Date Submitted: February 14th 2025

To: Ministry of Business, Innovation and Employment (MBIE)

Tap/Click here to download submission

The NZ Shareholders’ Association (“NZSA”) appreciates the opportunity to comment on the December 2024 Discussion Document “Enabling KiwiSaver investment in private assets” (‘Discussion Document’).

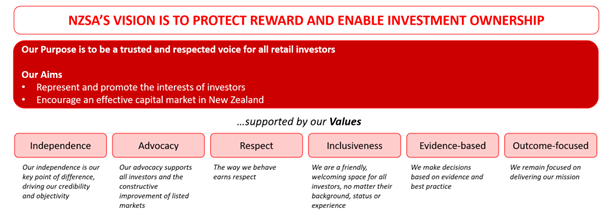

NZSA is a non-profit entity that is a trusted and respected voice of New Zealand investors. Our aims are to represent and promote the interests of investors and encourage an effective capital market in New Zealand.

NZSA Overall Commentary

NZSA notes the role of Fund Managers and KiwiSaver providers as playing a key role in the investments of most New Zealanders. Ultimately, and on this basis, we believe that KiwiSaver Fund Managers have a role to play in representing the interests of their investors.

This also means that KiwiSaver schemes should reflect the broad base of their constituency. For example, most New Zealanders are not certified as wholesale investors; KiwiSaver investment funds, targeted and mass-marketed at a broad section of New Zealanders, should overall reflect this status.

NZSA believes that there is a role for KiwiSaver to play in long-term investment of private assets, but that much further work is required to determine an investment process that will maintain the following core principles associated with KiwiSaver investments:

- Simplicity: Ease of understanding for KiwiSaver investors.

- Transferability: The ability to ‘switch’ KiwiSaver providers.

- Valuation: An easy-to-understand process for investors to value their investment.

- Transparency: Ongoing transparency for investors as to their portfolio asset components and value, as well as ongoing fees and net returns achieved by KiwiSaver providers.

Overall, NZSA believes that investment in private assets by KiwiSaver funds cannot be considered in isolation. Further work is required to develop and enhance KiwiSaver legislative settings to allow any investment in private assets to be better matched with the more sophisticated investor capability that this implies. Rule settings could include:

- Ability to invest in multiple KiwiSaver Schemes.

- Limit access to KiwiSaver funds containing unlisted assets above a defined threshold to wholesale investors only (although NZSA would wish to see greater enforcement of the wholesale investor regime in this situation).

- Clarifying liquidity provisions as it relates to private investments (as per the Discussion Document).

- Increases in KiwiSaver contribution rates should also be considered as this offers more scope for long-term cash management alleviating liquidity concerns.

Response to discussion document questions

Liquidity management tools—questions for the public

Question 10: Do you support more investment by KiwiSaver funds into private assets? Why / why not?

NZSA is open to more investment by KiwiSaver funds into private assets – however, we believe that this requires a broader range of changes to KiwiSaver settings than those considered in the discussion document (as per our Overall Commentary above).

We accept that an increase in investment into private assets may support ongoing diversification and provide investors with exposure to alternative asset classes. However, we believe there are several factors that should be considered in implementation:

- Introducing changes to support KiwiSaver investment in private assets should be accompanied by clear ‘guardrails’ that define the extent of such investment in different types of funds.

- Allowing private investment will essentially expose retail investors to ‘wholesale’ investment opportunities, creating additional risk for investors.

- As the ratio of private investment increases, investors are placing more trust in the long-term cash management modelling of their provider, balancing contributions, costs, withdrawals/transfers and returns. In Australia, this is somewhat mollified by significant ongoing contribution rates (at approx. 12%) compared to the relatively low contribution rate in New Zealand.

Investment in private assets requires a specialist capability, which may not be able to be appropriately resourced or developed amongst smaller KiwiSaver providers.

Question 11: Do you support the use of liquidity management tools like ‘side pockets’, if they may have an impact on the availability of your KiwiSaver funds? Please explain.

NZSA believes that there should be more liquidity options developed and explicitly considered within existing KiwiSaver regulations. Clarity on existing liquidity management guidelines (and their relationship to legislation) should be considered regardless of whether an option to allow greater KiwiSaver investment in private assets proceeds.

The Discussion Document considers both redemption gates and ‘side pocketing’ as liquidity tools. Both come with significant downsides;

- implementation of redemption restrictions comes with significant reputation risk for the KiwiSaver provider and is in conflict with the requirement for KiwiSaver balances to be transferrable.

- Side pocketing has been shown to be prone to manipulation in overseas jurisdictions in the past. It also exacerbates a ‘power imbalance’ between Fund Managers and their clients.

- The complexity associated with side-pocketing (and other technical liquidity management tools) are not well suited to the average capability of KiwiSaver investors.

NZSA believes that neither of these liquidity tools are suitable in a KiwiSaver context (although we appreciate that redemption gates may be used as a last resort).

One option that NZSA believes is worth exploring is the development (and regulation) of specialist KiwiSaver “private asset” funds – effectively, a regulated ‘side pocket’ structure. This would require a change in KiwiSaver settings as they apply to investors; KiwiSaver investors certified as wholesale investors would be able to ‘opt in’ to a private asset KiwiSaver fund in addition to their usual KiwiSaver provider. Such a structure would ultimately place choice in the hands of the underlying investor, while minimising liquidity issues within core KiwiSaver funds.

Please provide any further comments on the proposed approach.

Valuation: In addition to the liquidity considerations discussed above, NZSA considers that valuation methodologies and disclosures should form a key consideration for any review.

- Investors in listed funds that own private assets (e.g., Infratil, most listed property companies) are well used to the valuation mechanisms that apply. Protections for investors in the listed environment include a.) the use of independent valuers, b.) adherence to ‘Level 3’ valuation methodologies as defined in IFRS13 (e.g., discounted cashflow valuations) and c.) the provision of detailed information on the performance and projections of the underlying businesses they own.

This allows investors to either gain assurance or form their own assessment as to a “sum of the parts” valuation of the listed fund. This in turn enables effective price discovery (valuation) of the fund.

- Conversely, an investor in a KiwiSaver fund that owns private assets is offered much less disclosure – they are simply reliant on what they are told by the Fund Manager. This shifts the balance of power for valuation away from the investor to the Manager.

- In general, a KiwiSaver Fund Manager will benefit from increased valuations (through higher management fees).

In this context, NZSA believes that both valuation independence and provision of information become key factors in enabling private asset investment by KiwiSaver providers.

KiwiSaver provider capability: As noted in our response to Question 10, NZSA holds concerns relating to the significant extension of capability required by KiwiSaver providers, with the potential for unintended (negative) consequences for investors. This may include a lack of ability for smaller KiwiSaver providers to offer effective diversification of private investments, increasing the underlying risk exposure for investors.

NZSA believes there are a number of options to further develop KiwiSaver provider capability, including:

- The development of effective guidelines, overseen by the Financial Markets Authority (FMA), as to minimum capability thresholds for providers directly engaging in the purchase and sale of private assets.

- The development of specialist, separately regulated, KiwiSaver ‘private asset’ funds, with KiwiSaver investors certified as wholesale investors able to ‘opt in’ to a private asset KiwiSaver fund in addition to their usual KiwiSaver provider (note – such a structure may also overcome liquidity issues in core KiwiSaver funds). The advantage of this structure is that it places choice in the hands of the investor rather than the provider.

- As per Question 11(b) above, but with KiwiSaver Schemes able to select from specialist, separately regulated, KiwiSaver private asset funds. This option does not offer a liquidity advantage to a KiwiSaver provider.

Impact on Listed Markets: NZAS is uncertain that greater investment by KiwiSaver in private assets would support a listed market environment. From a legislative efficiency perspective, it may simply be more advantageous for KiwiSaver providers to encourage private assets to list on a licensed market, thereby strengthening capital markets, providing a solid basis for valuation and allowing a business to access future capital from non-KiwiSaver investors.

Private asset categories—question for the public

Question 18: Do you think it would be useful to have better visibility over how much KiwiSaver funds are investing into private assets?

Yes.

Furthermore, NZSA believes that the level of disclosure should extend beyond the categorisation of “how much” is invested into private assets, but provide greater information disclosure that allows KiwiSaver investors to gain assurance as to the valuation ascribed to the overall asset class within their portfolio (please note our comments under “Valuation” above)

Within a (new) separate category for “unlisted investments” or similar, NZSA would expect more detailed data that allows KiwiSaver investors and external commentators to assess a valuation or gain assurance as to the value provided. In our earlier commentary (see above), we gave examples of current investor protections and/or assurances provided by listed funds invested in private assets:

- the use of independent valuers and description of the valuation basis

- adherence to ‘Level 3’ valuation methodologies as defined in IFRS13 (e.g., discounted cashflow valuations)

- the provision of detailed information on the performance and projections of the underlying businesses they own (e.g., growth rates, cashflows)

NZSA appreciates that multiple investments in different unlisted assets could be ‘rolled up’ to mask individual companies but still allow the portfolio of private investments to be assessed externally.

Total Expense Ratio—questions for the public

Question 29: Do you look at KiwiSaver scheme fees when deciding which KiwiSaver scheme to put your money with?

NZSA experience is that some people consider KiwiSaver fees as part of their selection of provider, but there is awareness of overall returns. We believe that awareness of both returns and the relationship to fees is increasing.

Question 30: What do you think should be included in any figure that is called “KiwiSaver scheme fees”?

NZSA believes that KiwiSaver fees should reflect the total cost basis for the investor – including all management fees, custody fees, transfer fees, admin fees and any ‘pass-through’ fees from outsourced providers.

A breakdown of fees by asset category is unlikely to be appropriate.

While the focus of the Discussion Document is on the increased costs that may be passed on to investors by increased investment in private assets, NZSA considers KiwiSaver fees as a broader conversation. Ultimately, KiwiSaver fees, returns and ‘non-financial’ aspects (e.g., ESG focus) for each provider should form the competitive landscape enabling investors to make a choice as to the fund that suits them.

NZSA is much more concerned about:

- KiwiSaver provider capability: The ability of a KiwiSaver provider to provide a diversified private asset investment; an investment in a single private asset is likely to be inherently riskier than a diversified portfolio of private investments. Scale matters.

- Investor sophistication: The ability of the investor to understand the level of enhanced risk that may be derived from private asset investment.

Question 31: Please share any thoughts you have around the TER (total expense ratio) and its function to inform the public of the expenses involved in KiwiSaver management.

NZSA believes that KiwiSaver investors should have greater awareness of the efficiency by which their chosen KiwiSaver provider creates their returns.

Final Comments

Please refer to our opening comments at the beginning of this submission under the heading NZSA Commentary as well as the un-numbered section below Question 11. Thank you for the opportunity to provide this submission. We would be happy to follow up with any required clarifications or questions on our submission.