Annual Meeting Report, October 22nd 2024

Click here for NZSA Assessment and Voting Intentions

| Metric | 2021 | 2022 | 2023 | 2024 | Change |

|---|---|---|---|---|---|

| Revenue | $8,120m | $8,498m | $8,469 | $7,683m2 | -9% |

| NPAT | $305m | $432m | $254m | -$227m3 | n/a |

| Gross Margin Pct | 29% | 30% | 31% | 28% | -9% |

| Inventory Turnover | 4.81 | 4.45 | 3.73 | 3.81 | 2% |

| EPS1 | $0.371 | $0.552 | $0.30 | -$0.11 | n/a |

| PE Ratio | 20 | 9 | 15 | n/a | |

| Capitalisation | $5.9b | $4.0b | $3.6b | $2.4b | -34% |

| Current Ratio | 1.59 | 1.52 | 1.51 | 1.53 | 1% |

| Debt Equity | 1.15 | 1.24 | 1.47 | 1.67 | 13% |

| Operating CF | $889m | $592m | $388m | $398m | 3% |

| NTA Per Share1 | $3.12 | $3.38 | $3.10 | $2.90 | -6% |

| Dividend Per Share1 | $0.30 | $0.40 | $0.34 | $0.00 | n/a |

1 per share figures based off actual shares at balance date (not weighted average)

2 note that prior years include Tradelink, which is treated as a discontinued operation in FY24 and therefore not included in revenue.

3 excluding Tradelink, was -$79m.

This was always going to be a tough meeting. NZSA had a full set of questions prepared as we headed into the meeting, and we were not alone. The room was full, with nearly 200 people present. That level of attendance is representative of the challenging year Fletcher’s has had, and the breadth of shareholder ownership and interest. The company has exercised emotion in New Zealand like no other, encompassing shareholders, past and present Directors, FBU’s staff and a myriad of other stakeholders.

NZSA has been vociferous in its requirements for both accountability and a return to performance. Whether by accident or design, the company has now followed through on every requirement set out in a letter sent to the company’s Board in February, including a call for the company to “do the maths” when it comes to the constituent parts of the Fletcher Building group.

Overall, this was a Fletcher Building board that we have not seen for many decades. With few exceptions, the presentations and discussion offered humility instead of arrogance, empathy instead of coldness and an ability to listen. Whether this is simply an Oscar-winning performance, or authenticity on display in all its glory will likely be judged throughout FY25 and at next year’s shareholder meeting.

Directors Tony Dragicevich and Barbara Chapman were not present at the meeting; Tony was unable to attend due to “long-standing prior commitment”, with Barbara Chapman attending remotely due to having Covid.

Chair’s Address

Barbara Chapman provided the opening address via video. Her opening comments acknowledged the poor performance of the company and the resulting sharerholder disappointment.

She went on to highlight the challenging operating environment that included significantly reduced activity in the NZ (-39%) and Australian (-31%) residential property markets from their respective peaks in late 2021 to June 2024.

Given that the combined exposure FBU has to these two residential markets is 51% of its revenue, this has hit financial performance hard. Chapman noted that this is a more significant decline than FBU experienced during the GFC and has also been accompanied by a marked slowdown in the NZ commercial and infrastructure markets which make up another 39% of FBU’s revenue.

- The company is still experiencing significant cost pressures across its operations, and the combination of the revenue and cost pressures has led to a reduction in profitability at the EBIT level. Together with the one-off and significant items, this led to a reported $227m loss versus a $235m profit in the prior year.

- Operating cashflow was slightly better than the prior year at $398m versus $388m, with less cashflow invested ($426m versus $641m in FY23) and a net financing outflow of $26m versus the net inflow in the prior of $269m from financing arrangements.

- TRIFR was fairly static against prior year levels and seems to have bottomed out – at impressively low levels for the construction sector, reflecting the investment FBU has made in this area over the last decade.

The company offered no guidance on the resumption of dividends.

“Significant Items”

Iplex: Fletchers reached an in principle agreement under a ‘joint industry response’ (JIR) during the year that will see Fletchers fund 80% of costs relating to the Iplex pipe issue, with the WA government the remaining 20%. An estimated A$155m provision will be required in the FY25 financials, paid over 5 years in cash terms. Importantly, this avoids a potential product recall that would see the product removed for all sites regardless of whether it was operating defectively or not.

Puhoi – Warkworth SH1 motorway: This has now reached full works completion.

NZICC: Chapman noted that the “pain and distraction” associated with the ‘legacy’ construction projects is nearing an end. Full completion of the NZICC is due to occur in FY25.

THAT Capital Raise

With regard to the recent capital raise, the Chair outlined that this was centred around strengthening the balance sheet, with the amount of $700m determined to be the ‘Goldilocks’ amount – not too little and not too much. The non-renounceable structure was chosen after reviewing several potential structures, and was intended to enable all shareholders to participate if they wanted to, while offering Fletcher Building price certainty at a reduced level of disclunt compared with an (uncertain) renouncebale offer. The Chair then stated that shareholders that did not partake had benefited from the share price appreciation post raise – however, how the directors could have known the share price would rise post-raise when making their deliberations over structure is debatable.

The manager for the raise, Jarden, was chosen by the board as they know Fletcher Building and its business well. The board chose only one Lead Manager to minimise the risk of a confidentiality breach (as it was, details of the raise were leaked to Australian media during the weekend prior to the announcement).

As to the $22m cost of the raise (which has been the subject of media and shareholder criticism), the inference was that given the particular set of risks around the raise, the Board still considered that it had achieved a good price despite the market criticism.

Board Chair recruitment

The anticipated timeframe has now shifted to March 2025. Following any appointment, Barbara Chapman announced she intended to step down from the board.

The core criteria for selecting the new Chair would be:

- Strong governance experience

- Trans-Tasman experience

- Experience in the building products industry

- Ability and experience at managoing a “portfolio” company like Fletchers.

CEO Address – Andrew Reding

The address from newly-minted CEO and Managing Director Andrew Reding reflected his passion for Fletcher Building. He outlined that this was his return to Fletcher’s after many years, and was impressed by the operating capability and safety culture prevalent at the businesses within the Fletcher Building that he had visited since his appointment.

“Investors have every right to have high expectations”

Andrew Reding, Fletcher Building CEO, October 2024

He also provided an update on trading for the first quarter of FY25: volumes are down 10-15% on this time last year and house sales have averaged 17 per week in the quarter compared to 23 per week in the same quarter last year. On a brighter note, the weekly sales volume had increased as the quarter progressed.

In terms of the outlook for FY25, Andrew commented that the company continued to expect FY25 market volumes in its materials and distribution businesses to be circa 10% to 15% lower than FY24 and that FY25 EBIT before significant items was expected to be c.60% weighted to the second half.

Questions

Meeting Chair Peter Crowley then opened the floor…and it did not take long for the avalanche to begin.

Normalising one-off’s and reporting

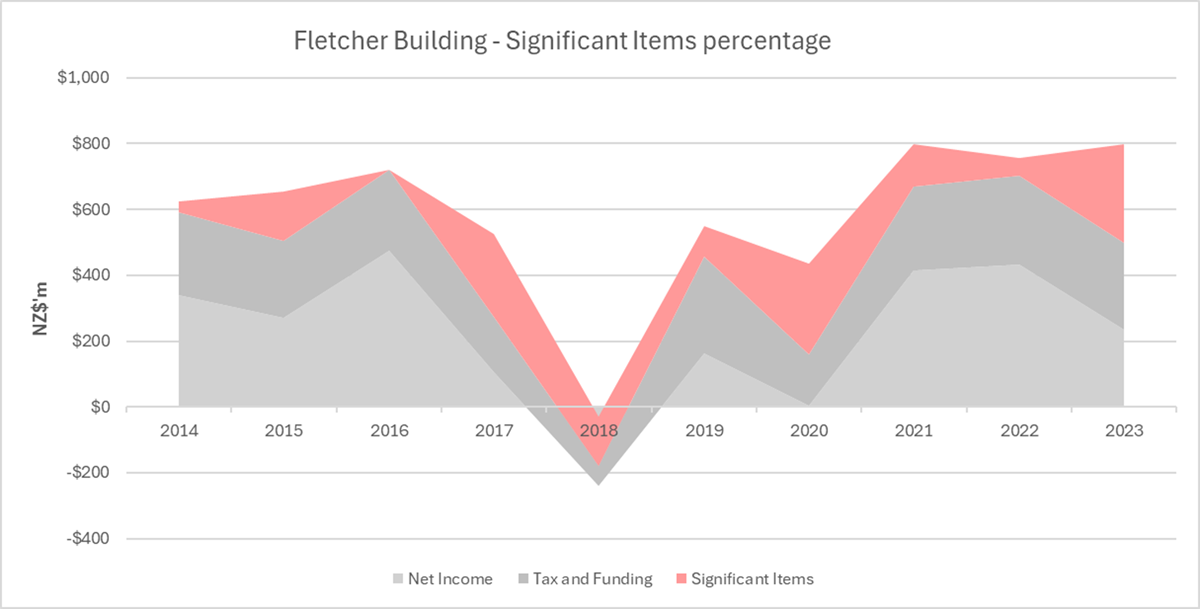

The first question came from Oliver Mander (NZSA CEO), asking whether the company’s investor presentations should focus on bottom-line NPAT instead of ‘NPAT before significant items‘, given the large number of portfolio businesses and that the company has a decade-long history of writing off 25% of its NPAT each year.

The response wasn’t particularly convincing, referencing historical issues that took time to work through and that individually were recognised as on-offs as the resolution processes worked through.

The question was followed up later in proceedings by another shareholder from Black Bull Research, highlighting the poor capital allocaton decisions made in the past. Return on Funds Employed (ROFE), a preferred measure of FBU, averaged only 2.6% after ‘significant’ items had been taken into account.

Risk Management

Mander kept going, asking what assurance shareholders could have in relation the risk management culture at the organisation.

Crowley responded by saying that the Board is “now taking a broad view of the risks facing the organisation“. As an example, he cited the recent outage of the Golden Bay Cement ship, noting that the risk of such an incident was on the company’s risk register and FBU was able to move very quickly to implement a mitigation.

Board Composition

Next came Alex Ball (NZSA), regarding the board composition that Fletchers would be looking for with a fully refreshed board, given the reduced number of directors currently on the board.

The response was that this would be decided once the Chair was appointed, and a gap analysis done at that time.

NZ International Convention Centre

A frustrated shareholder asked when the provisions against the NZICC project would cease. Crowley explained that given the multistage nature of the project – with separate completion dates for the hotel (completed), the car park (pretty much complete) and the convention centre itself (due to complete in FY25), one-offs came at different intervals. He also outlined that the insurance process was multilayered with different policies responding, and that while c.$100m had been recognised from one claim, further claims were due to be worked through with the insurers.

Raw materials sourcing

Would the sourcing of raw materials from offshore, eg China, cause potential quality issues in finished Fletcher Building Products?

The response was that quality products were important and that in New Zealand, regulations helped, also protecting Fletcher’s quality products being substituted for offshore cheaper imports (editor’s note – other suppliers of plaster wallboards might have something to say about this response).

Iplex

A question from an ex-employee noted that all pipes supplied to Australian customers were manufactured in one factory, with a leak rate in Western Australian installed pipes at 18% compared with only 0.5% in the Eastern states. So why is FBU paying at all?

Crowley re-iterated that the issue was still Fletcher Building’s problem and given the strong desire to avoid a full product recall across Western Australia, had agreed to the JIR solution. He noted the earlier NZSA question, stating this was a form of risk management in action.

Reece

Why had Reece, a competitor plumbing company in Australia, succeeded where Tradelink (Fletcher’s plumbing business) had failed?

Crowley explained that Reece had focussed on the SME plumber businesses (‘white van men’) in its business model and only after that had moved into the commercial plumbing space. This had meant a focus on replacement and repair work which was not discretionary in nature, and therefore less impacted by recessionary pressures. Tradelink on the other hand, focussed on the renovation and new build sectors which had been significantly impacted by the economic downturn.

Capital Raise

Well-known Australian activist shareholder, Stephen Mayne, stated that in his view the capital raise had been oversized, focused on institutions and inappropriately diluted retail shareholders. In his view retail shareholders should be able to participate in a $100m share purchase plan (SPP) to balance up this dilution.

Crowley’s response reflected what had been outlined earlier: that the raise of $700m was a ‘goldilocks’ point, the structure had been chosen so that everyone who wanted to participate could do so, and that the other priorities had been on certainty and speed of funds in the door.

Other write-downs

A shareholder asked about the Higgins write-down and Wellington airport provision, and why these had occurred –

Crowley noted that the Higgins business had expanded into non-core areas that hadn’t delivered, and had therefore triggered the threshold for impairment.

The Wellington Airport car park provision related to the concrete cover over the steel in the construction, and whether this had been sufficient. The company was working through whether this was a design flaw or not in determining the full amount of any provision.

Resolutions

Director Elections

The first resolution was the re-election of Cathy Quinn as a director. Cathy addressed the meeting where she accepted that as a director for the last six years, she acknowledged the poor business performance and accepted her share of accountability.

She also summarised the company’s more positive achievements during her tenure.

NZSA was suppporting the re-election of Quinn, chiefly on the basis that she is now the only ‘legacy’ Board member remaining. Someone has to know where the bodies are buried.

Pre-submitted shareholder questions asked why she was still looking to be a director given she had been part of a board tainted by underperformance and shareholder value destruction. Quinn outlined that she believed she could still add value through her skills and her experience of the issues still facing Fletchers.

Mander (NZSA) asked about her workload, given she sits on the majority of board sub-committees and had a significant governance portfolio outside of Fletcher Building. Her response was that as the issues had presented themselves she had ‘leant in’ and that she wasn’t in a position to ‘lean out’ yet, but would do so when that was appropriate.

Mander asked her about her motivation for seeking re-election and she responded that she had come onto the board to help in a turnaround of the company’s performance – this hadn’t completed and she wanted to finish what she had started. She said she was “not a quitter“.

The election of Tony Dragicevich was the next resolution put to the vote. Tony addressed the meeting by pre-recorded video given he had a ‘long standing prior commitment’ which meant he could not be there. He outlined his building product experience, that he had already visited six FBU businesses and had been impressed by the safety culture in place. He outlined that he understood the market issues in Australia in particular and was committed to helping the rest of the board and senior management improve performance.

There were no questions from shareholders on the resolution.

The third resolution was the appointment of Andrew Reding as Managing Director. Andrew outlined that he had requested the dual role to ensure there was “no gap” between board and management; shareholders deserved unanimity of leadership. He too mentioned his site visits and his confidence in FBU’s operational capability. He was also focused on ensuring Fletcher Building had the right culture and values

A question from Oliver Mander, NZSA, surrounded the timeframe for Andrew to separate the CEO and board roles and step down to a ‘CEO only’ role – Andrew responded that he was “not averse to this when the time is right“; this would be when he considered it appropriate, but would not be for some time.

A shareholder asked Andrew what had he learnt, from his review of Fletcher’s recent issues.

Andrew responded that the business understood risk reviews in many areas – a key learning was to get the commercial settings for contracts right.

The next resolution was to fix the auditors remuneration – there were no questions on this resolution.

Remuneration Report

The last resolution was a non-binding vote on the Remuneration Report presented to shareholders.

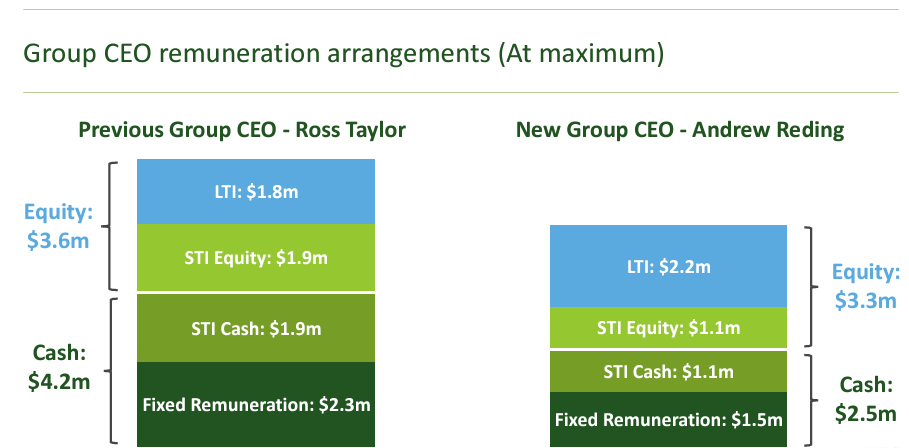

NZSA was voting against this resolution, due to the quantum of incentives (in percentage terms) associated with the new CEO. Oliver Mander questioned why there had been a significant increase in the percentage incentive payments within the remuneration package for Andrew Reding.

Crowley outlined that this was deliberate, and followed external advice around further aligning CEO pay to the long-term performance of the company. He noted that even with the increased percentages, Andrew Reding’s total proposed remuneration was $3.3m which was less than previous CEO, Ross Taylor’s at $3.6m.

Another shareholder asked why the vote was not binding like the requirement for ASX only listed entities. The response was that it was not required for dual-listed companies although the board would take on any feedback.

This led to a further question from Tim Hunter, business journalist and shareholder, who asked how the board would respond to the result of the vote. Crowley responded that the board was taking on feedback around the remuneration report – he cited the earlier query relating to ROFE before one-off items was a performance measure, when it was clear one-off items occurred seemingly each year.

The final question related to the fact that the only remuneration disclosed related to the CEO/MD and not other executives as occurred with other ASX and NZX companies. Peter Crowley responded that given NZ privacy law, consent was required from other executives but that this might occur going forward.

NZSA was pleased to observe that votes received in advance were shown to the meeting AFTER shareholders present had voted

Result

And 2hrs, 45 minutes later, the meeting was over.

There was a significant ‘protest’ vote against the re-election of Cathy Quinn (23%), with a significant number of votes abstaining. The resolution to approve the remuneration report had 10% of shareholders voting against.

A final comment from the floor congratulated Peter Crowley on a well chaired meeting, and would he consider the Chair appointment himself?

He was non-committal.

Alex Ball and Oliver Mander

2 Responses

Let’s hope Fletchers have now sorted their Board and CEO out as it has been a ‘roller coaster” ride with many, so called, “professional” Board Members and CEO’s going onto the Board and becoming CEO only to be “spat” out the other end!

I am sure Andrew R will do a great leading a great NZ company (well, nearly NZ).

Thank you to NZSA for this report, which gave a “feel” for the atmosphere as well as factual result. This is very helpful to those shareholders like us who are unable to attend in person. While the ability to attend “virtually” is also an option, the timing is often not possible, so a report such as this is invaluable, together with the analysis and comment.