexity is likely to be of concern to both Rakon and the offeror also – both parties will take time to verify their assumptions surrounding fair value.

Finalising due diligence: This can, and should, be a complex negotiation. NZSA would be concerned if any target company allowed due diligence by an offeror without appropriate conditions being placed on what was discovered by the offeror. In Rakon’s case, their announcements have made clear that the NBIO was received from an industry player; while stated to not be a direct competitor, this is a key factor. Giving an industry participant access to the proprietary keys to your own chamber of secrets should indeed be a protracted negotiation. A potential outcome is that the bidder decides not to proceed with any takeover – but now has a deep knowledge of the inner workings of Rakon. Even if the offeror is not a competitor today, that offers them great scope to become a future competitor.

Confidentiality: A separate, but related, issue. It is not a great outcome for Rakon (nor its shareholders) if commercially sensitive information becomes general market knowledge.

“In play” considerations: The very act by a Board of declaring an offer, regardless of its status, is likely to encourage other interested parties to come forward. That could be a good outcome for shareholders – but one that is likely to be discouraged in terms of any negotiation with a bidder. In this case, that may be a factor in the offeror attempting to maintain confidentiality, to limit the degree to which others may express interest. It is in shareholders’ interests for the Rakon board to negotiate against any restriction to solicit other opportunities.

Trading and Operations: There is some potential for target companies to be restricted in undertaking the ongoing investment required to support their existing operations while a Scheme of Arrangement is being negotiated. If the offeror for Rakon is indeed an industry participant, shareholders would expect the Board to ensure that Rakon can operate until any final agreement is reached.

It is, of course, worth noting that Rakon is likely to have a future as an independent company – yesterday’s announcement of a new $17m contract is ample evidence of that. The question for the Board is whether that future value is greater than what can be negotiated with any Offeror at this time.

Shareholders should want the Rakon Board to make progress on the NBIO, and should expect to receive reasonable assurance that work is progressing. But that should not be at the expense of shareholder value. The old saying “patience is a virtue” comes with a very real financial payoff for shareholders.

Oliver Mander