Date Submitted: February 14th 2025

To: Ministry of Business, Innovation and Employment (MBIE)

Tap/Click here to download submission

The NZ Shareholders’ Association (“NZSA”) appreciates the opportunity to comment on the December 2024 Discussion Document “Adjustments to the climate-related disclosures regime” (‘Discussion Document’).

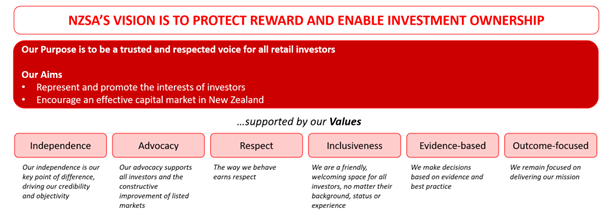

NZSA is a non-profit entity that is a trusted and respected voice of New Zealand investors. Our aims are to represent and promote the interests of investors and encourage an effective capital market in New Zealand.

NZSA Context and Commentary

NZSA is a strong advocate for both climate reporting and broader environmental sustainability disclosures. Such disclosure provides meaningful information to investors that allow them to assess environmental impacts on a company’s strategy.

NZSA believes that the introduction of the climate-related disclosure (CRD) regime has made a meaningful difference to both organisations and investors when it comes to their capability and understanding of material risks and opportunities, and how these manifest within a business.

1. Definition of a Climate Reporting Entity: NZSA has commented previously on the current definition/scope of a climate reporting entity (CRE). The definition refers to ‘market capitalisation’, thereby excluding any unlisted company from a CRD reporting obligation.

There are many large, unlisted companies in New Zealand that would otherwise be subject to the CRD regime.

The narrow application of CRD obligations to listed companies seems at odds with the General Policy Statement of the original bill, as noted in the Discussion Document.

If the objectives are “to ensure that the effects of climate change are routinely considered in business”, “demonstrate responsibility and foresight in their consideration of climate issues” and “to lead to smarter, more efficient allocation of capital, and help smooth the transition to a more sustainable, low-emissions economy”, then NZSA considers that excluding a significant portion of New Zealand business does not support optimal achievement of these outcomes.

a. The scope for “regulatory arbitrage” remains significant in this context, acting as a disincentive for companies to consider listing on a regulated stock exchange and creating a long-term impact on New Zealand’s capital productivity and public investment opportunities.

b. We continue to advocate for threshold levels based on a combination of total assets, revenue and employees (with no reference to ‘market capitalisation’).

2. NZSA Environmental Sustainability Policy: NZSA has assessed each listed company on its climate-related disclosures (and other environmental sustainability disclosures) since late 2022. Our policy, determining our assessments, can be viewed at this link.

3. Developing issues: NZSA is in broad agreement with the reasons for considering change as stated in the Discussion Document related to cost, threshold levels, and a ‘compliance focus’ created by director liability settings.

In addition, our assessments of listed companies have indicated additional considerations:

Assurance provisions: Capability relating to the provision of limited assurance services in relation to CRD continues to develop. However, we do not believe that the industry has yet reached full capability maturity and is not yet able to offer a consistent service approach. Providers operate to different standards, depending on their own context.

Investor development: Disclosures to date have not yet captured the imagination of most investors. NZSA believes that over time, both CRE’s and investors will determine the critical elements of the disclosure regime, with CRE’s becoming more focused in their disclosures while responding to emerging investor demand for broader environmental disclosures.

NZSA considers that the CRD framework is a critical extension of a transparent ‘risk and opportunity’ framework, alongside key strategic and business risks, allowing investors to make an informed judgement as to the impact of climate risks on business strategy.

Scope 3 maturity: In line with our initial submissions on CRD in 2022, NZSA is supportive of a ‘flexible’ approach to determination of Scope 3 emissions, given the potential for mis-reporting created by lack of transparency within international supply chains.

Global alignment: As other jurisdictions expand their climate-reporting requirements, NZSA believes it is critical for NZ to maintain a degree of consistency with these requirements – both in terms of disclosure requirement and CRE threshold design.

4. A ‘Broad’ Environmental approach: NZSA believes that the framework underpinning the CRD regime should (ultimately) be considered for a wider scope of environmental sustainability disclosures that extend beyond climate change. Different companies, operating in different industries, are facing different environmental sustainability issues (eg, water pollution, soil pollution, land use) that should be of interest for investors.

a. We note the focus of the European Corporate Sustainability Reporting Directive (taking effect from FY24) that expands environmental sustainability reporting requirements to include other key factors (including pollution and water). NZSA considers that a pragmatic, simple, nature-based framework would add value to ongoing environmental disclosures.

b. Some issuers in NZ have developed the climate-reporting within the construct of a broader sustainability framework. NZSA considers this a best-practice approach in terms of providing a holistic view for investors.

5. We’re all learning: NZSA recognises that all stakeholders (regulators, issuers, investors, auditors) continue to develop and refine their capability when considering climate-related disclosures. On this basis we are supportive of both this legislative Discussion Document and the planned post-implementation review by the External Reporting Board.

Response to discussion document questions

Reporting Thresholds

Question 1: Do you have any information about the cost of reporting for listed issuers?

NZSA estimates that the average, first-year “fully costed” cost of compliance for listed issuers is approximately $500-$600k. This is based on discussions with listed company stakeholders. It is likely to include existing embedded costs (e.g., staff time) and improvements to systems and processes that offer future benefit.

While we forecast that annual costs are likely to reduce into the longer term, as CRE’s establish data collection processes and improve their disclosure efficiency, this has been a source of disquiet for many CRE’s and investors alike. This average cost includes both issuers who have not yet provided any limited assurance and some that have chosen to do so ahead of the timeline. NZSA believes that as some issuers have already undertaken assurance engagements, future compliance costs (excluding inflation) are more likely to decline from first-year levels.

Question 2: Do you consider that the listed issuer thresholds (and director liability settings) are a barrier to listing in New Zealand?

Broader – based threshold levels

As noted in Section 1 of our general commentary above, NZSA believes that any threshold level solely defined by “market capitalisation” represents a barrier to a company considering a listing on a licensed market.

NZSA’s preference is to create a threshold design more aligned with those being adopted in Australia and Europe, which define threshold levels (and disclosure requirement) according to a company meeting two out of three thresholds relating to revenue, total assets and employees, thereby including unlisted companies within a CRD scope.

- We believe that broad global alignment is a key factor for New Zealand capital markets in maintaining credibility and international investor confidence.

- While we wholeheartedly support a New Zealand regulatory regime that sets thresholds that are competitive with other jurisdictions, NZSA does not think this should not be at the expense of a significant departure from global practice.

NZSA believes there may be a basis for considering CRD thresholds for unlisted companies within the construct of the Financial Reporting Act. As existing CRD settings for listed companies are primarily governed by the Financial Markets Conduct Act (FMCA), this may also enable a fit-for-purpose ‘differentiated’ regime between listed and unlisted companies.

Current Market Capitalisation-based setting

If no change is to be considered in altering the scope of a climate reporting entity (CRE), NZSA considers that an increase in the market capitalisation threshold will reduce barriers to listing in New Zealand.

Director Liability NZSA believes that the current director liability settings form a barrier for company directors deciding to list a company on a licensed market as compared to other forms of accessing capital.

Question 3: When considering the listed issuer reporting threshold, which of the three options do you prefer, and why?

NZSA believes that Option 3 represents a preferred outcome, in the context of a threshold level determined solely by market capitalisation. We believe that the adoption of Option 3 would be further enhanced by consideration of a differentiated reporting regime for Group 2-equivalent companies ($250m-$550m market capitalisation). Please see our response to Question 4 below.

As per our response to Question 2, NZSA prefers a broader application of the CRD regime to include unlisted companies, with differentiated disclosure requirements based on size metrics.

Option 1: NZSA acknowledges both the impact and the reduced public benefit in the application of the current non-differentiated reporting regime on smaller issuers.

Option 2: While focusing full CRD reporting at an appropriate threshold, NZSA would be concerned at the “fixed” nature of this regime in terms of threshold determination, especially in the context of the Australian Group 2 definition.

As per our comments in Question 2 above, we do not believe it is in the long-term interests of New Zealand listed companies or investors to require NO CRD reporting for the equivalent of Australian ‘Group 2’ companies, partly for the reasons expressed in paras 53-54 of the Discussion Document.

Option 3: In terms of threshold scope (Group 1 and 2) and timing (2026-2028), this aligns most closely with NZSA’s preferred option.

NZSA notes that most listed Group 2 companies have prepared climate statements (albeit with utilisation of adoption provisions) in 2024.

We also note the likely one-year ‘gap’ between the likely application of any new regime in New Zealand (2026) and the Group 2 legislative timeline in Australia (2028). Given the learnings from the 2024 introduction of the current regime, NZSA considers it unlikely that any Group 2-equivalent company would undermine any existing CRD reporting capability for the sake of a one-year gap in compliance requirement. We consider it more likely that they will use that year to continue to develop their CRD and environmental sustainability capability. Given the extended lead time, however, NZSA would be unlikely to support the utilisation of adoption provisions by companies that have previously prepared CRD reports.

Question 4: If the XRB introduced differential reporting, would this impact on your choice of preferred option?

NZSA believes the introduction of a differential reporting regime is likely to provide the optimal means of regaining regulatory competitiveness while ensuring broad alignment with global practice (as discussed in Questions 2 and 3 above).

We also note the Minister’s comments in the Discussion Document stating that he “want(s) to ensure that our climate reporting regime is proportionate”.

Differential reporting could be considered both in terms of size metrics (e.g., market capitalisation) or listing status.

Listed Companies: Where there was differential based on market capitalisation levels of $60m, $250m and $550m, NZSA may consider Option 1 (i.e., a lower overall threshold) as appropriate, depending on the disclosure requirements under any differentiated regime.Unlisted companies: Differential reporting may also be considered for ‘unlisted’ companies, not only ‘within’ different size metrics (see our comments in Question 2) but also as compared to their listed counterparts. This may provide a means to support capability development in climate reporting, while reducing the regulatory arbitrage available between listed and unlisted environments.

Question 5: Do you think that a different reporting threshold for listed issuers should be considered (i.e., not one of the options above) and, if so, why?

See NZSA comments in Question 2, relating to a threshold design more akin to Australia and incorporating unlisted companies. In terms of listed companies, NZSA considers the threshold breaks ($60m/$250m/$550m) as broadly appropriate.

Question 6: If Option 2 or 3 was preferred do you think that some listed issuers would still choose to voluntarily report (even if not required to do so by law)? And, if so, why?

NZSA believes that there will be some issues that will continue voluntary reporting under options 2 and 3.

NZSA will continue to encourage listed issuers to maintain and enhance voluntary disclosures on the environmental aspects that impact their business – including climate change – even where not required by law.

As per our response to Question 10 below, NZSA continues to encourage investment scheme managers to encourage listed companies to support environmental disclosures, regardless of compliance requirements, as part of their representation of their clients’ interests. Most retail investors invest via funds; we note with interest the statement in para. 73 of the Discussion Document that “86 percent of retail investors somewhat or strongly support investment funds providing information on the impact of investments on climate change.”

- As per our comments in Question 3 above, should Option 3 be adopted, we consider it likely that Group 2-equivalent issuers will not cease progress on their climate disclosures for the sake of a 1-year ‘compliance gap’.

- If Option 2 is adopted, we believe that some internationally focussed Group-2 equivalent companies will continue to provide CRD reporting, depending on the nature of their investor base.

- Regardless of the option adopted, as reflected in para 52 of the Discussion Document, companies that have a vested interest in climate or environmental reporting, driven by customer or supplier requirement, are likely to continue at least a ‘reduced disclosure’ form of climate reporting.

- NZSA believes that nearly all Group 3-equivalent companies would cease their current CRD reporting. Some may choose to adopt a form of voluntary ‘differentiated’ reporting focused on qualitative matters, highlighting the broad strategic impact of climate-related issues.

Whether listed or unlisted, NZSA believes that investors gain strong benefit from disclosure of environmental impacts (including climate change) on a company’s strategy.

Question 7: What are the advantages and disadvantages of a listed issuer being in a regulated climate reporting regime?

Advantages

- Access to capital: Maintaining the confidence of international investors in New Zealand’s systemic support for a transition to a low-carbon future.

- Consistency in information disclosure for investors, managed investment scheme managers and other users of climate disclosures.

- Prioritised capital: Reporting and associated metrics allow climate mitigations to be prioritised, in response to constructive investor feedback.

- Access to markets: Increasing demand by customers and stakeholders for quality environmental and/or climate assurance.

Disadvantages

- Cost: A significant cost that may not be borne by an unlisted competitor

- Capability development: Significant lead-time to develop a meaningful environmental practice.

Personal Liability for Directors: This acts both as a significant disadvantage to being a listed issuer director but also inhibits the scope of environmental reporting. Currently, Directors are encouraged to adopt a ‘conservative’ approach in reporting (as per para. 102 of the Discussion Document).

Question 8: Do you have information about the cost of reporting for investment scheme managers?

NZSA has no information on costs of implementing the CRD regime for investment scheme managers. However, NZSA acknowledges the significant difficulty faced by investment scheme managers (‘Managers’) in creating a quality climate-related disclosure from the information provided by the underlying assets in which they have invested client funds.

Proposals for KiwiSaver Fund Managers to increase their investments in ‘private’ assets are likely to increase the difficulty for Managers in obtaining effective climate disclosure information (unless the definition of a CRE is broadened as suggested by NZSA in Question 2).

Question 9: Do you have information about consumers being charged increased fees due to the cost of climate reporting?

NZSA has no information on consumers being charged increased fees due to the cost of CRD.

Question 10: When considering the reporting threshold for investment scheme managers, which of the three options do you prefer, and why?

NZSA supports maintaining the status quo (Option 1) as the CRD threshold for Fund Managers – however we also consider that the introduction of a fit-for-purpose differential reporting regime (see Question 11) would alleviate issues for smaller fund managers.

- Our position recognises a ‘trade-off’ between an increasing desire by retail investors to see their investment funds provide greater information on how climate impacts their investments, and the compliance costs and complexity associated with disclosure.

- We believe that Fund Managers should ultimately reflect the interests of their clients, a position exemplified by the reference made in para. 73 of the Discussion Document. NZSA believes this same trend is occurring amongst individual investors in New Zealand.

- However, NZSA notes that the public interest benefit is reduced at a lower threshold level. At a $5 billion FUM threshold, we note this preserves over 80% of the current public benefit of the regime ($185b à $150b), while significantly reducing the number of impacted Managers. This encourages consideration of a differential reporting regime to reduce compliance complexity for smaller Managers.

A differential reporting ‘Option 1’ regime is likely to result in fund managers asserting more pressure on listed and private companies to provide quality disclosures, whether required by compliance or on a voluntary basis (see our response to Question 6 above).

NZSA believes that as most retail investors invest via Funds, there is a reasonable expectation by investors that Funds are reflecting their interests.

We note the comment in para. 64 of the Discussion Document “that fund managers do not use climate reports or find the reporting especially useful.” NZSA considers that Fund Managers ultimately operate in the interests of their clients, most of whom would consider climate impacts as a relevant factor (as per para. 73 highlighted in Question 6).

As noted in Section 3(b) of our General Commentary above, we believe that as the CRD regime matures and issuers continue to develop capability, disclosures will become more focused on investor needs.

Option 3: NZSA does not support Option 3. We are concerned at the potential for an unintended behavioural consequence inherent in Option 3, that could encourage Managers to “close” investment schemes to new investors at a level under the threshold. For this reason, we believe that continuing to assess a threshold at an overall Fund level is appropriate (regardless of threshold).

Question 11: If the XRB introduced differential reporting, would this impact on your choice of preferred option?

NZSA would support the introduction of a proportionate differential reporting regime for fund managers.

- A regulated CRE environment will support consistency of information in underlying assets (i.e., listed and unlisted issuers) that will enable easier reporting for Managers in future, even where differential reporting exists at issuer level.

- For Managers with FUM between $1 – $5 billion, a fit-for-purpose regime could include a focus on the qualitative aspects (strategy, governance, key risks/opportunities and mitigations).

- A further criterion for differentiation could relate to the underlying reporting jurisdiction of an asset, with a reduced reporting requirement for funds/scheme assets in defined jurisdictions.

Were differential reporting to be pursued as an option, NZSA would expect clear disclosure by Managers as to the level of reduced CRD reporting, and the percentage of the fund/scheme to which this applied.

Question 12: Do you think that a different reporting threshold for investment scheme managers should be considered (i.e., not one of the options above) and, if so, why?

NZSA believes that further thresholds could be considered if differential reporting for Schemes or Funds were to be implemented under any of the Options. However, we note the long ‘tail’ of Managers operating smaller schemes and believe that the $1bn and $5bn thresholds proposed are likely to be appropriate.

Question 13: When considering the location of the thresholds, which Option do you prefer and why?

NZSA believes that the basis for the threshold (e.g., ‘market capitalisation’) should continue to be maintained within primary legislation.

However, the numerical definition of thresholds should be considered within secondary regulation.

This approach provides a robust framework that offers consistency to preparers of CRD, while ‘futureproofing’ the underlying legislation. NZSA notes that the thresholds could be set out in the Aotearoa New Zealand Climate Standards (together with any thresholds at which differential reporting applies). Such an approach is no different to the tiered accounting standards applying to the preparation of financial statements. NZSA also notes that the XRB operates under a Letter of Expectations from the Minister, a Statement of Intent (SOI) and a Statement of Performance Expectations. The XRB also operates robust consultation processes.

Question 14: For Option 2 (move thresholds to secondary legislation) what statutory criteria do you think should be met before a change may be made, e.g., a statutory obligation to consult. What should the Minister consider or do before making a change?

Note our comments in Question 13 above – NZSA believes that a statutory obligation to undertake consultation would form a critical part of any such secondary regulation regime.

Climate reporting entity and director liability settings

Question 15: When considering the director liability settings, which of the four options do you prefer, and why?

NZSA supports Option 2 as proposed in the Discussion Paper, which would amend the FMCA so that section 534 no longer applies to climate-related disclosures. We believe that this will:

- encourage greater voluntary disclosure of broader environmental sustainability disclosures that are relevant for the company and its shareholders.

- encourage listed issuers affected by changes in thresholds to maintain some form of climate-related and/or environmental disclosure (as per our response to Question 5).

- reduce the “regulatory arbitrage” between listed and unlisted companies.

- reduce compliance costs (external advisor fees)

NZSA has commented in previous submissions as to the validity of applying enforcement and penalty provisions in the FMCA to the forward-looking data and ‘interpretive’ nature of climate statements – this involves a significant degree of directors’ judgement (supported by internal and external capability).

In this context, directors are ultimately required to undertake their duties with the care, diligence and skill that a reasonable director would exercise in the same circumstances, and may continue to be liable if they were actively involved in a climate reporting entity’s contravention (e.g. knowingly aiding or abetting the preparation of non-compliant climate statements).

Question 16: Do you have another proposal to amend the director liability settings? If so, please provide details.

NZSA is comfortable with the options presented.

Question 17: If the director liability settings are amended do you think that will impact on investor trust in the climate statements?

No – sections 19, 23 and 533 of the FMCA are still applicable, as are usual director duties expressed in the Companies Act.

Question 18: If you support Option 3, should this be extended so that section 23 is disapplied for both climate reporting entities and directors? If so, why?

n/a

Question 19: If you support Option 4 (introduce a modified liability framework, similar to Australia) what representations should be covered by the modified liability, i.e., should it cover statements about scope 3 emissions, scenario analysis or a transition plan, and/or other things?

NZSA does not support option 4. While providing initial relief, this reverts to current liability settings after a period of time. NZSA has previously commented that we believe that director liability associated with Scope 3 emissions reporting should be removed.

NZ has the ability to learn from its experience with the earlier introduction of CRD, with the unintended consequences of director liability being one of those key learnings.

Question 20: If you support the introduction of a modified liability framework, how long should the modified liability last for? And who should be covered, i.e., should it prevent actions by just private litigants, or should the framework cover the FMA as well? (Criminal actions would be excluded)

See our comments in Question 19.

Encouraging reporting by subsidiaries of multinational companies

Question 21: Do you think that there would be value in encouraging New Zealand subsidiaries of multinational companies to file their parent company climate statements in New Zealand?

NZSA is unconvinced that this adds any value.

Question 22: Do you think that, alternatively, there would be value in MBIE creating a webpage where subsidiaries of multinational companies could provide links to their parent company climate statements?

See our comments in Question 21.

Regards,

Oliver Mander

CEO, NZ Shareholders’ Association

February 14th 2025