Date Submitted: May 2021

To: Financial Markets Authority (FMA)

Tap/Click here to download submission

This submission focused on two exemptions: Kauri Bonds and other Unsubordinated Debt Securities

Review of Wholesale Investor Exclusion $750,000 Minimum Investment Exemption

Reliance

To what extent do you, your clients or your members rely on the wholesale investor notice exemption in relation to Kauri bonds?

NZSA Commentary: The total level of household investment in Kauri Bonds is extremely low (approx. $16m from a total of $24bn).

Recommendation: NZSA believes there is no practical impediment to maintaining the current exemption on Kauri Bonds

To what extent do you, your clients or your members rely on the wholesale investor notice exemption in relation to unsubordinated debt securities (or to what extent are you or they likely to rely on it in the future)?

NZSA Commentary:

- NZSA notes that the current bright-line test for wholesale investors does not necessarily correlate to investor sophistication or experience.

- NZSA believes that the current exemption regime for unsubordinated debt securities does not recognise how this market may evolve in future.

- While we understand that bank issuers of such debt have appropriate controls in place to focus mainly on institutional investors, the exemption makes no reference as to other current or potential types of issuers of these type of securities, and their differing behaviours.

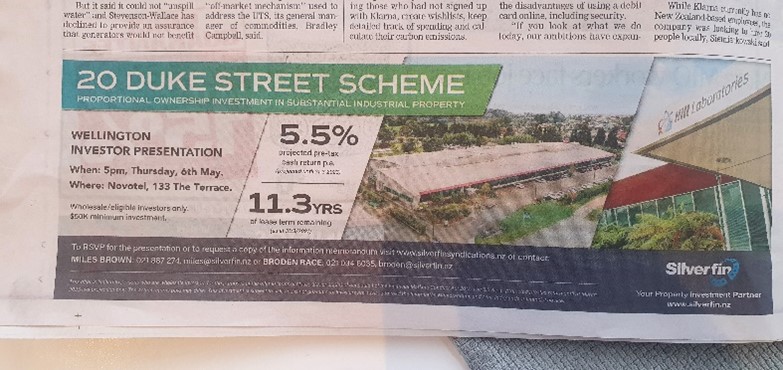

- For example, we note that property syndicate issuers have been advertising in major daily newspapers, promoting investment offers containing the wholesale investor exclusion. It is not clear from the advertisements whether these are debt or equity products, or whether they are unsubordinated, but they do rely on the wholesale investor exclusion (albeit noted in very small type at the bottom of the advertisement).

- Please see attached below a typical advertisement from the Dominion Post on May 5th 2021.

- From a consumer/investor perspective, the existence of a ‘bright-line’ test does not necessarily bear a relationship to investor experience – an inexperienced investor is likely to see the headline return and not read the fine print containing the exclusion.

- From an issuer perspective, it is questionable whether such an offer is genuinely targeted at ‘wholesale investors’, as it is advertised in major daily newspapers.

Recommendation: NZSA believes that the wholesale investor exclusion limit should be replaced by the provision of an ‘investor capability’ questionnaire, with a practical application similar to that applied by banks under the Responsible Lending Code for debt finance. NZSA would consider that recognition of issuer behaviour and the nature if investortargeting of unsubordinated debt securities becomes a key determinant as to whether the exclusion and an investor capability questionnaire should be mandated.

Regulatory Burden

Has the wholesale investor notice removed unnecessary compliance costs?

NZSA Commentary:

- NZSA believes that the addition of compliance costs will drive some benefit for investor protection.

- An investor questionnaire may in some cases discourage offers that are NOT targeted at institutions.

Recommendation: NZSA supports any compliance cost required to protect investors who lack appropriate experience of investment in unsubordinated debt securities.

Do you consider that the conditions under the wholesale investor notice impose unnecessary compliance costs?

NZSA does not believe that the current regime or our proposed amendments lead to any unnecessary compliance costs.

If the wholesale investor notice is discontinued, please tell us about any impact this would be likely to have on offers of Kauri bonds and other unsubordinated debt securities.

NZSA Commentary:

- The removal of a wholesale investor exemption for unsubordinated debt securities is unlikely to have any major impact – but that does mean that restrictions should not exist.

- Refer to the Silverfin example above – the notice is so small as to be rendered irrelevant for unsophisticated investors. Even if they could read it, that does not mean they would necessarily understand its implications.

Recommendation: NZSA would like to see an improved regime focused on issuer behaviour and investor sophistication – rather than relying on a simple ‘bright-line’ test of total funds.

Support for Renewal

Do you support the granting of the exemptions in the wholesale investor notice for a further 5 years?

NZSA does not support the renewal of the exemption in its current form.

Do you think any amendments are needed to the wholesale investor notice if it is renewed? Please specify the amendments you propose, why you think they are necessary and how they promote or facilitate the purposes of the FMC Act.

See the recommendations above