NZSA Disclaimer

Last week was ‘world investor week’, with this year’s campaign focused on helping investors to understand ethical investing. The key message is to invest in a way that is aligned with your own values – whatever your outlook on life, that’s likely to make all of us ethical investors at some level.

Ethical investing represents a growing trend, not just around the world, but in New Zealand. A late 2020 survey carried out by the Responsible Investment Association Australasia (RIAA) and Mindful Money noted that “76% of New Zealanders with KiwiSaver funds or other investments expect their KiwiSaver funds and investments to be invested responsibly and ethically.” This was broadly supported by Financial Markets Authority (FMA) research in 2022, that showed 68% of New Zealand investors preferred their money to be invested ethically and responsibly – although only 26% selected their fund manager on this criterion.

Information availability

But just how easy is it to get information on the various factors that might be considered as the bedrock for ethical investors? NZSA knows that it can take a fair degree of deciphering to determine core governance-related information from corporate disclosures, let alone other factors. In recent years, there has been strong focus on environmental disclosures, as listed companies prepare themselves for the impending climate-related disclosure regime. But in a very general sense, the culture of non-financial reporting in New Zealand (including environmental disclosures) lags disclosures in other countries.

This is not just about our listed companies. Investment via exchange-traded funds (ETF’s), unlisted funds and other ‘indirect’ means continues to increase. That places an intermediary in between the investor and the underlying investment; so non-financial disclosure is an issue not just for listed entities, but for fund managers as well.

And let’s not even start on unlisted companies. The gulf between disclosure of listed and unlisted companies continues to grow, supported (unintentionally) by legislation and regulatory frameworks. “A rising tide floats all boats” – but apparently not when it comes to disclosure requirements that unfairly target one class of company. Investors of the future will not thank lawmakers for a reduced pool of listed companies in future – taken to an extreme, the consequence will be that wholesale or unlisted investment becomes the norm, typified by weak disclosure for investors and even weaker protection mechanisms. That heightened risk profile won’t suit many.

Another factor that will perhaps increase the uptake of fund managers and funds as New Zealander’s preferred investment method.

Yet, July 2022 research undertaken by the Financial Markets Authority (FMA) covering 14 KiwiSaver and non-KiwiSaver funds highlighted that when it comes to disclosures associated with ethical investing, the professionals have quite some way to go.

All of the funds we reviewed had weaknesses in information disclosure in at least one area. Most funds had multiple areas where improvement was needed.

FMA Research, July 2022

Key issues included:

- information scattered across multiple sources

- a lack of clarity around “exclusions”

- risk disclosures associated with specific ethical factors

- vague or high-level statements (eg, a form of ‘greenwashing’)

- the consequences of a breach of the fund’s ethical parameters

Key Ethical Factors

NZSA has always focused on transparency and disclosure; it would be difficult for us to not advocate for improved non-financial disclosures. This year, we have created assessments of all companies around our Environmental Sustainability policy. In practice, this is forming a useful baseline for NZSA (and issuers) as we head towards the implementation of the climate-related disclosure regime – however, our policy is clear that we are seeking disclosure of all material environmental risks and opportunities that may affect a corporate strategy. The NZSA approach should not scare off smaller issuers – it is simply exposing what should already be a valid investment discussion on ‘risk’. On the other hand, we’re not convinced that most NZX companies are particularly strong when it comes to having a discussion on strategic, business or operational risks with their shareholders.

In our conversations with listed issuers this year, we have sought broader disclosure and discussion on the range of environmental sustainability factors that are best suited for a specific company. An investor in NZ King Salmon should be concerned about changing sea temperatures and climate change – but an investor in Synlait or PGG Wrightson might also be concerned about the risks posed by water or soil pollution.

There is no one size fits all.

Ultimately – the factors that impact ethical investing are determined by you, the investor. And the very nature of ethical investing approaches is never black and white. For example, the role of the healthcare sector in improving global health and saving lives forms a backdrop of clear conscience for those choosing to invest. On the other hand, the sector is well known for testing treatments on animals. An alternative example is investment in weapons or armaments companies – those same weapons and armaments that are helping Ukraine repel its larger, more aggressive and clearly expansionary neighbour.

A sector-wide approach also ignores specific companies within a sector, which may operate different strategies. No two companies are the same.

Perhaps this is a case of picking the poison that hurts you the least – and maintaining an open and inquiring mind that may challenge the broad generalisations that characterise ethical investing discussions.

An individual, ‘DIY’ investor may perhaps feel better placed to pick their way between the values implied by industry sectors, the different strategies of individual organisations – and their own ethical values.

Funds will typically focus on exclusions or inclusions – specifically including companies or industries that are producing a service that results in a beneficial social outcome. There are also a growing number of ‘activist’ investors (both funds and individuals) that use their influence and voting to encourage companies to improve their ethical standing.

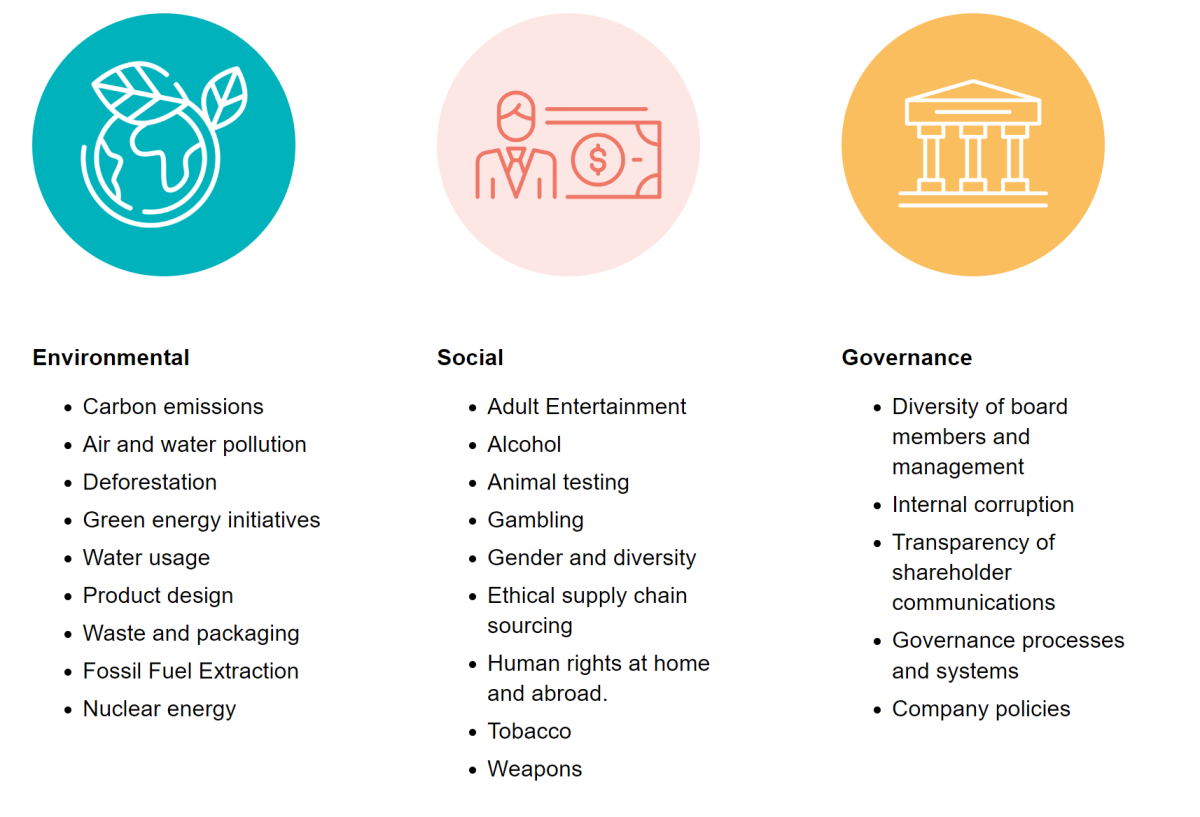

The list highlighted in this graphic may look familiar from an NZSA context. In NZ, NZSA is the original ‘activist’ when it comes to improving corporate governance – we assess those factors listed in the governance column above (and many many more).

As noted above, we are now assessing listed issuers around their environmental disclosures and impacts.

Right now – we assess very little around social factors. Because ethical values vary between different individuals, it would be difficult for NZSA to advocate or assess ‘best practice’ in a manner that would be consistent with the values of all shareholders.

But maybe we should at least objectively highlight some core social factors that can support investors in determining their own ethical portfolios.

Oliver Mander