NZSA Disclaimer

A few weeks ago, we wrote about the proposed takeover of Millennium Copthorne (MCK) by its major shareholder, CDL Investments at $2.25/share. In that commentary, NZ Shareholders’ Association challenged the independent directors to demonstrate their independence by rejecting the offer and (in so doing) the ‘patronage’ offered by their majority shareholder.

It was clearly a busy day at the MCK office today. Not only did the company issue a significantly-improved set of annual results, the independent directors committee (IDC), chaired by Leslie Preston, issued a target company statement recommending that shareholders do NOT sell their shares into the Takeover Offer made by CDL Investments.

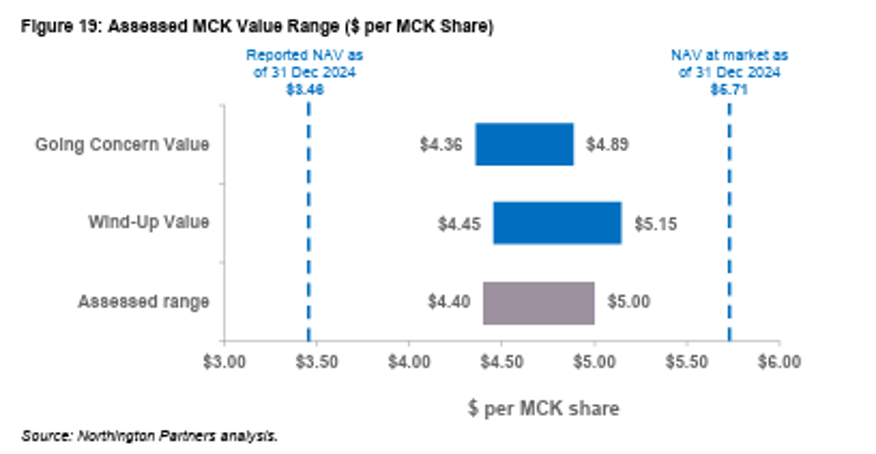

Given that the independent report prepared by Northington Partners set an expected valuation range of $4.40 – $5.00 per share, this may have been an easy decision to make. The IDC also offered other reasons, including:

- The timing of the Offer is at a low point in the property/hotel valuation cycle;

- The company has offered a positive outlook as the “Revive and Thrive” strategy bears fruit;

- The Offer undervalues future cashflows from recent capital expenditure;

- The Offer does not value any integration benefit that could be gained by CDL Investments.

Interestingly, Northington Partners’ assessed Net Asset Value is $5.71 / share, compared with MCK’s own assessment shown in today’s interim report of $5.39 / share. We continue to challenge the company to revert to an independent assessment of realisable value for its property assets, rather than rely solely on directors’ judgement, and consider reverting to more conventional accounting practices as regards property revaluations.

Valuation

In our original article, we had called on the independent advisers to create a valuation based on an estimate of the realisable value (less costs) if they were sold to third parties as individual properties over a defined timeframe. It was good to see Northington Partners produce a valuation based on both a “going concern” basis and a “wind up value”, based on an orderly sale of the company’s assets over a 2-4 year timeframe.

These two valuations highlight the conundrum facing MCK directors – the company is (arguably) worth more in pieces than operating in its current form. That puts pressure on both Directors and company executives to exceed their own expectations in the longer-term.

Liquidity

On the face of it, shareholders hardly seemed to react to the news that their company was worth around double the current share price, with the $0.10 movement to $2.50 today reflecting the much improved annual results and outlook.

Independent Directors (and shareholders) should be pleased with this report and its outcome. But CDL Investments 75% ownership, this mutes the positive impact of a strong outlook – individual investors are well aware of the risks of being a minority holder.

“This low liquidity will be a large deterrent to institutional investors and larger market participants, as executing large trades without significantly moving the share price is likely to be difficult.”

Northington Partners Independent Report, February 2025

Given the material difference between share price and valuation, this might form the somewhat unusual situation where “less is more” for CDL Investments. A sell-down of shares to below 50% of the orindary shares (while retaining their redeemable preference shares) would be likely to improve liquidity for the ordinary shares and attract investors – eventually resulting in a share price more aligned with underlying valuation. The absolute value of CDL’s stake could be worth more than today, despite reduced ownership.

But in that scenario, there is no prospect of a ‘cheap’ takeover.

And thanks to Leslie Preston (Independent Committee Chair), Colin Sim and Graham McKenzie, supported by Northington Partners, there has been no chance of that on this occasion.

Oliver Mander

One Response

Hi Oliver, thanks for the article. I would posit that a “cheap takeover” is now likely forever off the cards and if CDL wanted to enhance their value, they should really sell down to under 50%.