NZSA is pleased to bring you the 2023 Investor Conference – especially welcome after the Covid-related impacts on our events since 2019. We hope you make the most of the opportunity to gain insight from the amazing array of speakers we have brought together.

Our Changing World

NZSA believes that this is a theme that we can all relate to. Whether it’s the sudden change in the global economic outlook, the rising tide of younger investors in New Zealand or the changes in capital markets – we want to make sure that New Zealand investors are well-equipped for what they will face in the next year or two.

Register for the conference at this link. At only $85, this is great value for anyone with any connection to investing!

Agenda and Speakers

When: February 18th 2023

Where: Due Drop Events Centre, Manukau

9:00 Registration

9:30 Welcome (NZSA Chair, Andrew Reding)

9:40 – 10:20

Reflections and Predictions – NZX & NZ Capital Markets

Speaker: James Miller (Chair, NZX)

James Miller is an experienced company director. He is regarded as one of the country’s most experienced Chairs of company Audit and Risk Committees. He is Chair of NZX, Chair of Channel Infrastructure, Director of Mercury and Vista. He was appointed to the NZX Board in 2010 and became Chair in 2015.

James has previously held Board positions with Accident Compensation Corporation, Auckland International Airport and the Financial Markets Authority. He has been the Chair of the Audit and Risk Committee for Auckland International Airport and Refining New Zealand and Chair of ACC Investment Committee, managing a $50billion fund. He is currently Chair of the Audit and Risk Committee for Mercury.

James has 14 years capital markets experience with Craigs Investment Partners as Head of NZ Wholesale Equities. Prior to that he was Head of Equities and Head of Research at ABN AMRO and Barclays de Zoete Wedd. During this time, he specialised in the strategy and valuation of airport and utility companies. Specifically, he had a leading role in the valuation and global pre-marketing of Auckland Airport, Beijing Capital International Airport, Contact Energy Limited and Vector Limited initial public offers.

James is a qualified Chartered Accountant and is a Fellow of the Institute of Chartered Accountants of New Zealand, a Certified Securities Analyst Professional, an accredited Director of the Institute of Directors in NZ Inc, a Fellow of the Institute of Finance Professionals New Zealand and a Chartered

Fellow of the Institute of Directors (CFInstD). He holds a Bachelor of Commerce from Otago University and is a graduate of The Advanced Management Program, Harvard Business School (USA).

10:20 Beacon Awards Winner address

The winner of the 2022 NZSA Beacon Award will say a few words. The NZSA Beacon Award recognises excellence in governance, particularly focused on where the recipient has demonstrated commitment towards the rights of retail shareholders.

10:30 Morning Tea

10:50 BREAKOUT SESSION #1 (see below for detail)

11:50 The view from the Beehive

Come and hear how our politicians, and the parties they represent, see the future of investors in New Zealand and the policies that could shape investment decisions. Given that the election date has already been announced, we think this will provide a superb insight for all investors.

Andrew Bayly was elected to Parliament at the 2014 general election where he had the fourth highest majority of all electorate seats in New Zealand. In his professional life prior to Parliament, Andrew has been a merchant banker and a former officer in the New Zealand Army Territorials and also served in the British Parachute Regiment. He is a chartered accountant and a fellow of the Royal Geographical Society of London.

Andrew comes from a farming background and is a former director of an award-winning organic compost company. He is an adventurer and mountain climber, who has walked and dragged sledges to both Antarctic and Arctic poles.

He is the Member of Parliament for Port Waikato and currently holds the Opposition portfolios for revenue, commerce & consumers affairs, small business, and manufacturing.

David Seymour grew up in Whangarei with two younger brothers, where his parents were a pharmacist and a draughtsman. As a teenager, he moved to Auckland for high school before graduating from the University of Auckland in electrical engineering and philosophy. Before politics, David worked as an electrical engineer in New Zealand and for private sector think tanks in Canada. He has served as ACT Leader and MP for Epsom since 2014. In Government, he was responsible for Regulatory Reform and charter schools. From opposition, he passed the End-of-Life Choice Act.

Fearless and principled, he is known for standing up for his constituents and, if necessary, to every other party. He has been named MP of the year twice, and ‘the only one talking sense’ too many times to count.

Duncan Webb has served as the MP for Christchurch Central since being elected in 2017. He is currently the Minister of Commerce and Consumer Affairs and Minister for State Owned Enterprises.

Christchurch has faced challenges from earthquakes, terrorist attacks and COVID-19. Duncan is committed to making sure Christchurch gets the investment and jobs it needs and will continue to be a strong voice in a Jacinda Ardern-led Government.

Serving in Parliament has allowed Duncan to play a part in making New Zealand a better place through his pivotal roles in climate change legislation, resource management reform and COVID-19 response laws. Prior to entering Parliament, Duncan was a professor, lawyer, and social activist. He lives in St Albans with his family and has advocated for policies that promote Christchurch Central as a place to live as well as work. He believes thriving businesses, supported by good government policy, are essential to building a just society that cares for all.

Raf Manji is Leader of The Opportunities Party, a role he took up in early 2022. Prior to that, he served two terms as a Christchurch City Councillor. As Chair of the Finance Committee, his main focus was the Council’s financial position and insurance settlement, as well as its post-earthquake strategic direction, risk management and engagement with Central Government. He also acted as an Independent Advisor to the Christchurch Foundation on the distribution of donated funds and support to the victims of the 15th March Terror Attack. He sat on the board of Christchurch City Holdings Ltd and was a member of Local Government working groups on Funding, Risk and Localism and the Central Government Working Group on Trade for All.

Raf spent 11 years trading global markets and providing high-level macro-economic advice for investment banks in London from 1989-2000. In 2002, he moved to New Zealand and has since been actively involved in governance, strategy and social enterprise. He has worked with the AsiaNZ Foundation, the Christchurch Foundation, the Volunteer Army Foundation, Refugee Resettlement Services, Christchurch Budget Services, Pillars and the Christchurch Arts Festival as both a volunteer and board member. He has a degree in Economics and Social Studies from the University of Manchester and a Graduate Diploma in Political Science and a Masters in International Law and Politics from the University of Canterbury.

12:45: LUNCH

1:30: BREAKOUT SESSION #2 (see below for detail)

2:30: 2023 Outlook

Hear about the economic outlook coming up in 2023, and what it means for investors

Shamubeel Eaqub is an experienced economist who makes economics easy. He

is also an author, media commentator and a thought leading public speaker.

He has over two decades of experience as an economist in Wellington, Melbourne and Auckland in leading international banks and consultancy. He is a partner at Sense Partners – a boutique economic consultancy.

He holds a BCOM with Honours in Economics from Lincoln University and is also a Chartered Financial Analyst.

He lives in Auckland with his wife and two sons.

3:20: Afternoon Tea

3:40: Takeovers Code vs Schemes of Arrangement

We know that in recent years, Schemes (SoA’s) have become much more prevalent when it comes to takeovers, as compared with the Takeovers Code. This short session offers some insight as to whym and how that impacts investors.

Andrew Hudson is an experienced M&A lawyer, with private practice and in-house experience. Andrew joined the Takeovers Panel in 2012 as the Panel’s General Counsel and has been Chief Executive of the Panel since 2017.

An independent Crown entity, the Takeovers Panel is responsible for regulating takeovers of publicly listed and widely-held unlisted companies in New Zealand

4:10 NZSA Journalism Awards

Hear from Tim Hunter, the 2022 overall winner of the NZSA Journalism Awards. This brief session, introduced by Sam Stubbs, aims to highlight the key role of media in supporting transparency for investors.

One of New Zealand’s most experienced and decorated business reporters, Tim Hunter joined NBR in May, 2015. The Scottish expatriate received an MA (Hons) in philosophy and international relations from the University of St Andrews and an MBA in business strategy and finance from the University of Edinburgh. After emigrating to New Zealand, he held a string of senior roles including business news editor for the NZ Herald, business editor of the Sunday Star-Times and deputy editor of Fairfax’s Auckland Business Bureau before joining NBR. His trophy cabinet includes Qantas Media Awards for Best Business, Finance & Consumer Affairs columnist and Best Newspaper Feature Writer (Business). He was also named the inaugural EY Business Journalist of the Year in 2014, the NZSA Business Journalist of the Year in 2019, Voyager Media Awards Business Journalist of the Year in 2020, and NZSA Business Journalist of the Year in 2023.

Sam Stubbs is the co-founder of Simplicity, one of NZ’s fastest growing KiwiSaver plan. Simplicity is a nonprofit KiwiSaver and Fund Manager that gives 15% of all fees to charity and invests with a conscience. Sam was previously CEO of Tower Investments, MD of Hanover Group and worked for Goldman Sachs in London and Hong Kong. He has also worked for NatWest Markets, Fay Richwhite and IBM.

Sam has an MA (Hons) in Politics from the University of Auckland. He is a father of 4 children, and has no time for any hobbies! He dreams of Simplicity and sailing around the world.

4:20: Discussion – “The current environment is loaded with investment opportunity“

Originally planned as a debate…but a combination of the Cyclone Gabrielle and Covid-19 has had an impact! Nonetheless, the session will still focus on the same topic, with different perspectives provided by Greg Smith of Devon Funds (see above) and Stuart Millar of NZX.

Stuart Millar is the Chief Investment Officer for NZX’s Smartshares Limited. Stuart has led the Smartshares Investment team since 2019, with over 20 years experience managing funds across broad range of asset classes.

Prior to Smartshares, Stuart was Head of Diversified Portfolio Management for ANZ Global responsible for diversified funds in NZ, Australia, and Singapore. During his funds management career, he has held lead roles in investment strategy, asset allocation, global equities, and currency management.

Stuart is a CFA charterholder and a director of the CFA Society of NZ.

10:50 and 1:30 Breakout Sessions

Breakout sessions are repeated twice during the day, allowing attendees to participate in two of the four sessions on offer. Each session is focused on a key area of interest for NZSA and its members. Audience participation is welcomed – the aim is to be as interactive as possible – so come prepared with any questions for our panellists!

Session 1: A Young Person’s Perspective

NZSA believes that the next generation of investors will have a significant influence on investor expectations. So what exactly DO the younger generation look for when investing? Come and hear what our panellists have to say – and feel free ask a few questions of your own!

Molly Rhodes is a fourth year Law and Finance student at the University of Canterbury. She is the CEO of The Investment Society at UC for 2023 and has a passion for financial education.

Madhura Banerjee is a Resolution Adviser at the Reserve Bank of New Zealand (RBNZ) and works in a function that is responsible for enacting the RBNZ’s resolution and crisis management powers under legislation. She has had the opportunity to shape policy responses to emerging risks such as climate change and technology. She has also worked within consultancy and risk management at Deloitte. Madhura holds a Bachelor of Commerce (Economics and Finance) from the University of Auckland. Madhura is proud to be the Chair of Young Women in Finance (YWF, a sub-committee of INFINZ) which offers a platform for thought leadership and networking opportunities for young professionals.

Andrew Parker is NZSA’s newest researcher, starting his role in February 27th in supporting assessments of listed issuers against NZSA’s Environmental Sustainability Policy. He is beginning his third year at the University of Waikato studying towards a Bachelor of Management Studies (with Honours) majoring in Accounting and Finance. He is currently doing a summer internship in the commercial department of OceanaGold where he assists in the monthly budgeting and property management reporting of their Waihi operation. He has had 3 years’ experience of investing through Sharesies.

Session 2: Learning to Learn

Developing a knowledge hub for investors of all ages and stages will be a key focus for NZSA in 2023. No matter your age or stage, NZSA believes that investor knowledge development is important for everyone. Our panellists are steeped in experience relating to investor capability development – hear what they have to say about the current and emerging challenges, and what we should be doing about them.

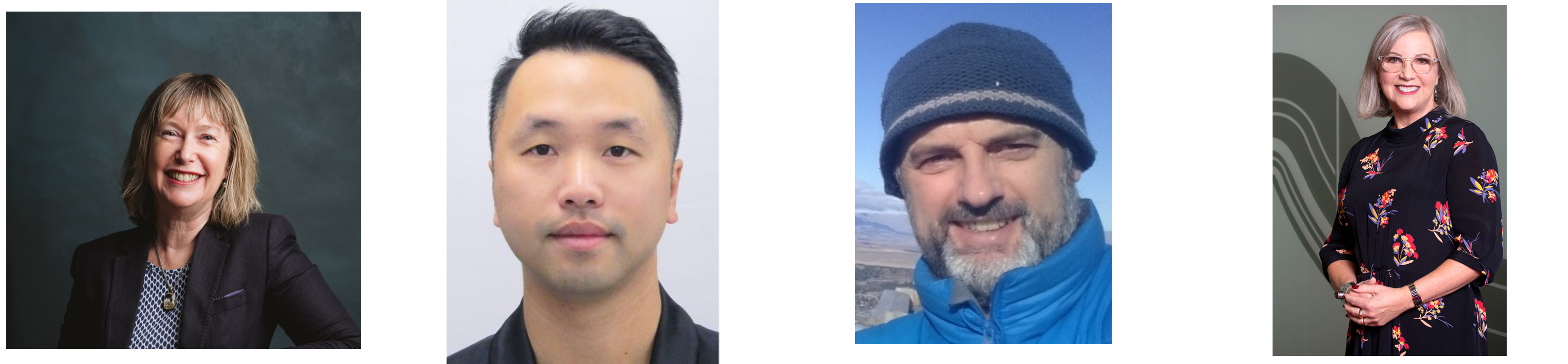

Gillian Boyes is the former Head of Investor Capability at the Financial Markets Authority, where she led work to improve investor decision making – in her view the very best time to help investors learn. Now leading a membership-based organisation, she retains her interest in investing through a board role on Women in Super, a network of women associated with the retirement savings and wider financial services industry. Women in Super’s goals include providing and supporting education and training that empowers women of all ages to become more financially aware and to make good financial decisions throughout their lives.

Jerry He is the former Deputy Convenor of The Small Business Council & Small Business Development Group (SBDP), which advises the New Zealand Government on issues affecting SMEs and helps government agencies communicate more effectively with them. In his position as the Chairman of the New Zealand Green Industry Association, Jerry also receives regular trade updates and speaks with CIQ officials from Chinese Customs. Jerry also advises New Zealand Asia Initiative, Business School University of Auckland on Asian topics. He is an Associate Director of NZSA.

Warren Frost began his investment journey began some 30 plus years ago, initially in residential real estate which developed to include equities and commercial real estate. His working life began in running the family motor parts store in the weekends as a teenager, progressing to work as a Fitness Consultant after graduating from Otago University. He has worked as a teacher, a Sports Scientist and Sports Medicine Coordinator for New Zealand Cricket and as a Deputy Principal for a University Accommodation Hall. Warren lives in Christchurch, is married to Maree and is father to Hadleigh – who lectures at Oxford, UK.

Louise Nicolson is a corporate communications specialist, with experience working for government, business, the media and agencies. She has held senior roles in New Zealand, Australia and Asia. Most recently, she was part of the leadership team of New Zealand’s Financial Markets Authority and prior to that was a partner in one of the Asia Pacific’s most successful public affairs agencies.

Louise’s specialty is issues and reputation management, with a particular focus on financial communications and the rights of investors. She is a current member of the NZSA Board.

Session 3: To thrive you must survive – Bear Market Strategies

If 2022 was the year of turmoil and decline in financial markets, what exactly will 2023 bring? And – are you ready? This session will set out some practical steps that may help encourage your own investment success, regardless of the environment around you.

Martin Watson started investing in equities in the 1980’s and has been actively involved in company analysis and investment ever since. In 2000 Martin made the decision to follow his passion and become a full time investor. Subsequent to this he established MJW Funds Management Ltd, a boutique financial service provider, building portfolios for separately managed accounts, focused on listed investments in New Zealand and Australia. Martin is actively involved in a wide range of community and sporting groups. Martin has held various committee roles for Waikato Branch NZ Shareholders Association since 2010.

Greg Smith is the Head of Retail at Devon Funds, with an excellent track record of operating in the financial markets. Prior to joining Devon, Greg was the Head of Research at the Australian based funds management and market research business Fat Prophets. Prior to his time there, Greg was a Global Investments operations manager at Mellon Global Investments in London. Greg has been prominent in the business media for much of the last 20 years, having regularly appeared on business channels such as CNBC and Bloomberg. In New Zealand Greg is a well-recognised market commentator, regularly appearing as a guest speaker on Newstalk ZB, and contributing to stock market-related articles across other media platforms. As Head of Retail, Greg is representing Devon across multiple channels, with a particular focus on the Financial Adviser networks and retail clients.

Session 4: Shareholders’ role in reinventing tomorrow

Whether angel investing is a part of your strategy or not, some and hear the practical experiences of those who operate in the angel investing industry, how they support investor strategies and create the conditions for future innovation.

Nina Le Lievre, has been manager at Enterprise Angels since 2013 (and its CEO since 2019). She has a background in Investment Banking, having worked in the European Transactions Group at Dresdner Kleinwort Wasserstein in London for six years and in the Equity Capital Markets team at Craigs Investment Partners in Tauranga for three years. Her current role has immersed her in angel investing, working with prospective and existing portfolio companies, guiding due diligence teams, negotiating deals, launching, raising and managing EA Funds 1, 2 & 3 and managing the angel network. Nina sits on the EA Nominee Board and the Angel Association of NZ Leadership Council. She recently launched EA Fund 4, designed to combine the best of both an Angel group and a VC fund.