NZSA Disclaimer

Over the last week or so, investors have been surprised by two separate actions in the local market, both having the potential outcome of removing all members of the Boards for NZ Media and Entertainment (NZME) and Bremworth (BRW). Both actions claim the support of a broader shareholder base, 32% in the case of Bremworth and 37% in the case of NZME.

Such action is unusual, but not entirely without recent precedent. About this time last year, the independent directors of PGG Wrightson (PGW) were busy fending off the aggressive ‘board change’ resolutions proposed by their major shareholder, Agria. On that occasion, NZ Shareholders’ Association wrote to most PGW shareholders, calling for their support in rebuffing Agria’s advances and advancing some Resolutions of our own to be tabled at the (planned) Special Shareholder Meeting.

Back in 2021, the NZ Shareholders’ Association was itself the instigator of (successful) non-binding resolutions proposing the removal of the NTL Chair and CEO from the Board of New Talisman Gold Mines (NTL). All three previous members of the NTL Board left NTL shortly after the meeting. We also proposed a resolution for the election of a further director and chose not to support the nominees recommended by the Board.

We have also been vocal for many years of calling for Board change at Fletcher Building (FBU) – calls that could no longer be ignored during 2024.

A high bar

In both cases, however, the threshold set for complete board renewal was appropriately high. A complete change of all Board members offers a heightened risk for investors, as a completely new Board lacks institutional knowledge of the company and must come to grips with how the company is operating.

For NTL, the factors underpinning the action by NZ Shareholders’ Association related to the sheer lack of delivery associated with developing mining operations, the underlying independence of the Board in holding the Chief Executive to account, the conduct of the Chief Executive that warranted FMA investigation and the level of Chief Executive remuneration. All of these factors had combined to form an existential threat for the company, with a consequent risk of loss for investors.

Concerns relating to Fletcher Building have been well-documented – again, however, NZSA’s advocacy was based on key factors associated with the long-term loss in value for shareholders and the failure of the company’s Board to come to terms with FBU’s risk profile and legacy operations. Nonetheless, after the accountability shown by the company’s Board during 2024, NZ Shareholders’ Association chose to vote in favour of the re-election of one of the few remaining directors, Cathy Quinn, with both board stability and her institutional knowledge cited as factors.

Whether you agree or disagree with that specific assessment, both factors become highly relevant in the calls for complete Board change at both NZME and Bremworth.

For both companies, there is a clear differentiation from the conditions that caused NZ Shareholders’ Association to instigate Board change proposals in the past. NZME and Bremworth both have a clear (albeit, ‘in progress’) strategy, both have independent Boards with no perceived conflicts that impact their ability to hold the Chief Executive to account and to the best of our knowledge, neither company’s Chief Executive is under investigation by the Financial Markets Authority.

Challenges – but not broken

That isn’t to say that either company is free from challenges, or even existential threats.

The difficulties facing the media sector are well known. NZME has done well to maintain profitability over the last few years, although the latest result (a loss) reflects both a significant impairment to the company’s publishing mastheads (-$16m) and a further decline in underlying profitability to $12.1m from 2021’s high point of $23.6m. These outcomes reflect the difficulties in published media and the broader impact of poor economic conditions in New Zealand over the last year.

Despite the decline in profitability, the company has continued to maintain a dividend of $0.09; at NZ Shareholders’ Association, we can’t help but wonder about the pressure exerted on the company’s Board by major shareholders to maintain the dividend flow – although we also note NZME’s relatively consistent operating cashflow and a dividend policy based on a free cashflow range. All well and good, even if on the face of it the long-term health of the company’s balance sheet may have benefitted from debt reduction instead of a short-term sugar hit for shareholders.

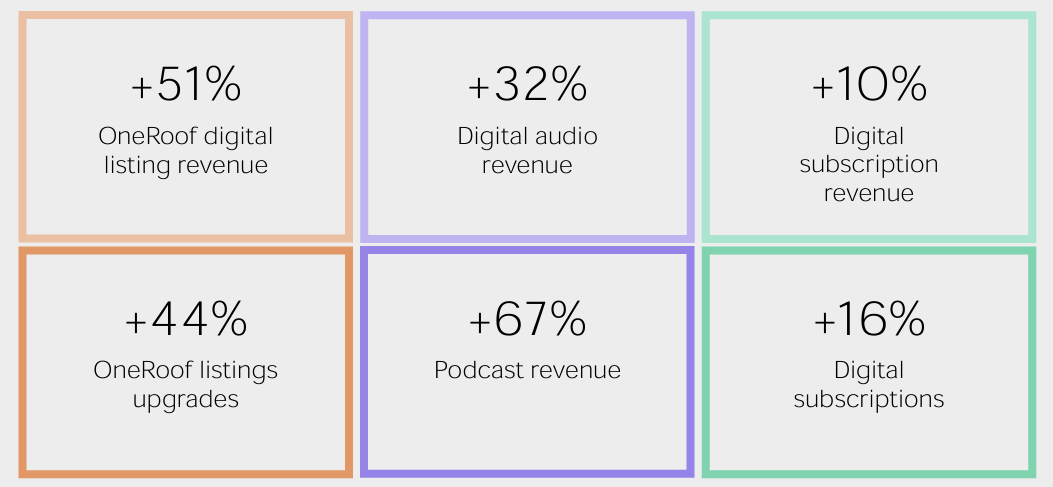

On the other hand, the company continues to look for ways to maximise value from its balance sheet. In 2021, the company recorded a $15m gain from the sale of GrabOne. NZME’s most recent investor presentation highlights, amongst other options, the potential sale of OneRoof as a means of maximising shareholder value. Additionally, the company’s stated ‘Digital First’ strategy seems to be underpinning a more sustainable ‘publishing’ business in the long-term.

When it comes to the challenges facing Bremworth, Chair George Adams must be wondering when he might be able to catch a lucky break. A new strategy devised in 2020, that saw the company focus on the manufacture and marketing of woollen carpets and rugs, has been interrupted by Covid-19, Cyclone Gabrielle, the subsequent loss of market share (revenue) and re-invention of supply chains aimed at maintaining longer-term customer relationships (costs) and the navigation of a complex insurance process.

Bremworth’s release of interim results on February 28th may have formed the ‘trigger’ for the shareholder group; an increase in revenue does not offer comfort and joy to shareholders when accompanied by declining gross margins, increasing costs and reduced earnings. The group is calling for a Special Meeting and proposing the removal of all current directors and the appointment of four directors, led by proposed Chair Rob Hewett. Interestingly, this is only three months after Adams was resoundingly re-elected to the Board at the company’s annual shareholder meeting.

Underpinning the financial headlines, the company also noted a cost-savings target, the re-instatement of its optimised, vertically- integrated supply chain, the potential for a significant capital return and even declared, with some determination, that “margins and profitability need to improve“. More critically, it also announced a strategic review “to identify the highest value owner for Bremworth” – in essence, putting the company ‘in play’ for either an equity partner or takeover.

It is easy for shareholders (especially those who purchased pre-2020) to dwell on Bremworth’s difficult past. However, it is also easy to see the opportunity in front of the company as it emerges from the aftermath of Cyclone Gabrielle and attracts the interest of potential suitors.

NZ Shareholders’ Association note that the issues, and potential solutions outlined by the shareholder group seem to be in strong alignment with that of the current Board. That may lend itself towards a ‘collaborative’ approach to solving the vexed problem of board renewal, rather than focusing on the ‘scorched earth’ alternative.

Board Renewal

Bremworth have two directors (John Rae, Dianne Williams) that have served on the Board since 2015, well before the company’s refreshed strategy announced in 2020. At NZME, Carol Campbell has served nearly nine years. All should form part of any discussion between the shareholder groups and the current Board when it comes to determining a Board succession plan.

Nonetheless, the key arbiter of Board composition should stem from the Board itself, based on the skills the company needs to govern itself effectively – with subsequent approval by shareholders. In principle, the requirement to govern in the ‘best interests of the company’ should ultimately trump the representative desires of major shareholders. In practice, however, it is easy to see why individual shareholders lack confidence in the ability of large shareholding blocks to hold themselves to this principle.

Ultimately, shareholders should value the certainty provided by a managed succession rather than the disruption caused by a full board transition – especially in the context of the change rationale not meeting the thresholds for the removal of a full Board described above.

Control, Governance and Management

In both cases, speculation abounds that the respective shareholder groups want to take a more active role in the ‘execution’ of strategy within each business. For NZME, the proposals made by Jim Grenon, should they succeed, are likely to manifest in greater editorial oversight by the Board. Yet, it should not be the role of a Board to ‘deliver’ strategy – that is the role of the Chief Executive. By all means, if they fail, a Board should hold the Chief Executive to account.

The role of a Board is to set a strategy that reflects the ‘best interests of the company’. Usually, this will align with the expectation of shareholders to receive the benefit of a long-term, sustainable return on their investment.

Many shareholders will also act (and react) in other ways that serve their interests. A shareholder in NZME may well be prepared to conflate their interest as a shareholder with their personal or political interest. Directors, however, do not have this luxury – they must always act in the best interests of the company, regardless of their own political or personal views. That could make life interesting for Grenon’s proposed directors, especially in the context of a widely-held company like NZME. It’s unlikely that NZME’s publishing and audio divisions will have the same degree of mass engagement (ie, revenue) if a balanced approach is removed from editorial content.

News media fragmentation and proliferation has ensured that none of us need to tolerate media commentary opposed to our own view. We’re able to self-select from a variety of online sources, of variable journalistic quality (including this blog), without being distracted or incensed by the provision of balance. In its current form, NZME provides balanced views as a key premise of its business model; a mass audience implies a balanced view, providing scope for media consumers to vehemently agree or disagree within the same commentary.

So is the future of media a multi-faceted, mass media organisation like NZME? Perhaps with multiple brands focused on different aspects of the social polarisation that has occurred over the last two decades? Or does Grenon’s vision represent the new media future in New Zealand?

When NZME’s shareholders vote at their meeting on April 29th, they could be voting on this critical question. For NZ Shareholders’ Association, however, our assessments must be limited to shareholder interests.

NZ Shareholders’ Association has long warned investors to be aware of the motivations of dominant shareholders or shareholder groups when investing, and make sure that their interests align with those of the dominant shareholder. It might be that the interests of Grenon align with many shareholders, based either on shareholder or personal interest. However, on the basis of the information provided to market so far, this does not feel like a compelling proposition for individual small shareholders.

In particular, Grenon’s approach to propose a transfer of control to an as-yet-unknown Board would represent a transition of control to a shareholder group that could be considered to be ‘acting in concert’. Directors representing a group ‘acting in concert’ may not meet the qualification as an independent director. In this situation, the minority shareholders represented by independent directors will receive no ‘control premium’ either by way of cash or share price increase attributable to a transition of control.

Minority shareholders could be forgiven for feeling that this is takeover by stealth, with the personal views of Jim Grenon riding roughshod over long-term shareholder interest.

Oliver Mander

Oliver is the Chief Executive of the NZ Shareholders’ Association (NZSA) and a former NZ Herald business columnist. NZSA advocates on behalf of all investors and promotes effective corporate governance within New Zealand’s listed companies.