NZSA Disclaimer

This scene from Monty Python has indeed set the tone for the events that have played out at Fletcher Building (NZX: FBU) over the last week. Unfortunately, however, the brave and beleaguered ‘Black Knight’ made famous by the Monty Python sketch represents not just the company itself, but the many thousands of shareholders who have lost their financial limbs. Just how many wounds does their company need to have before shareholders will admit defeat?

Perhaps not too many more. Following an update last week that set out yet more provisions related to the International Convention Centre (ICC) and the Wellington Airport Carpark building, the share price took a further tumble from around NZ$4.50 to $4.15. That adds to the narrative of poor returns and a history of provisions taking the gloss off so-called underlying performance improvements.

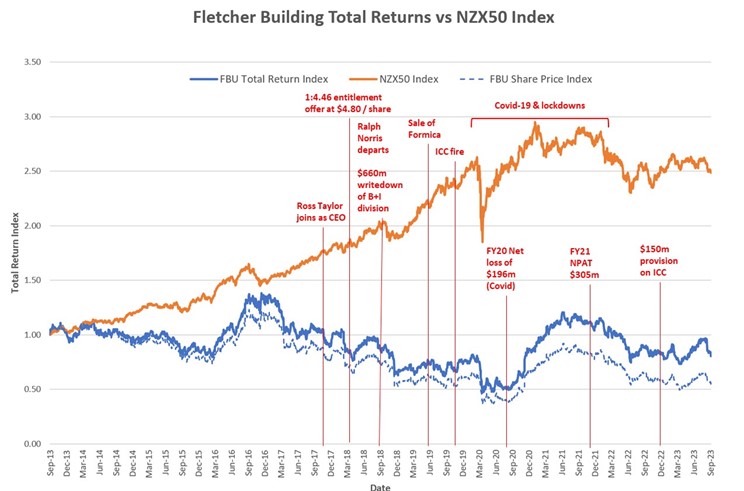

We published the chart above in our company assessment report for Fletcher Building back in September 2023. It clearly shows that the company has not performed relative to the wider market – despite much of that time period being a period of relative prosperity for most industry sectors and for shareholders of other companies.

Performance culture

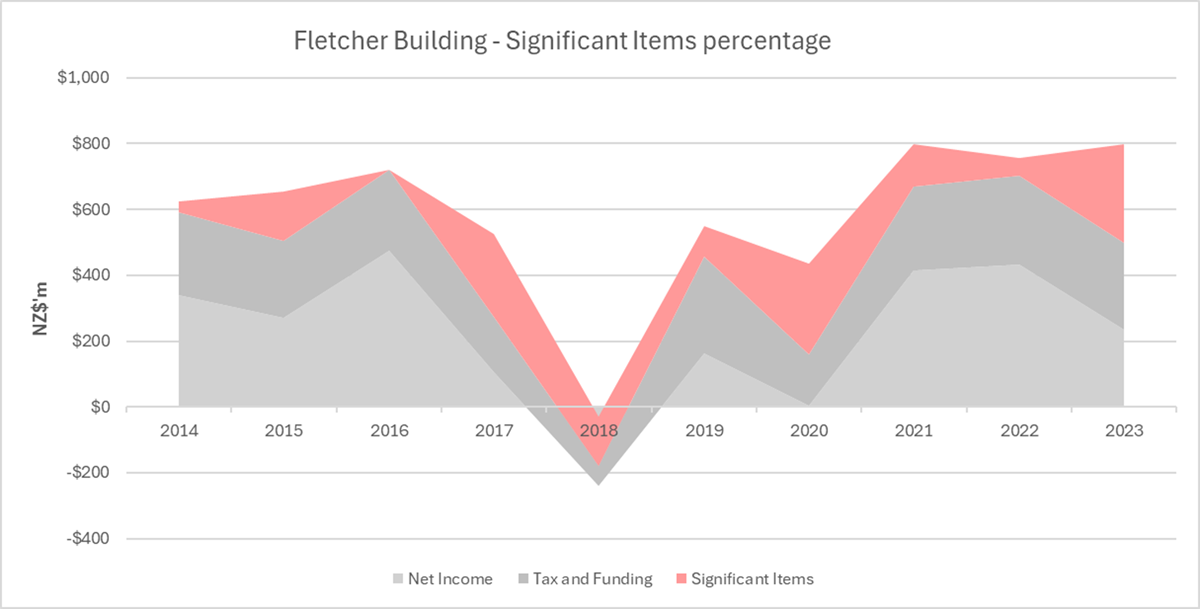

FBU has made much of its increasing “Underlying profit” (represented by earnings before interest and tax – EBIT) over the past few years, recovering from those dark days of 2018 and perhaps forming the bones of a performance culture. The company has stuck to a narrative related to addressing the sins of the past. Certainly, CEO Ross Taylor ensured that a large provision was in place to allow for future losses from ‘legacy’ construction projects.

Those legacy projects are now nearly complete – unfortunately, however, the ICC has turned out to be the gift that just keeps on giving. Year after year after year, ‘significant items‘ have blighted the underlying corporate earnings landscape.

And it is those provisions that tell the real story for investors – and create the credibility problem for the Fletcher Board.

The message is clear. Whatever ‘underlying profit’ is, investors should be discounting it by at least 25% each year, to account for the future as-yet-unknown financial disasters that might befall the company. That’s the average of the ‘significant items’ as a percentage of underlying EBIT over the last 10 years. What reliance can investors place on ‘underlying performance’ when below-the-line provisions and/or impairments have become such a systemic issue?

Even the term ‘legacy’ may turn out to be something of a poisoned term for FBU. Right now, the company has (unfortunately) found itself in the firing line in Western Australia, thanks to its Iplex subsidiary. As a Wellingtonian, I hear the words “leaking pipes” with a degree of stoic acceptance, but it’s clearly not good news for affected homeowners – nor shareholders. Regardless of rights and wrongs, the situation with Iplex is casting its own long shadow across FBU’s balance sheet and investor sentiment. Is the Iplex provision the beginning of the ‘new’ legacy of Fletcher Building?

If so, the Board has nowhere to hide.

Ross Taylor, THAT announcement and the Board

Yesterday, via lawyers Russell McVeagh, FBU requested a trading halt on both the NZX and ASX. There was a curious distinction of the details and timing of the announcements on the two exchanges. But of note, the application letter (released on the ASX) contained the phrase “the CEO of FBU will consider his position…”.

NZSA has no intention of speculating on whatever will be said tomorrow morning in relation to the future employment of Ross Taylor. That’s not our role. It is the Board’s role to appoint and review the performance of the CEO. While it is fair to state that he has failed to keep within the boundaries set by the first provisions made relating to legacy projects back in 2018, it’s a little unusual that an employment discussion appears to be playing out in public.

Whatever the nature of Fletcher’s woes, it is certain that those difficulties have not continued solely because of Ross Taylor. The Board will still have a credibility problem regardless of whoever is CEO.

NZSA has advocated for change on the FBU Board for some time. Many will recall our sentiment two years ago, when we felt that the Board was not assuring themselves as to the risk profile of the company they were governing.

In all honesty, not much has changed.

Risk assurance practices and the capability of the Board to improve them continue to be at the forefront of NZSA’s mind – especially given that they keep translating into large and costly accounting provisions for shareholders.

We continue to state that the skills required to govern a company with the complexity of FBU needs a thorough review – and that should result in changes on the Board of FBU.

As an aside, NZSA’s analysis shows that the Board of FBU is the highest paid on the NZX, with a fee pool of $2.0m. To their credit, the company removed a resolution that that would have seen that increase to $2.5m at their September 2023 shareholders’ meeting. One could argue that the current fee pool is also a function of ‘legacy’ – a reflection of a fee pool commensurate with the size of a company that was once a lot bigger. We commented on that proposal in this blog post (also published in September).

If anything, the high-level observation is that the impacts of poor governance and strategic decisions last a long time. FBU has been defined by its legacy projects and former strategy for nearly a decade, to the ultimate cost of shareholders.

The NZX/ASX announcements

As a footnote to the events of the past 24 hours, it is worth highlighting the differences in process between NZX and ASX that led not only to a difference in timing but also in content between the respective announcements. Essentially, market practice on the ASX is to receive and review an application for a trading halt, and then publish the letter of application. On the NZX, the letter of application is formed into a market release by NZX and published.

This difference is well known to the NZX – in fact, it forms a part of changes planned for this year (and under consultation during 2023). The section in the consultation paper related to trading halts (see page 23/24) specifically discusses the benefits of changing the way disclosures are managed – including the risk of ASX misalignment with the current practice.

That in itself doesn’t explain why the shares were halted on the NZX at around 2:40pm yesterday (Feb 12th) while this did not occur until around 3:00pm on the ASX. Did FBU leave it too late to contact the ASX?

NZSA is always concerned about investors being able to trade with differential information. Let’s hope the NZX and ASX (and issuers) manage to sort it out in future. The planned changes at NZX, due to take place in mid-2024, will be welcomed.

Oliver Mander

3 Responses

It must be 20 or more years ago, at an ASM of Fletcher Challenge, that I criticized their heavy use of the concepts of ‘Underlying Profit’ and EBIT as obfuscations used by unintelligent, lazy or conniving executives to mislead investors as to the reality of situations. I gave the example of a manager who might choose to increase the apparent profit of a production line by borrowing to invest in more efficient machinery that would increase production, therefore underlying profit, but without regard to possibly high costs of interest, depreciation or maintenance, whereas a proper calculation, before buying the machinery, might show the production cost benefit would be far outweighed by other new costs.

My comment fell on puzzled or deaf ears, so I sold my shares in Fletchers. Nice to hear this concept finally being criticized by someone else, though after much more damage has now been done.

Thanks Brian. We tend to look at a net income line for the obvious reason that it is set to an accounting standard.

Thanks, Oliver. But I want my highly-paid managers to actually manage, by planning and executing to optimise the real results, without much regard for EBITDA++ plus other excuses indicating lack of foresight.