The woes of a2 Milk have been well documented over the past 18 months. What exactly might the future hold?

Back in the June 2021 edition of Scrip, NZSA CEO Oliver Mander made more than a few comments about a2 Milk (NZX: ATM). His article set out the timeline or downgrades that frustrated investors and caused the share price to fall from the giddy heights of $20+ to a low of around $5.70 in May 2021. A rebound in October 2021 to nearly $8 has been tempered by the general market sentiment, with shares currently trading just under $6.

The article discussed the impact of information quality on decision-making – particularly in relation to understanding a2 Milk’s inventory decisions, called for greater transparency around share sales made by senior executives and questioned whether shareholders could place trust in a2’s recovery plan.

Perhaps a different a2 will emerge from this current crisis – one that is more focused on the sustainability of its future financial performance, more aware of its underlying commercial risks and perhaps with more humility than it has demonstrated at the height of its success.

Oliver Mander, Scrip, June 2021

With the next shareholder meeting coming up for a2 during November (closely followed by both Synlait and Fonterra), we felt it was worth testing the extent of change at the company – and some of the challenges it continues to face. All three have their shareholder meetings over the next few months. The questions and risks raised below will likely form the basis of NZSA’s conversations with each company prior to their ASM.

Supply Chain Risks

Unsurprisingly, given the inventory management and supply chain woes that led the company’s fall from grace, concerns related to supply chain visibility remain – in particular, the impacts of the daigou channel. The risks associated with this translated directly into the issues of 2020/21 – but there are further potential risks associated with traceability of product (for example, in the event of a recall) where subsequent trader sales can’t easily be tracked.

During September, the company noted that Synlait’s registration renewal for infant formula (supplied to a2) had been temporarily renewed by China’s State Administration for Market Regulation (SAMR). A key question for both Synlait (NZX: SML) and a2 is the extent to which they are able to provide further assurance to shareholders as to how they are developing and trialling their response to upcoming new standards – no product made from 1 March 2023 can be shipped to China without registration renewal.

China

It’s clear that China is the ‘big bet’ for a2. The company has deliberately pursued all avenues for growth in that market at the expense of other potential opportunities for diversification. FY22 results show some return to pre-Covid growth to revenue of $1.446 billion, albeit from a significantly lower base in FY21 ($1.201 billion).

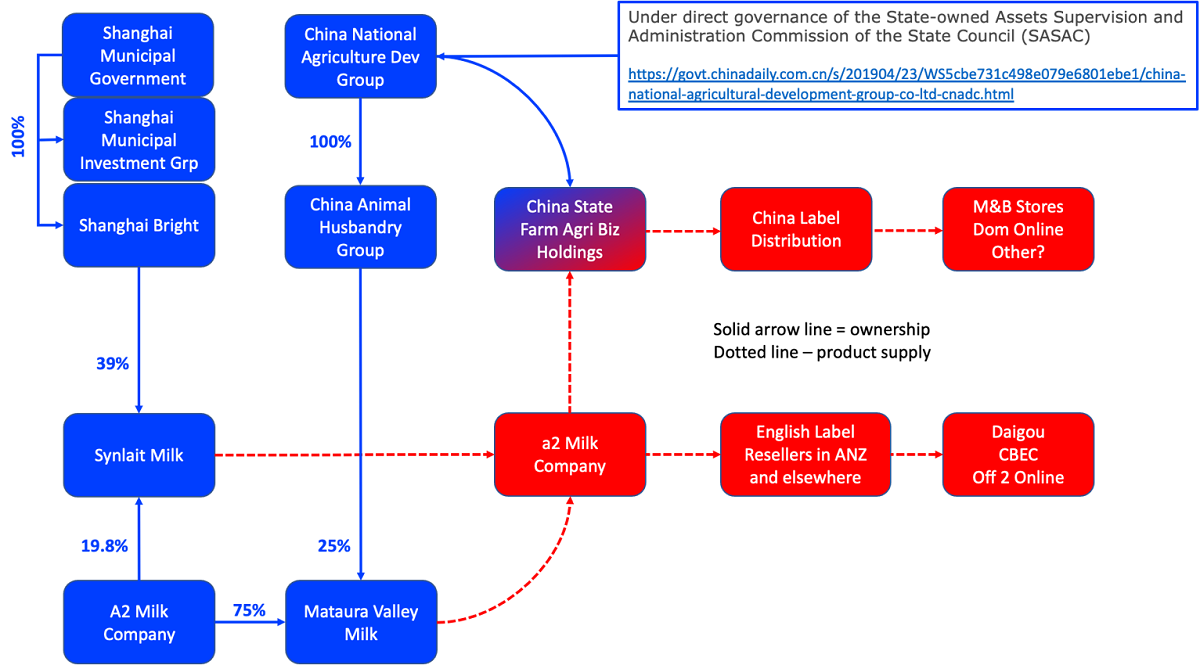

Geopolitical Risks: However, the change in global geopolitics over the last year has had an impact, both in terms of investor perceptions towards a2’s ‘big bet’ and the risk of a Chinese state reaction to Western sentiment. Just how likely is SAMR to favour western companies as an alternative to domestic Chinese production and Chinese political targets? Albeit, Synlait’s partial ownership by Chinese-based Bright Dairy and the minority shareholding of Chinese Animal Husbandry Group of Mataura Valley Milk may help on that front.

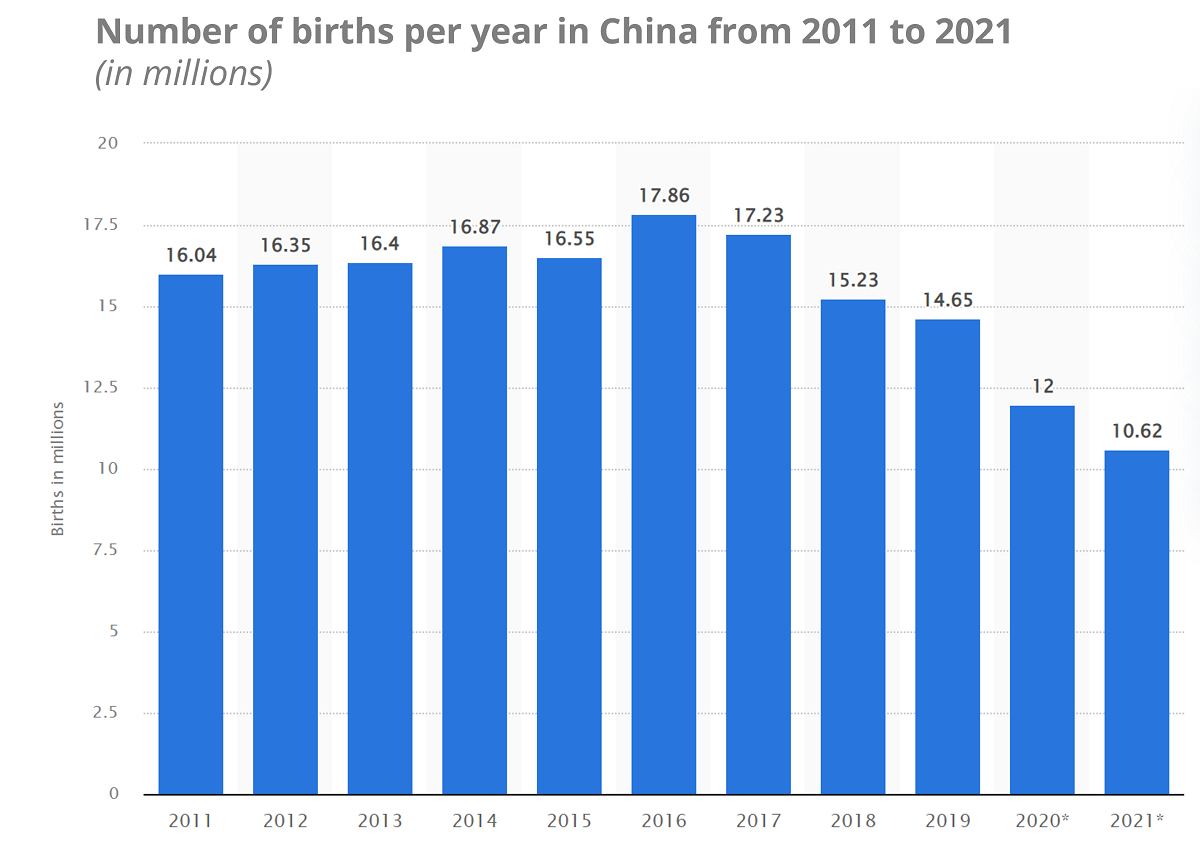

Birth Rate: The impact of a declining Chinese birth rate is also relevant for a2. a2’s annual results presentation highlights an 11.5% decline in FY21 – although the company does not discuss this within its schedule of key risks in the annual report.

Brand: Last year, the company had noted that its brand awareness and ‘preference’ in China remained high. The company observed that it moved to new record-high brand health metrics in its annual result presentation, remaining in the top 10 of preferred brands and achieving 9% in “top of mind” brand awareness. This remains critical in underpinning a2’s growth.

New Zealand v Australia

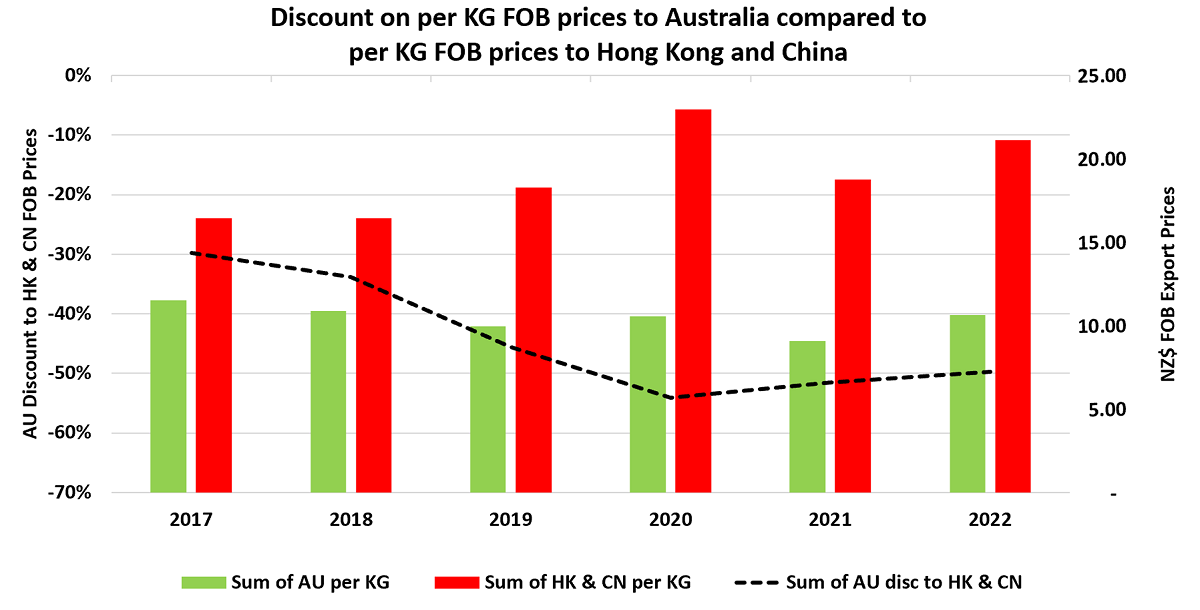

To be honest, this is really an addendum to a risk associated with supply chains. a2 Milk has invested heavily in shoring up its ability to source NZ-based infant formula supply, with the most recent acquisition being Mataura Valley Milk (MVM). Yet over the past year, Statistics NZ reports that exports of infant formula to Australia have significantly reduced (around -50%).

Much of that decline is likely down to issues in the Australian-based daigou channel, exposing the extent of re-export of NZ-sourced product to China from Australia.

The key risk for a2 is that the investments it has made in New Zealand are not remunerated by what is potentially a low export price for infant formula to support the margin required by multiple intermediaries in the value chain. Time will tell.

Of potentially greater concern, investors should be interested in the price relativity for alternative export paths for New Zealand produced infant formula. Again from Statistics NZ…export unit values ($/kg) achieved by direct export to China / Hong Kong are approximately twice that achieved to Australia. At best, that indicates that there should be greater pressure from minority shareholders in Synlait for a change in how their product reaches Chinese shores. At worst, it raises a curious eyebrow as to the role of the World Trade Organisation and actions they may take relating to transfer pricing activity and its impact on competitors.

Sales Channel Management

The complexity of a2’s sales channels requires shareholders to have a strong analytical mindset in reviewing a2’s disclosures relating to market share and growth. a2 has five channels to market within China:

- Chinese label – Mother and Baby Stores (Physical)

- Chinese label – Domestic Online

- English label – Cross-border Online

- Daigou (English Label)

- ‘Offline’ to Online

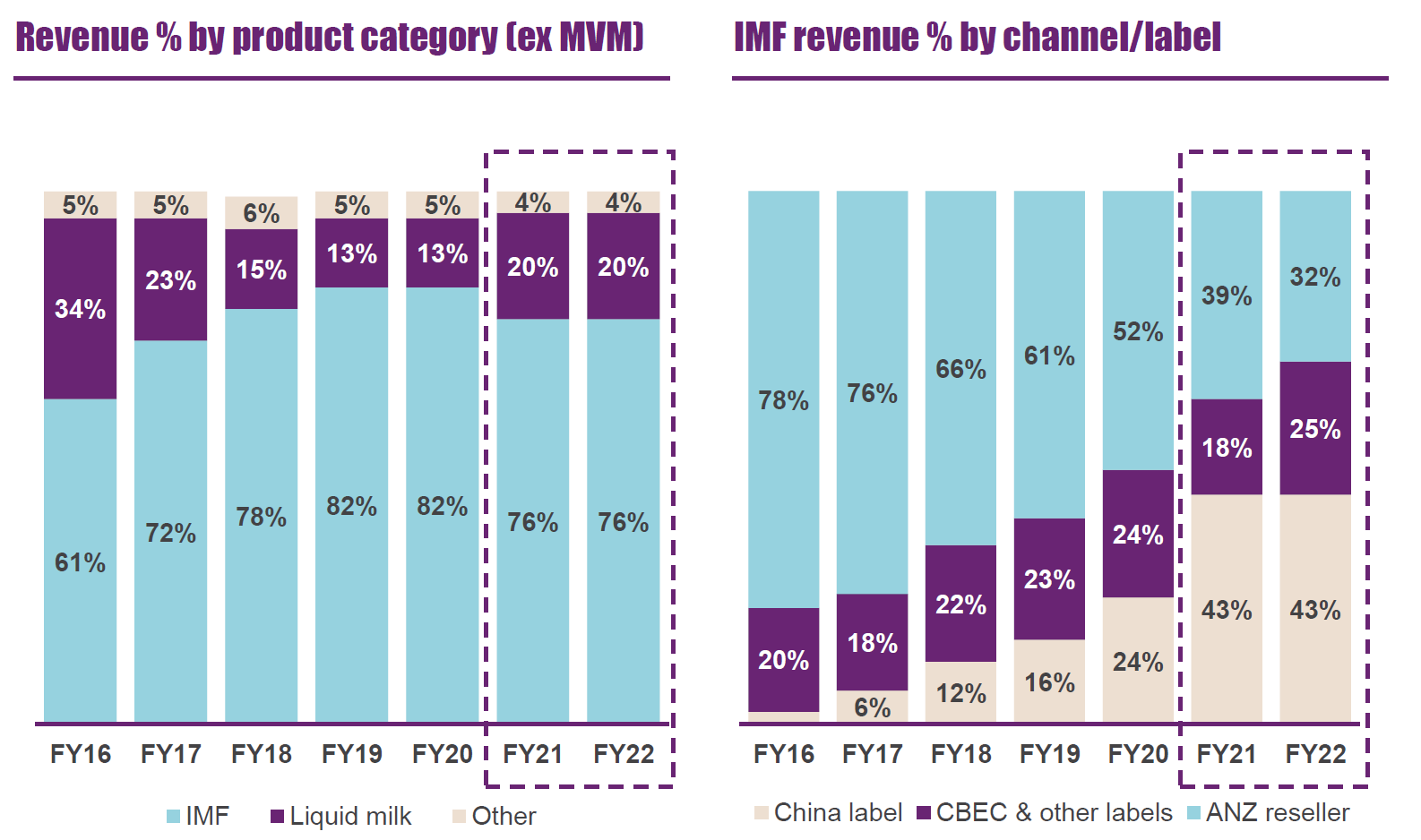

It’s worth noting that Chinese-label sales represent 85% of the market for infant formula in China. The Covid-19 pandemic impact had seen a significant shift towards Chinese-label product, one of the ley impacts for a2 in FY21. The company observed that market value for Chinese-label product declined by 3.1% in FY22

In addition to its core infant formula sales, a2 also offers a new ‘Stage 4’ product (Junior Milk Drink). It isn’t clear as to whether this is regarded as a product ‘adjacency’ or a key component of infant formula sales, although the company has chosen to embed Stage 4 sales into their infant milk formula reporting. We’re not clear whether Stage 4 product will be included in the requirement for renewed registration by SAMR discussed above.

Geographically, it is difficult to understand the ‘end-geography’ for a2’s sales. a2 is clear in terms of its geographic sales breakdown – but many of the infant formula sales in ANZ ultimately turn up in China as English-label cross-border or daigou sales – although there is some transaprency associated with cross-border e-commerce sales (CBEC). Nonetheless, we feel there is still some degree of ‘opaqueness’ relating to the remaining ANZ sales.

The a2 annual report highlights that 76% of a2 Revenue is from infant formula. Sales to ANZ resellers (some of which will be daigou) is showing a long-term downward trend. Long-term, this may help remove some of the cross-channel complexity in a2’s approach to the Chinese market.

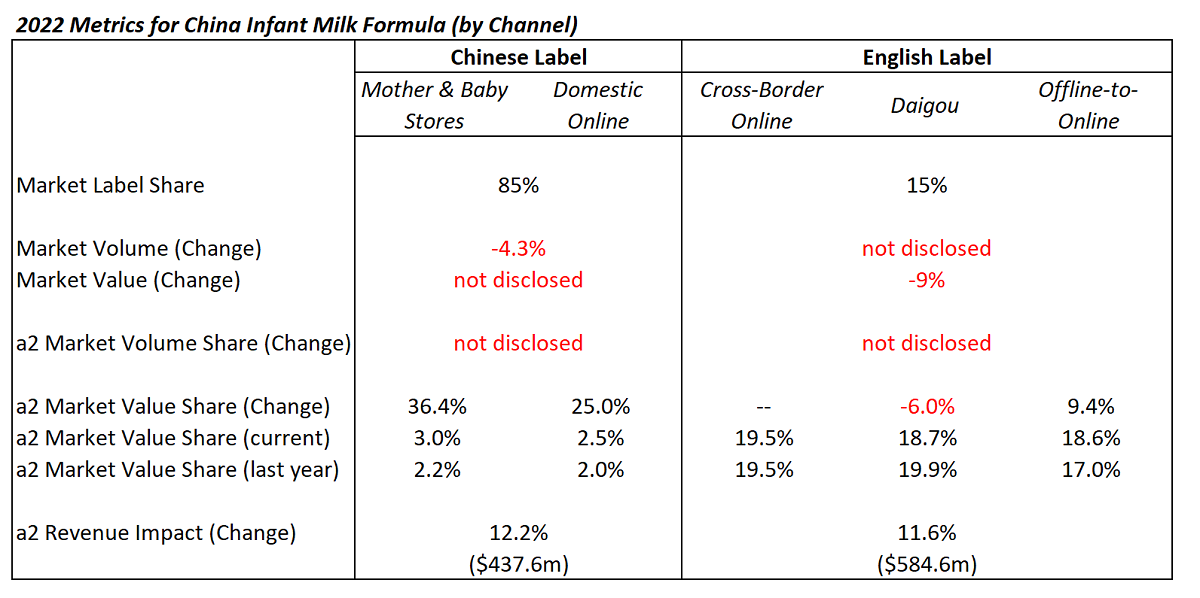

The following table is based on a2’s own disclosures in it’s annual results presentation – but attempts to provide a one-page summary of a2’s performance (as an alternative to the 57-page presentation).

There are many gaps in the table above, with some clear implications.

- What is the volume share of a2’s products? This is particularly apparent in the relative difference between the growth in value share of Chinese label sales for a2 (20%-36%) and its lower absolute revenue growth (12%). While some may be explained by the 4.3% market volume decline, linked to birth rate, has there been an additional loss of volume share suffered by a2 in these channels?

- a2, for the most part, chooses to use market share figures based on market value – suiting the premium-isation startegy it is pursuing. The use of a volume market share to describe China label changes is curious.

- The new ‘Stage 4’ product is included in the value share figures above. If Stage 4 sales are removed, what has occurred (in terms of market share) to the like-for-like products?

a2 goes into some detail to describe the technical aspects of its recovery and (perhaps inadvertently) the changes in external influences that may have dealt a mortal blow to it ever regaining its previous highs.

Regardless, a2 still has an emotional journey to compete with its investors. Transparency and disclosure should continue to dominate investor sentiment towards a2. The company’s ability to make the complex ‘simple’ for shareholders will be a key factor in regaining investor trust.

Malcolm Tweed and Oliver Mander

One Response

concerning