This year sees the New Zealand Private Capital Association celebrate its 20th year representing the country’s private equity and venture capital industries. A worthy celebration indeed, notwithstanding that each of the founding firms of New Zealand’s private equity industry, Direct Capital and Pencarrow, date their origins back to the mid-1990s with the establishment of managed funds that targeted the large, but untapped, private company market.

The scene was set with highly successful investments into the likes of Ryman Healthcare, Methven, Hurricane Wire, Sky City, Nobilo Wines, Airwork and EFT-POS New Zealand. Amongst a small group of closely held private companies to have completed an initial public offering, Ryman Healthcare went on to become one of New Zealand’s most successful public companies, listing on the New Zealand Stock Exchange in 1999 and today enjoying a market capitalisation of $4.7 billion.

The Growth of Private Equity

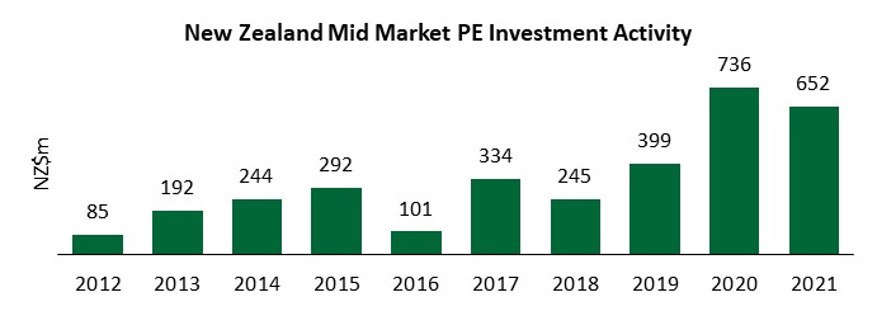

The success of these early investments created a momentum for the private equity industry that has seen both the number of firms and level of investment grow significantly. The NZPCA’s most recent annual survey of mid-market investment highlights the tremendous growth of private equity in New Zealand with more than $650 million invested into private companies during 2021 and a cumulative investment of more than $3.2 billion completed over the past 10 years.

This investment activity spans a range of sectors and company sizes – household names such as Beca Group, Farro Fresh, Icebreaker, Mondiale VGL, Bell Tea, Bayleys Real Estate and financial service providers Perpetual Guardian and MMC Group.

While it is often these names that capture the public attention, the vast majority of private equity investment is made into companies with much lower public profiles. These companies are often owned by families, or a small number of shareholders that have worked together over many years to create large and highly successful businesses.

New Zealand retail investors enjoy an unusual level of access to private equity. In offshore markets private equity is normally the preserve of large financial institutions, endowment funds and very high net worth family offices. With the exception of the Kiwisaver sector, the industry in New Zealand is equally well-supported through its institutional investor base. But almost unique to New Zealand is the access that individual wholesale and retail clients have to a variety of private equity funds through the broker networks of private wealth providers. This was led in no small way through the joint establishment in 2005 of the Pohutukawa family of funds co-managed by Craigs Investment Partners and Direct Capital. The model is now well-established across private wealth providers including Forsyth Barr, Jarden and JB Were.

The New Zealand private equity industry is in good health indeed.

The Differing Styles of Private Equity

The range of private equity managers gives rise to understanding the differences that exist between their models and investment styles, and indeed, how New Zealand private equity firms differ from their international peers.

In markets such as Australia and the US, private equity has drifted to the large company buyout market. This is where businesses are “control acquired” by the private equity firm, usually highly leveraged, and management teams are directed as to strategy, execution and timing. It works, particularly in a low interest rate environment, but it is somewhat ruthless and transactional.

For owners who regard their business and business relationships as being part of the family, the wrench of change can be devastating. Australian private equity firms will generally not invest in minority shareholding situations – so for company owners raising capital but not yet wishing to sell down their control shareholding, Australian private equity is an unlikely source of capital.

New Zealand private equity firms offer a friendlier face to business owners and are generally more growth orientated and partnership focussed. New Zealand firms tend to be indifferent to the investment being a minority or majority shareholding relationship. The shareholding structure becomes an outcome of valuation and the desired sell-down by owners.

Indeed, Direct Capital’s first fund, Direct Capital Partners, had a mandate limitation to invest in minority shareholdings only. There is nothing quite like being a minority shareholder to help develop the behaviours that suit partnering with people and to continually seek the alignment of interests among all stakeholders.

There can be style differences between private equity firms, including different preferences for the size and stage of companies that they seek to invest in (influenced by fund size, prudential limits on investment allocation and the team size and capacity to work with portfolio companies). Other style differences include a focus on where growth is oriented – export growth, a design-led product focus, international expansion, or acquisition strategies. That said, given the size of the New Zealand market, most private equity firms are generalists and will respond to opportunities that meet their broad mandates.

Clichés aside, New Zealand really is a small market, particularly so within its investor base and community of private company owners. Reputation counts, even if at times, memories can seem very short. Unrewarded risk-taking and poor investor outcomes are more visible to New Zealand investors. Today’s company owners are generally well guided by their corporate advisors and are more acutely aware of the consequences of a poor partnership choice. When raising capital in a private company, value is important, but so is reputation and the quality of relationship.

The Role of Private Equity

The role of private equity is to match its capital with a step-change in the business. This might be a step-change in growth – expanding a company’s operations into new markets or funding an acquisition strategy; or it may be a step-change in ownership – managing the succession of ownership from older owners to the next generation. In both situations, partnering with private equity offers invaluable experience.

Across Direct Capital’s history, just under half its portfolio companies have expanded their operations into the Australian market, or beyond. International expansion is complex and probably not something to learn on the job for company owners, or to fund through high levels of debt. The cost of failure is high. And when it comes to acquisitions, most management teams simply don’t have the transactional experience that private equity teams offer.

Succession is also a unique process for owners. Most owners associate a strong sense of self with the business that they have created. Selling their business to a competitor feels like losing, even though it may provide a higher value outcome if “cost out” synergies can be achieved (to the detriment of their own staff of course). Perhaps the greatest benefit that private equity has brought to New Zealand is the greater optionality that it has created for owners when thinking about selling their business. Likewise for management employees seeking an ownership stake in their business. Private equity offers an ownership transition that can be achieved over time. Owners can step back, rather than out, while management step up.

Capital aside, one of the key benefits to introducing a private equity partner into the business is the additional resource it adds to management. Private equity firms typically see their role as being an active shareholder and as a sounding board for executives. Their input is usually provided through board representation and, when required, through analytical support for major capital decisions, acquisitions, and growth initiatives. They will often lend support in banking relationships and the recruitment of senior executives. PE firms provide a relentless focus on strategy and ensuring that the gameplan to achieve it is in place.

Each of these step-change initiatives contain elements of risk. From an investment perspective one of the great benefits of private equity is that these step-changes can be managed – by definition, in private. While patience is not a free ride for management, it is a virtue that enables management to enact their strategy properly even if it varies over time or, if there are missteps along the way, for mistakes to be corrected. Private companies retain the ability to act strategically, taking a long-term view without the constraint of meeting the short-term market guidance and continuous disclosure obligations required of public companies. Embarking on major growth initiatives for public companies usually requires disclosure, including to their competitors – a strategic disadvantage.

For companies thinking about step-change growth, remaining private can be a safer pathway. That is not to conclude that when moving to public markets that growth has been exhausted. It is simply that the key platforms for growth should have been implemented and the key risks associated with it, reduced. Private equity firms play a significant role in helping their companies become IPO-ready and de-risking the transition. It goes without saying that private equity sponsored IPOs must be successful for both the existing shareholders and new shareholders who join the share register at IPO in support of continuing the company’s success and growth.

Alignment of Interests

Perhaps the greatest opportunity that private companies have, whether partnered with private equity or not, is the ability to align the interests of shareholders, management, and employees. A critical feature of private equity is the importance it places on key managers becoming shareholders in the business through an employee share scheme. These schemes are often extended to include a broad pool of employees. Becoming an employee shareholder with the benefit of sharing in the value created by the team, is a powerful incentive for aligning management and staff with the long-term objectives of shareholders. The positive impact on company culture is significant.

This is an area where public companies continue to struggle. Option schemes tend to be orientated to the short-term and offer upside value to executives but no downside protection to shareholders. Executive careers are often brief and more heavily influenced by career objectives than long term value creation for shareholders. That is no great surprise given the lack of connectedness that often exists between a public company and its shareholders.

Preparing Companies for Public Life

“Being listed, but illiquid, is the worst of all outcomes.”

Companies must continue to evolve, and their capital base and structures must do the same. Gaining access to an even greater pool of capital is an obvious benefit for companies completing an initial public offering. But achieving market capitalisation and free-float thresholds that attract independent broker coverage and institutional investor support is critical. Being listed, but illiquid, is the worst of all outcomes.

A common issue for private company owners is the loss of privacy and the discomfort of a more public profile that comes with being publicly listed. It is not for everyone and possibly a unique trait of the New Zealand market, and perhaps a reflection on the small community in which we live, is the preference to downplay business and financial success. As a rule, we like to hide our success.

For this reason, private equity offers a unique role in assisting owners plan their succession and set up the company for continuing growth. It is through this transition that private equity can play an important role in assisting companies to ready themselves for a successful public listing if this meets their longer-term strategic goals. This role may include introducing new management to the team, transition business founders to non-executive roles, building management depth and ensuring that the appropriate governance and financial reporting structures are established. These benefits accrue to private companies whether completing an IPO or otherwise.

A Bright Future

In this 20th anniversary year for the New Zealand Private Capital Association, there is much to celebrate. Private equity is a well-established contributor to New Zealand’s capital markets – funding private company growth, facilitating ownership succession and, where relevant, helping New Zealand companies ready themselves for transitioning to life as a public company. The number of private equity firms now established in New Zealand, and the range of investment styles, experience and suitability to different companies, is a real mark of maturity in the New Zealand market.

Gavin Lonergan

Gavin is a Director of Direct Capital. Gavin has been with Direct Capital for 20 years. A past chair of the New Zealand Private Capital Association, Gavin served on the Council for five years, including through its establishment phase. In addition to investment responsibilities, Gavin manages the firm’s marketing and media communications. Gavin has represented Direct Capital on a number of boards. He is currently a director of Caci Group.