NZSA Disclaimer

The end of the golden summer came this time last week for Heartland Group (NZX: HGH) – and less than five months after the elevation of Andrew Dixson to the Chief Executive role, and only a few days before the announcement of Heartland’s 1H FY25 results. Dixson is doing what any newly-minted CEO should do – identifying the landmines, sealing them off and de-fusing them. Perhaps Dixson’s former role as Chief Financial Officer (CFO) may have offered him some unique insight into where to look.

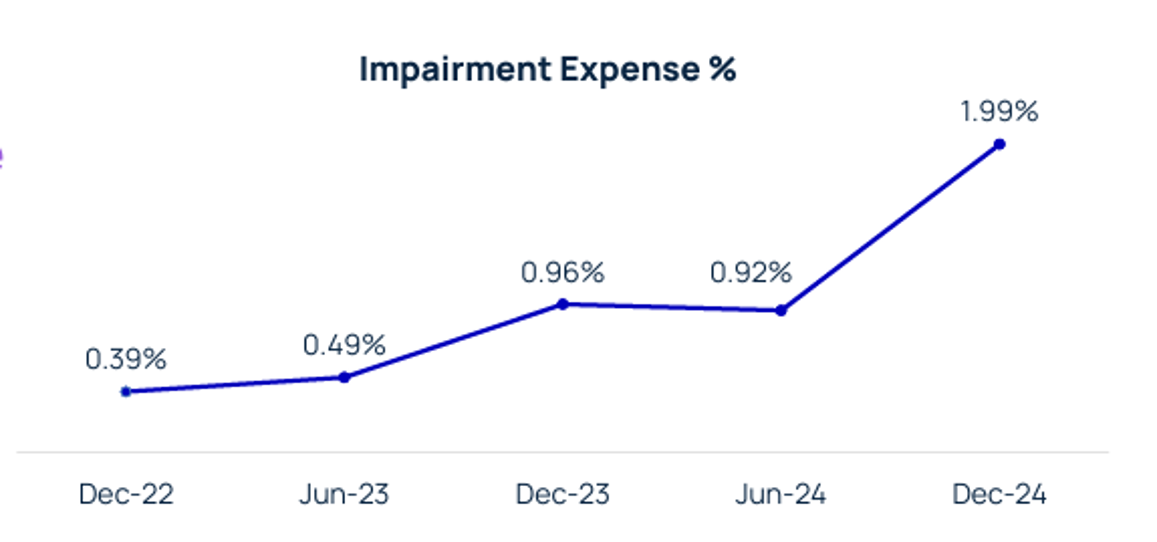

In this case, the landmine was Heartland’s increasing debt impairment levels, now impaired to the tune of $49.6m for the six months to December 2024 (1H FY25). That’s $49.6m of capital that won’t be heading back to shareholders and continues the sharp increase in impairment levels that has been observed since December 2022.

More could be to come. Should New Zealand’s economy remain in difficulty during 2025, Heartland has signalled a further $13m of impairment losses to come in 2H FY25.

From an investor’s perspective, then, there remains a degree of uncertainty around the company.

Legacy and Disclosure

More tellingly, while Dixson’s apparent transparency could be seen as a breath of fresh air, the events of the last week do not reflect well on recently-departed CEO Jeff Greenslade, nor on the Board members of Heartland Bank New Zealand. Rumours over the nature and quality of Heartland’s New Zealand lending have been circulating for some time, fed by market anecdote and the ongoing poor performance of the New Zealand economy.

But few would have picked the impact on impairments at Heartland New Zealand as this drastic. That, plus the potential for further impairments, has resulted in a steep decline in HGH’s share price – from $1.16 pre-announcement to around $0.88 today.

The continued reference to “legacy” lending implies that the past does not matter; that everything will be sunny side up in future, with new lending criteria in place (implemented in 2020) and a tougher collections policy applied (as per last week’s announcement). The term ‘legacy’ also seeks to distance the new CEO from the actions of his predecessor and the previous Board – perhaps rightly so.

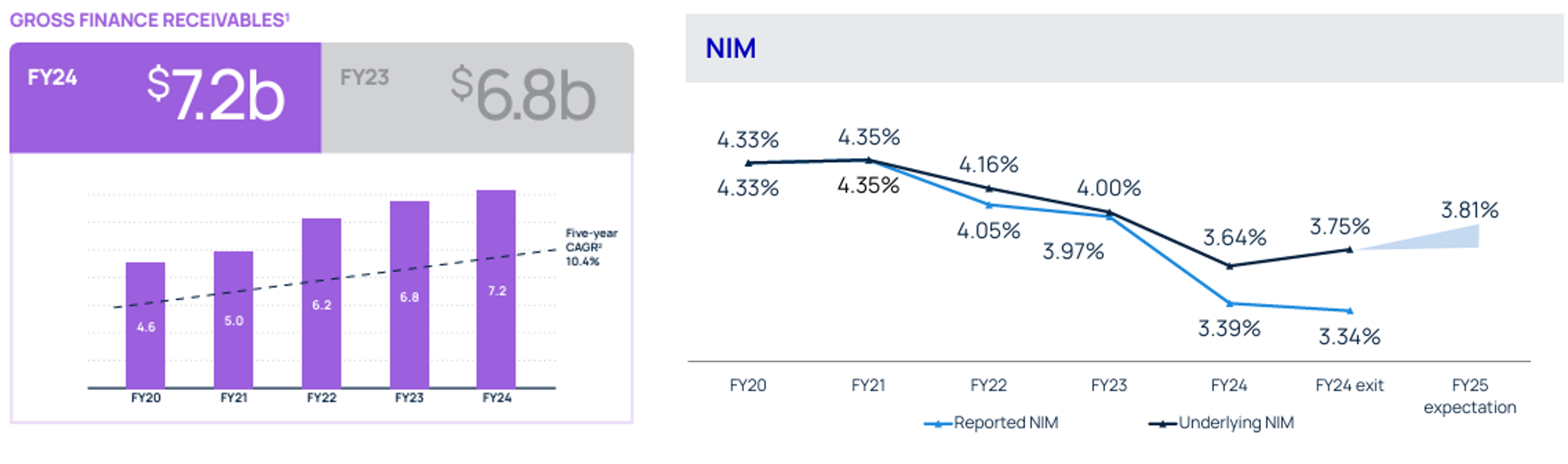

In past Annual Reports and investor presentations, Heartland has explicitly focused on growth in its lending portfolio – even as the net interest margin (NIM) earned by Heartland declined. In FY24 (June 30th 2024), Heartland recording total lending of $7.2 billion (of which $5.1 billion is in New Zealand).

One might say that the “legacy” now being unmasked is one of ‘growth at all costs’ – a focus on size and scale at the expense of profitability.

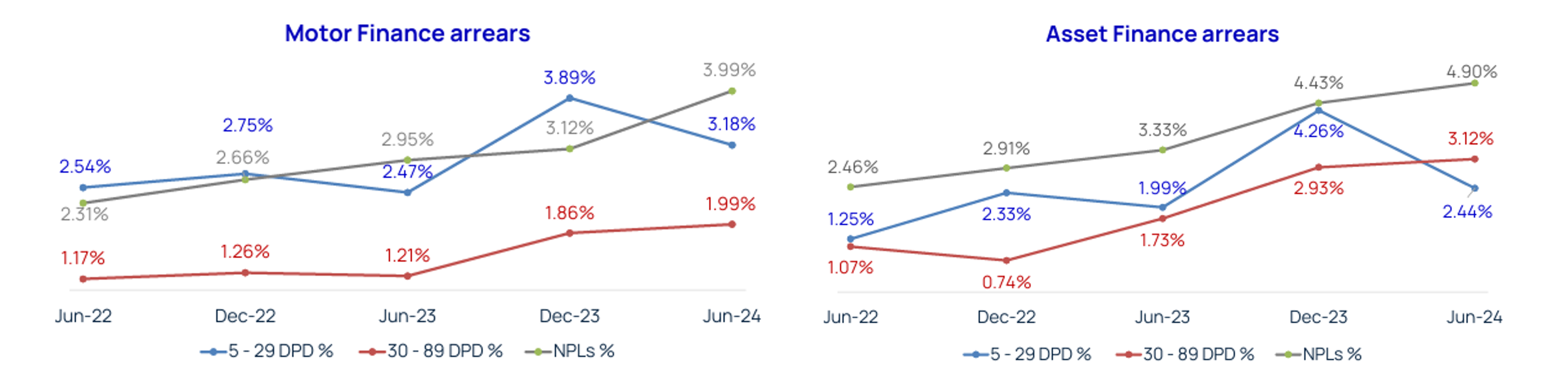

For example, it would have been a surprise for many investors to realise that a net $12.1m of the impairment last week stemmed from loans that were in arrears by greater than 365 days. Last week’s investor provision highlighted arrears aging for two key divisions: Motor Vehicles and ‘Open for Business’. In both divisions, there is a further significant degree of arrears between 180-365 days, with Dixson stating a goal to remove this aging profile by June 2026.

Prior disclosures had treated arrears beyond 90 days as “non-performing loans”, with the last disclosure in August 2024 showing increasing ‘non-performing loans’ in both Motor Vehicles and Asset Finance since June 2022.

The same presentation also showed a sharp increase in non-performing loans for Heartland Group overall, from 1.87% (FY23) to 2.92% (FY24).

As NZ Shareholders’ Association, we encourage Heartland to pursue increasing transparency as regards the aged arrears of its loan book – while the company has now offered transparency in two of its key lending areas within New Zealand, investors remain in the dark as to whether a similar problem is building in other bank divisions. We’re also not sure of the impact on Heartland’s (assumed) future growth of a toughened collections policy.

Heartland Australia – a distraction?

FY24 arguably set a tone of sense of cautious optimism for the way ahead, notwithstanding the significant impact of economic conditions within New Zealand. This was partly driven by Heartland’s successful acquisition of Challenger Bank in Australia and subsequent Australian banking license, allowing Heartland Australia to be a retail deposit-taker – reducing its underlying cost of capital and improving interest margins. The road to create Heartland Bank Australia has not been easy, with a massive amount of time and energy invested in its successful creation. At the time the acquisition was finally completed, in April 2024, many external commentators were concerned about Heartland’s probability of success as a bank in Australia. Also, the company issued capital at $1.00 per share to settle the transaction.

But perhaps a little like Heartland itself, those commentators were looking in the wrong place. References to Heartland Australia were conspicuously absent from last week’s announcement, other than to note that the “AU bank is unaffected [and] continues to perform well.”

Shareholders will be thanking someone for small mercies.

Nonetheless, the tone set by the company’s interim results announcement later this week (Thursday Feb 27th) will be critical – was there any distraction for the Board in establishing Heartland Australia – and if so, what role did this play in the Board losing sight of what was going on within its (larger) New Zealand business?

Time for accountability

Heartland comprises two separate banks, each with its own Board – as required by regulators in both Australia and New Zealand. Heartland Group Holdings (HGH) is the listed company that owns both banks, with its own Board – it is this Board that is elected by shareholders.

It is telling that of the five members of the Heartland Group Holdings Board, three were elected in 2024, one in 2021 with the longest-serving Board member being current Chair Greg Tomlinson, elected in 2018. Tomlinson is also a significant shareholder, owning 8.9% of Heartland.

Of these Board members, two (John Harvey and Kate Mitchell) are also on the Board of Heartland’s New Zealand bank. While both are relatively recent appointees to the Group Board (2024 and 2021 respectively), they have served far longer on the Board of Heartland Bank. In fact, John Harvey and Heartland Bank Chair Bruce Irvine are the longest-serving members of that Board, having been appointed in 2015.

Both Irvine and Harvey are at the tail-end of the strategy they have overseen (as Board members) within Heartland’s New Zealand bank, from its inception to the present-day outcomes. It is hard to define this strategy as a resounding success for shareholders. At its most simplistic, lending growth has been at least partly financed by regular capital calls from shareholders, with that capital deployed (via Heartland Bank in New Zealand) into underperforming loans. While Andrew Dixson has now expressed a clear desire to improve collections processes, it should be of some concern to shareholders that these were not up to scratch in the first place.

Shareholders in Heartland Group cannot directly vote against the election of Bruce Irvine or John Harvey to the Heartland Bank board. Their appointment is governed by their shareholder – Heartland Group.

But as shareholders, we can certainly make our displeasure with the performance of the Heartland Bank board known. As the Shareholders’ Association, we have already expressed our desire for accountability and change at the Board of Heartland Bank.

As for the directors of Heartland Group – we will all be watching to determine your success in putting future shareholder returns at the heart of Heartland.

Oliver Mander

7 Responses

What kind of comment is this to finish – “As for the directors of Heartland Group – we will all be watching to determine your success in putting future shareholder returns at the heart of Heartland.”. “Heartland” the name signals putting NZ’s heartland first. Probably thry are partly in this mess because of putting investor image first. If you check google reviews, you can see it’s customer service has been lacking, except for it’s generous terms. Customers don’t get called back, frequent transaction records aren’t provided, and perhaps until recently their app has been useless even in 2025 already. Just typically poor nz style customer service. Hopefully they clarify their lending criteria but ultimately if investors are going to get returns Heartland will need to ramp up thrir customer service in all areas. It`s nice to have great lending terms but if the service is poor it’s for lenders to trust the service.

No argument from us, Antonio. What’s good for customers is ultimately good for shareholders – at the moment, they’re serving neither very well.

Hopeless. The shareholders have been under attack for years, partly from the constant erosion of the share price by money grabs (equity raising) at lowball offer values.

A very disapointing result one has to wonder whats going on .

woeful management, unfortunately not alone.

woeful management, unfortunately not alone by a long shot.

Who’s been asleep at the wheel? Hard to imagine any lender not being aware of overdue loan repayments of such magnitude – and not doing anything about them.