NZ Shareholders’ Association protects, enables and rewards your investment.

Join Us!Appoint NZSA to vote for youThe NZ Shareholders’ Association (NZSA) is a non-profit membership organisation with an independent, credible and objective voice within the New Zealand investment community. NZSA plays a lead role in investor advocacy, capability development and improving corporate governance.

Our mission supports twin goals of advocating for investors and promoting vibrant, fair and transparent capital markets.

We work with regulators, industry stakeholders and listed corporates to ensure that we improve relationships between companies and their shareholders.

With members spread across seven local branches, from all walks of life, we’re looking forward to sustaining what we do for the next generation of investors.

Scroll

Latest Assessments and Voting Intentions

Join us! It will only take a minute…

Membership is only $145 per annum ($45 with student ID) or $15 per month.

Join Us today!Recent Features

Each week, we offer new and insightful material to our members and stakeholders.

Follow the links below for a recent selection.

What we do every day…

New Zealand Shareholders Association (NZSA) represents, promotes and protects the interests of investors in shares and other investment products.

ADVOCATING FOR YOU

One voice to represent, promote and protect investors’ interests.

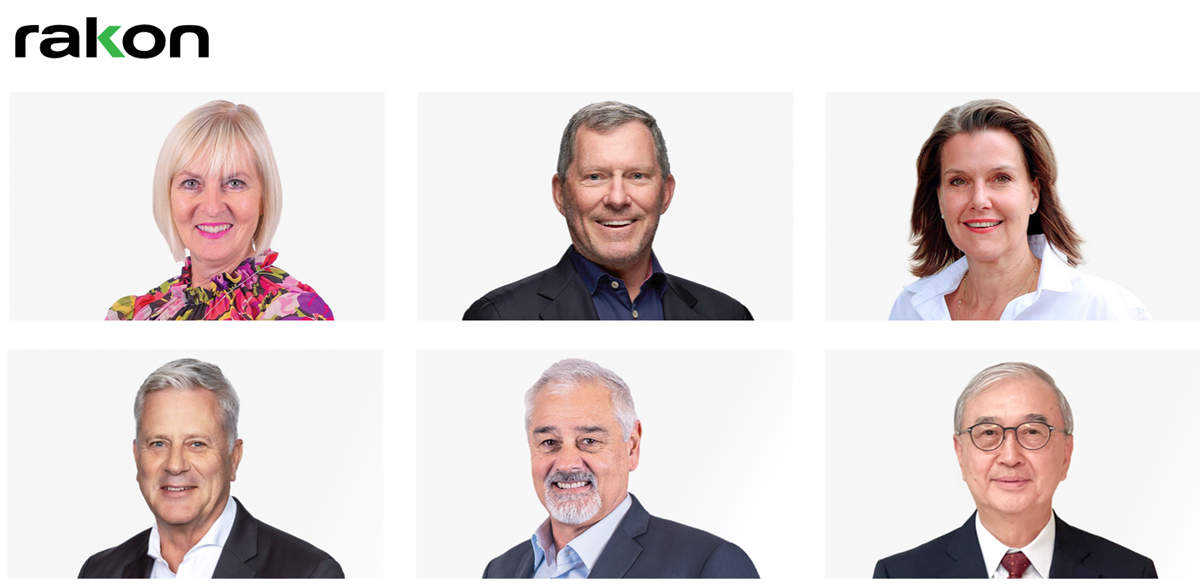

SCRUTINISING BOARD PERFORMANCE

Regular engagement with and constructive challenge for New Zealand’s corporate leaders.

VOTING FOR YOU

Represent your voice through a standing proxy service to ensure the votes of retail investors count!

ASSESSING COMPANY PERFORMANCE

Providing insight on nearly every NZX and USX-listed company.

INFORMATION

From meeting fellow investors at one of our many events to reflecting on insights from our publications or website – we can help you on your investing journey.

EDUCATION

Helping all investors from beginner to expert, with the tools and support you need.