There is something about the dairy sector that seems to make it very difficult for issuers to get their timelines straight when it comes to forecasts. Investors might remember the issues associated with the a2 Milk Company and its revised guidance disclosures way back in 2020. The share price has never quite been the same again.

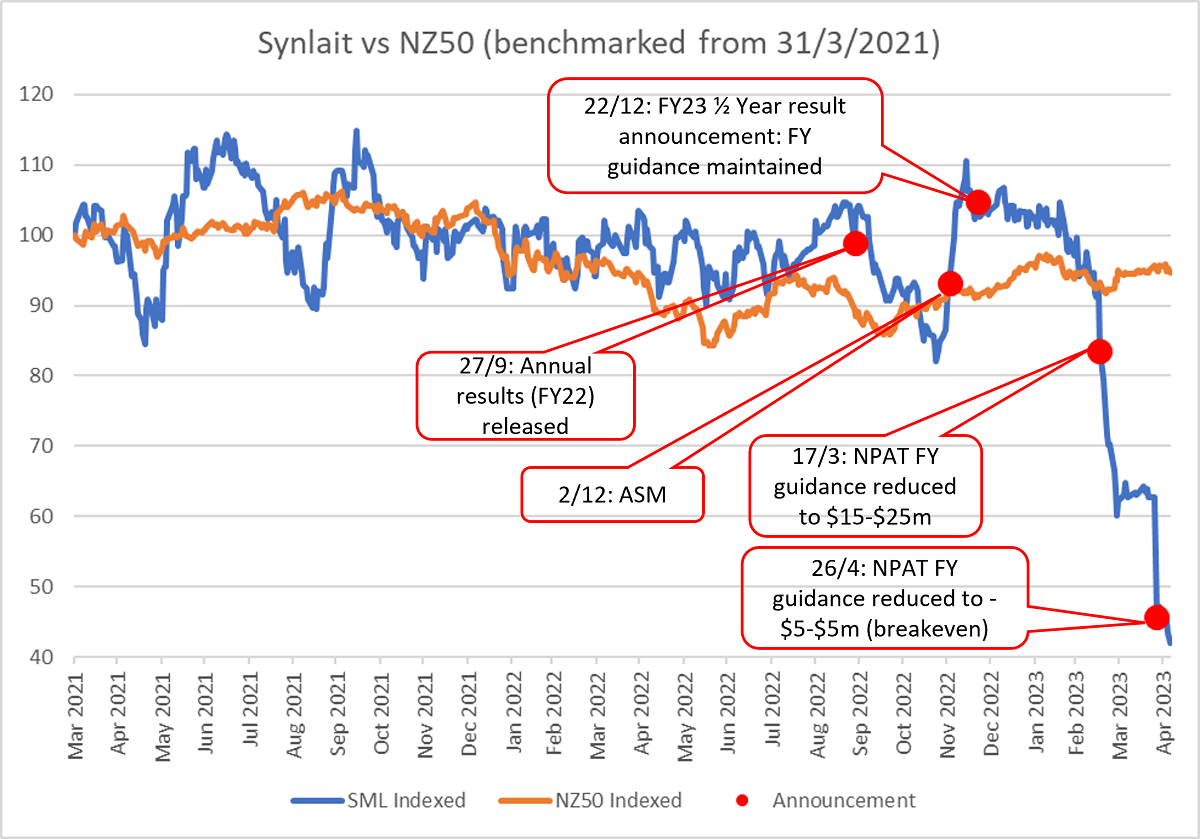

This time, it’s Synlait. From reporting a $38 million NPAT in September 2022, with a bullish forecast promised for FY23, a series of subsequent announcements during March and April have now resulted in an admission that a break-even outcome will be an outstanding result.

Arguably, the market has foreshadowed these announcements through the pricing of Synlait bonds on the NZ Debt Exchange (NZDX) over the last 12 months. An interest rate of 3.83% was always going to result in a decline of underlying bond value, but as of May 11th the bonds are now trading at an effective interest rate of 15%, with maturity in December 2024.

Technology troubles

The travails of deploying major IT systems are well documented by many major corporates. Synlait’s deployment of the well-known SAP tool has proven no exception – this deployment and it’s go live during August 2022 proved a significant factor in the first speed wobble highlighted to investors as a Christmas special on December 22nd 2022.

Earlier, it appeared to have been all smiles when it came to Synlait’s SAP implementation, with the reference to a successful implementation in the results announcement on September 27th. Less than two months later however it had become apparent the new system had caused issues with Synlait’s logistics, scheduling and warehousing operations causing a significant impact on first half results. Nonetheless, the company appeared to shrug this off, with an expected recovery to meet full-year forecasts.

A longer market recovery

Certainly since the December announcement there appears to have been much less focus on the impacts of what was clearly a difficult technology deployment. While it might have taken longer than desired to stabilise what would be a significant change in any organisation, shareholders could be forgiven for thinking that the worst was behind them and that Synlait was now in a position to reap the long-term benefits of efficient SAP-enabled business processes.

Not quite.

This statement of March 17th reflected a multitude of factors, that resulted in the company finally admitting a reduced NPAT forecast of between $15-25m for FY23.

“Key drivers of the guidance range include a reduction or delay in advanced nutrition demand, operational and SAP stability challenges and an increasing cost base. This is on top of inflationary and interest rate pressures.”

Grant Watson, CEO, Synlait

One cannot help wondering whether the company included the SAP demand forecasting tool as part of its deployment.

Nevertheless the statement revealed that there was much more to Synlait’s issues than mere technology. In producing its forecast the company noted that the expected market demand recovery was now likely to take three years rather than a previously signalled 2 years

a2’s demand forecast

Following a trading halt, it was the announcement of April 26th that caused the most significant consternation to markets. A further demand reduction from Synlait’s largest customer (later identified as a2 Milk) meant that profitability for the year was now forecast at between -$5m – $5m.

Further trouble was to come however when a statement by a2 made clear that it did not believe that its forecast reductions were such a significant nature as to cause a greater concern for Synlait.

What is likely, however, is that a2 can only see half the story. As a customer and marketer of milk products, a2 has little visibility or exposure to the underlying base powder production that forms the core of Synlait’s manufacturing process. A change in demand for a consumer product does not just affect the consumer margin but also the manufacturing margin Synlait enjoys on its base powder production. It is also possible the company now is less optimised in terms of manufacturing efficiency than previously.

Since March 2021, Synlait had been tracking more or less on a par with overall NZ50 returns, indicating some level of trust returning to Synlait’s announcements following difficulties in 2020. It is clear that the cumulative impact of the company’s announcements has had a dramatic effect on Synlait’s share price, with the shares trading at around $1.44 on May 11th 2023 (down from $3.57 on December 22nd 2022).

Disclosure

Shareholders could continue to look for signs that the company’s underlying system and process issues have been fully remedied. From an NZSA perspective, we hope that Synlait provides effective evidence and assurance (via disclosure) for shareholders that this is the case in future announcements or reporting.

Both company executives and investors will be keenly watching for evidence of ongoing market recovery. Similarly, the more transparency Synlait is able to provide, the happier shareholders will be.

Last, Synlait was at pains to point out in its April 26th announcement that its ongoing SAMR registration process is not at threat. Again, a successful registration will be music to the ears of shareholders.

Fundamentally, Synlait will need to work hard (again) to re-instil a sense of trust amongst its shareholders. There was a mystical and magical time an eon ago (August 2019) when the company’s share price was nudging $10.00. The well-documented consequences of the mid-Covid A2 infant formula bubble popped the balloon supporting that dream.

Capital Structure

The company is adamant that its current review of capital structure does not include any consideration of a capital raise, with a scope focused solely on debt management. Synlait has ensured bank support, at least until July 31st 2023 when its debt covenants are re-tested.

NZSA will watch with interest as to whether the intention to not raise capital remains. There is a very recent example of a company that regarded not raising capital as a ‘sacred cow’, leading to an outcome that was ultimately sub-optimal for shareholders and the company alike. And just like that other well-known company, Synlait’s share price is now trading at levels far lower than previously.

A ‘sacred cow’ is just another word for a closed mind – a trait that NZSA rails against when it comes to supporting the interests of shareholders. Synlait’s situation is further complicated by the interests of it’s two largest shareholders – Bright Dairy and a2 Milk – and the majority representation of Bright Dairy appointed Directors on Synlait’s Board, relying on a long-standing waiver granted by NZX. NZSA has been vocal in its lack of support for this situation, for reasons that could be becoming uncomfortably apparent.

Given Synlait’s clear statement highlighting the debt focus of its capital review, a shareholder could infer that neither holder is keen to contribute. Nonetheless, it’s the best interest of the company that matters. Not only does NZSA hopes that the (few) independent directors on Synlait’s Board are strident in highlighting that point, but that the current situation prompts serious consideration of changes to Synlait’s governance arrangements.

It might be that short-term pain for all shareholders in the form of injecting fresh capital might just be the medicine required to support Synlait’s ongoing growth and stability in the long-term. Yet for that to happen, both Bright Dairy and a2 need to make a choice between parting with cash or coming to terms with a diluted shareholding.

Let’s hope that Synlait’s interest prevails.

Oliver Mander

Oliver has worked as an SAP Deployment Manger and GM Business Transformation for four (successful) SAP deployments. He has (sadly) come to realise that system and process renewal is the challenge most under-estimated by senior leaders. He also has no hair.

An earlier version of this article did not include the share price comparison.

One Response

I liked this article! Just the sort of thing the Association can do so well – sometimes.