These are not three words that always go hand-in-hand.

As investors, we all know the deal. We like to keep our finger on the pulse; a “foot in the door”, so to speak, in managing our own investments. Even for those of us who for practical reasons have outsourced most of our investments to friendly investment managers, we keep a bit in reserve, simply for the love of the game.

But a hands-on approach to investing brings responsibilities. There’s research to do. Forms to fill out. NZSA assessments to ponder. And sometimes – just sometimes – there’s meetings to attend. Over time, all of these tasks have become easier; or at least, they should have. The rise of virtual meeting platforms, like Teams or Zoom, has meant that investors can now attend shareholder meetings from the comfort of their own living room – an inarguable encouragement to shareholder democracy, even with the limitations of the virtual platforms.

Convenient or not, it is still difficult to attend two meetings at the same time – even virtually. Well, I guess it’s theoretically possible, but I would challenge anyone to remain 100% engaged in two virtual meetings at the same time. My teenagers struggle to stay engaged in one conversation for 10% of the time.

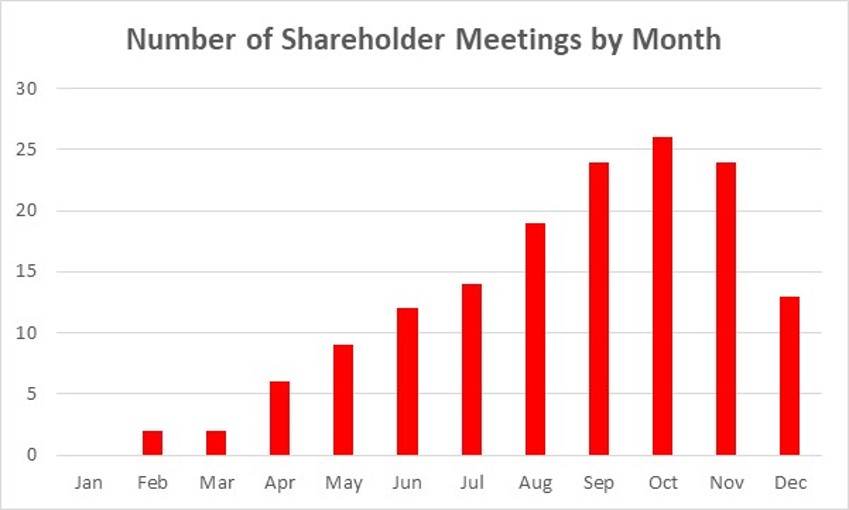

During 2021, NZSA representatives attended nearly every NZX-listed company meeting (and a few USX ones). Unsurprisingly, given that most balance dates are in March or June, there is a clear ‘skew’ towards the last six months of the year.

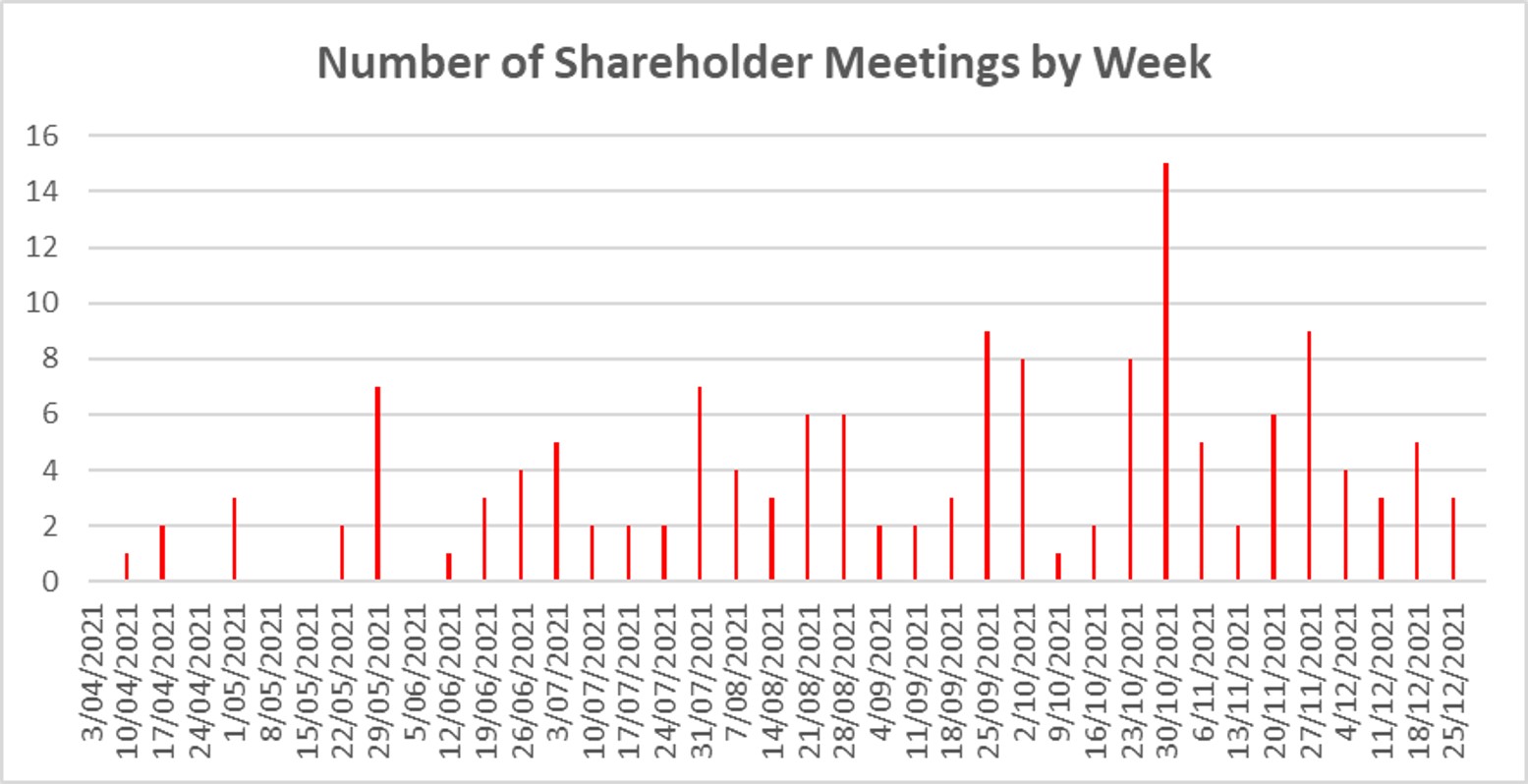

So, let’s keep breaking that down: what does the weekly cycle look like? For those investors who (rightly) diversify their portfolios across multiple investments, the workload associated with company meetings starts to get more impactful on a weekly work cycle.

Firstly, our “congratulations” to the 3 companies (Good Spirits, Sanford and Hallenstein Glassons) that held shareholder meetings in the week leading up to Christmas. That demonstrates a true work ethic and absolute focus on the matter at hand. And for Good Spirits at least, it could arguably double as the company Christmas function. Of course, this assumes that shareholders have the same dedication.

There are some interesting patterns to show here though. End-May and end-July are both popular choices, but both pale into insignificance compared with most weeks between Sep 25th and Nov 27th. So, let’s take a quick look at that…

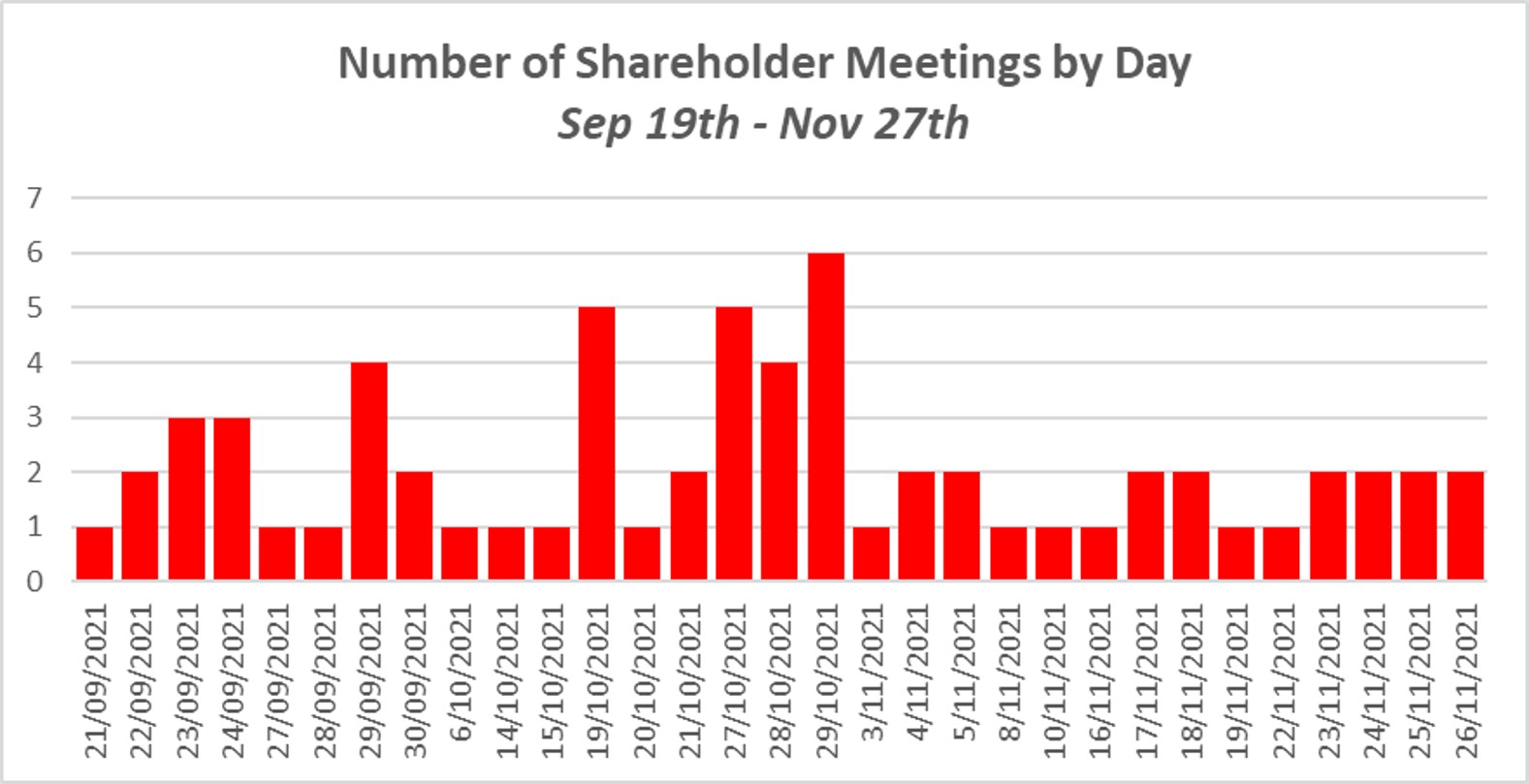

Well, well. Of the 151 company meetings in 2021, 65 (43%) occurred during a period of working days comprising only 25% of the working days during the year.

On an overall basis, it is worth commenting that shareholder meetings were held on 93 days of the year in 2021; when non-working days and public holidays are excluded, that’s roughly 39% of working days in the year. So, on the face of it, that still leaves vacant calendars for 61% of the year available for shareholder meetings.

15 meetings occurred on three days during late October, a group of meetings that included Chorus, Skellerup, Sky TV, Freightways, Air New Zealand, Heartland, Genesis, Sky City and Port of Tauranga. It is entirely feasible that for many investors, those companies would form the basis of their diversified portfolios. And yet to participate fully and responsibly in shareholder democracy would be problematic for many, simply due to competing timeframes.

OK, a last few data-based factoids for your consideration (or amusement).

- 35 days during 2021 had more than one shareholder meeting.

- The most popular meeting start time was either 10:00am or 10:30am (42 / 151).

- 28 shareholder meetings occurred at exactly the same time as another (ie, 14 meeting times with 2 companies each), with dates between May and November.

- That represents just under 20% of all shareholder meetings associated with listed entities in 2021.

There are some great matchups in there. Perhaps it’s fair enough that The Warehouse Group does not consider itself comparable with market minnow Enprise Group, but were the matchup between Ebos and Fletcher Building a rugby match, it would indeed be worthy of top billing and a sell-out stadium.

To prioritise one shareholder meeting over another for investors may be akin to a parent determining which of their children they love the most. And for some, when a clash in meeting timing occurs, which company is loved the most may be exactly how the prioritisation decision occurs.

(Meetings, prioritisation and love – I knew I’d work those into a sentence somehow).

Why does this occur?

Often it seems to be based on an unconscious experiential bias; the ‘we’ve always had it on that date, so why change?‘ approach. Event venues and planning considerations may impact on this as well, although NZSA would argue that there is no shortage of potential meeting spaces around New Zealand’s major centres. A company will adopt a ‘company-centric’ approach to determining its own schedule; meeting organisers are unlikely to directly consider clashes with other listed entities. Notice periods and timing considerations, based on balance date requirements and the need to produce quality disclosures, are also considerations. We’re not going to argue with that one.

There is a serious side to this. At NZSA, we’re sure the outcome is ‘unconscious’ – but regardless, it is one of the barriers that reduces the effectives of the director-shareholder agency relationship. And that’s something that is worth preserving and nurturing.

The NZSA Approach

NZSA wants to be practical about this. We’re quite happy to work with NZX, the registry companies (Link, Computershare) and anyone else to develop a ‘planned’ approach to company meetings – an approach that puts shareholder access at the front of any considerations.

As part of our Shareholder Meetings Policy, we will continue to keep an eye on the conduct and process to support effective shareholder access at meetings. We continue to view a shareholder meeting as one (important) part of a company’s overall engagement with its shareholders and we’ve noted the improvements made by both Link and Computershare in their virtual meeting systems.

But its the comparatively old-fashioned task of ‘scheduling’ that we feel needs a bit more work, providing a relatively easy ‘win’ for companies and their shareholders.

2 Responses

An excellent analysis of organisational, rather than shareholder (or even stakeholder), focus. Perhaps owners could have more influence on scheduling and format, rather than the Chairs, CEOs and/or accountants.

Hello Oliver, Thank you for raising this issue. I had some zoom meetings clash this year. However, if a zoom meeting option is offered and the meeting is recorded, the problem of, at least seeing and hearing the meeting is ameliorated, but viewing a recording precludes participation. In addition, if meetings are face-to-face only, then the difficulty of attending meetings would be exacerbated. I believe it is a serious issue that should be resolved.